Whale Behavior and its Impact on Solana Prices: Hidden Risks Behind the 30% Spike!

Jakarta, Pintu News – Solana’s recent price recovery to $120 does not seem strong enough to calm the market. Despite the significant price increase, many large holders are still incurring losses, and this has the potential to affect overall market sentiment.

On-chain data shows that one whale recently sold 274,188 SOL at an average price of $108, even though its initial purchase price was $148, resulting in an apparent loss of $11 million.

Key Supply Zone Analysis

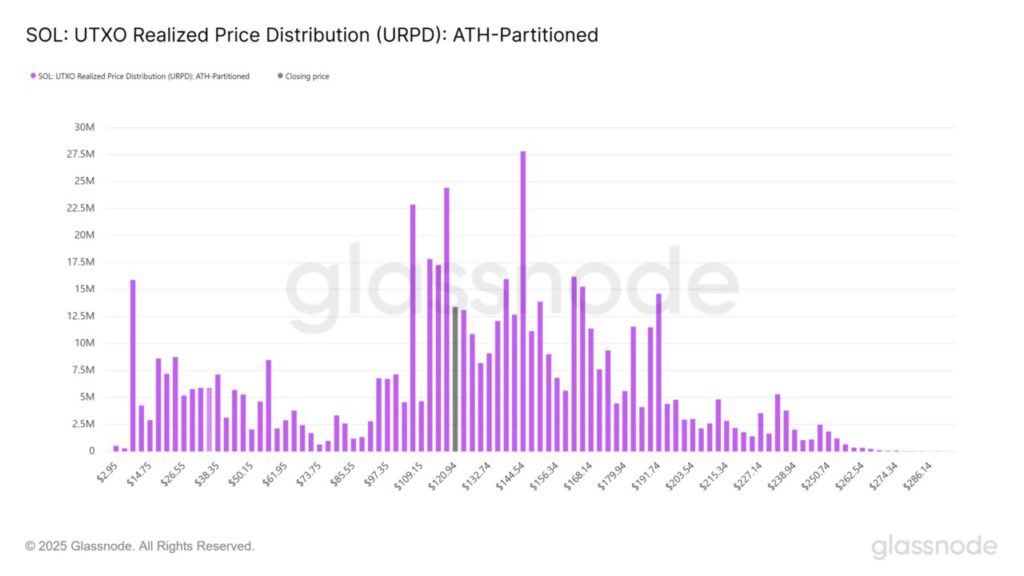

UTXO (URPD) Realized Price Distribution shows the distribution of recent Solana (SOL) transactions mapped against price levels. The data highlights three main supply clusters around $100, $120, and $140. These clusters indicate that most of the circulating supply was purchased at these levels.

The $140 zone is critical as over 27.8 million SOL are concentrated there, which is about 4.75% of the total circulating supply. This cluster is a key resistance area as many holders are close to breaking even or have unrealized losses. If Solana (SOL) fails to reclaim the $140 level, the risk of whale-induced selling remains. A price recovery to this threshold could trigger a bullish rotation driven by FOMO and market greed.

Also Read: Ripple (XRP) Movement and Potential Correction: What Crypto Investors Need to Watch Out for?

Whale Behavior and its Impact

On-chain data shows persistent distribution behavior among large holders, who are using the surge in liquidity to exit rather than accumulate. This is a warning flag for retail traders amidst a fragile macro and on-chain backdrop.

Additionally, 38 million SOLs are still accumulating between $117 and $120, making this range a potential hot spot for profit-taking as prices break this ceiling. This activity suggests that Solana (SOL) price volatility is likely to continue until the $140 level is tested. Failure to maintain momentum could trigger sharp downside volatility, especially as funding rates begin to lean positive.

Futures Data Strengthens Solana’s Market Outlook

The daily gain of 7.07% puts Solana (SOL) as the top-tier asset with the fastest recovery speed. However, the rally was not only driven by spot-data derivatives confirmed aggressive positioning. Open Interest (OI) surged 13.89% to $5.23 billion, signaling a new wave of leveraged exposure entering the market.

At first glance, it appears bullish. However, it also introduces fragility. The whale distribution is still active, and the Short-Term Holders (3-6 months) are still in the capitulation zone. A breach of the high-density supply zone ($117-$120) sets the stage for heightened liquidation risk.

Continuing Critical Momentum for Solana

Although the latest surge has sparked optimism, this rally has the hallmarks of a liquidity-driven relief phase-not a confirmed trend reversal. Until Solana (SOL) reclaims and maintains above the $140 supply zone with conviction, downside risks remain on the table.

Read More: Pepe Coin (PEPE) Price Movement and Potential Golden Cross: What Does It Mean for the Crypto Market?

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Solana Traders Alert: Uncovering the Risks Beneath the 30% Rally. Accessed on April 14, 2025

- Featured Image: Euronews