Aave’s High Yield Attracts Investor Interest: Is it Time to Join?

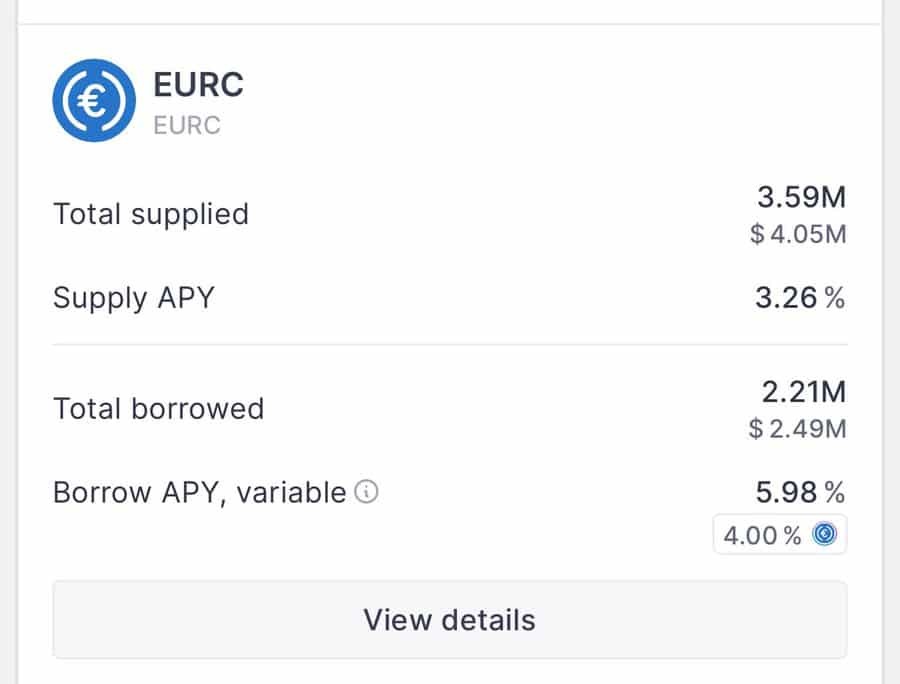

Jakarta, Pintu News – Aave’s protocol now offers a higher yield than other fintech solutions, with an annualized rate of return (APY) of 3.28%. This is higher than the 2.24% offered by Wise and 2.59% offered by Revolut on their Ultra plans.

Not only does this increase Aave’s appeal in the eyes of investors looking for better capital efficiency, but it also signals an important shift in the dynamics of the digital finance market.

Aave’s Performance Surpasses Fintech Solutions

As one of the leading lending and borrowing platforms, Aave has managed to attract attention by offering a competitive APY. A direct comparison with Wise and Revolut shows that Aave has the upper hand in terms of returns. This makes Aave an attractive option for users looking for a place to invest capital with higher efficiency.

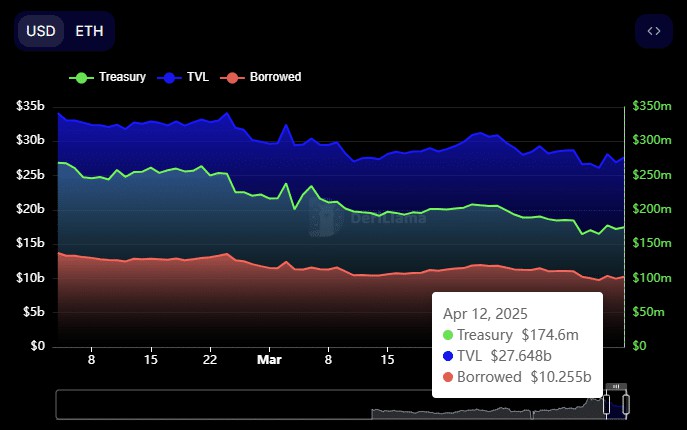

According to data from DeFiLlama, there has been a significant increase in activity on Aave, with liquidity flows increasing markedly. Total loans on Aave have reached $10.255 billion, indicating an increase in user engagement. Meanwhile, the total value locked (TVL) on Aave has reached $27.648 billion, indicating an increase in deposits and stronger trust in the Aave ecosystem.

Also Read: Ripple (XRP) Movement and Potential Correction: What Crypto Investors Need to Watch Out for?

Market Reaction to AAVE

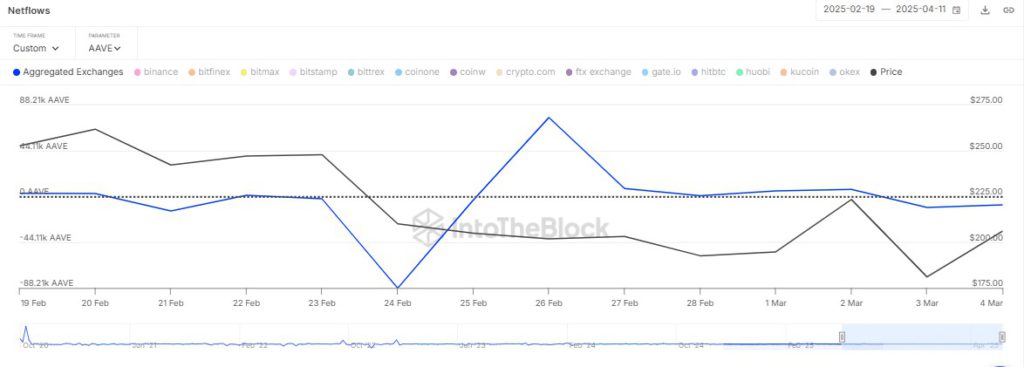

The market has shown a positive response to the latest developments from Aave. Buyers continue to accumulate AAVE tokens following news of the development and the attractive yield. This demonstrates investors’ growing confidence in Aave’s long-term prospects.

Data from IntoTheBlock shows a significant increase in the amount of AAVE being purchased on exchanges to hold as a long-term investment. To date, approximately $1 million worth of AAVE has been purchased from the market. This indicates a strong optimism for the future value of AAVE.

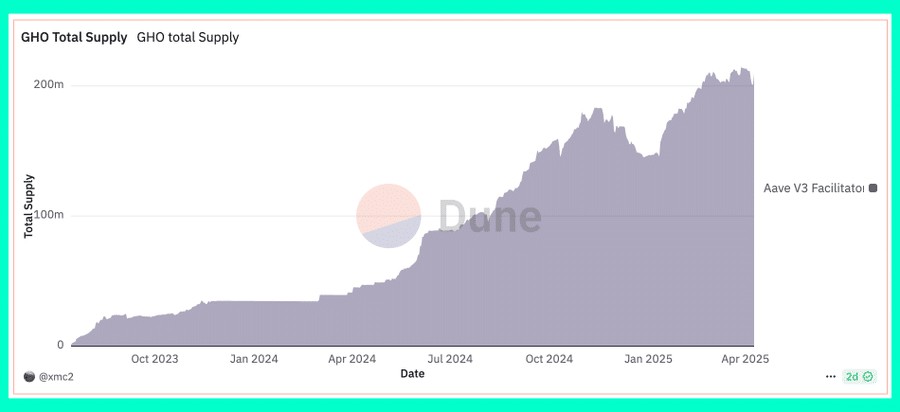

Growing Adoption

Adoption of Aave’s native stablecoin, GHO, has seen significant growth, with a 442% increase over the past year. This increase in stablecoin supply shows that the utility of GHO continues to grow, which in turn supports wider use of the Aave protocol.

If total supply continues to increase, this would indicate a growing demand. This will most likely be reflected in an increase in the value of AAVE in the market. This growth not only indicates greater confidence in Aave, but also the potential for future increases in investment value.

Conclusion

With higher yields than many other fintech solutions and growing adoption, Aave is establishing itself as a key player in the digital finance arena. Steady growth in TVL and increased user activity show that Aave is not only attracting new interest, but also maintaining the trust of existing users. This signals a new era for investors seeking opportunities in DeFi.

Read More: Pepe Coin (PEPE) Price Movement and Potential Golden Cross: What Does It Mean for the Crypto Market?

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Will Aave’s new yields be enough to pull in fresh buyers for a breakout?. Accessed on April 14, 2025

- Featured Image: Beamstart