Huge Loss of $400 Million Crypto Investors Due to Spell Price Crash (OM)

Jakarta, Pintu News – While the rest of the crypto market saw a significant recovery, the price of Mantra experienced a drastic fall. In just a few hours, the popular altcoin plummeted by almost 90%, causing huge losses to its holders. Although the cause has been identified, the losses persisted, leaving a group of investors with $400 million in losses and many more affected.

Spell Price Collapse Causes $400 Million Loss

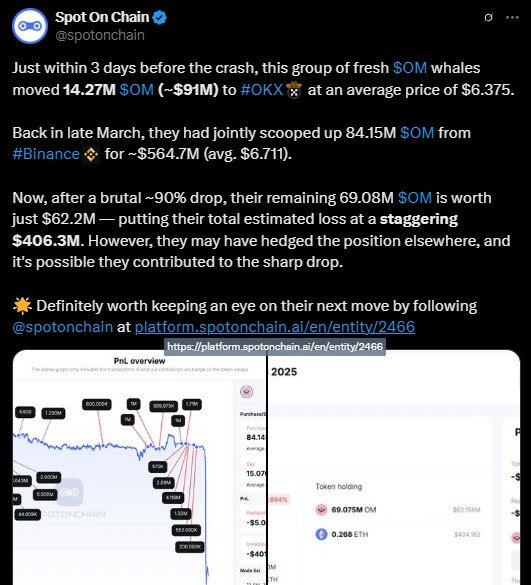

Amidst high crypto market volatility due to the war between the US and China, the Mantra price collapse has caused huge losses for investors. This includes a group of 19 new crypto wallets or traders who moved 14.27 million OM worth $91 million just three days before the crash.

A post from Spotonchain X revealed that these investors had raised a large amount of OM tokens, namely 84.15 million ($564.7 million) from Binance just three days earlier. Now, with the collapse of OM prices, their 69.08 million OM is only worth $62.2 million, leaving them in an astonishing loss of $406.3 million.

Read More: Market Volatility: Mantra Token Plummets 90% in an Hour, Here’s the Explanation

Forced Liquidation Causes Mantra Price Collapse

The Mantra price collapse has wiped out almost $6 billion from the crypto market. Crypto experts like StarPlatinum compared it to the LUNA crash, which affected the entire market. In a detailed analysis, StarPlatinum revealed that crypto whales, Mantra airdrop failure, and investor panic were to blame for the crash.

John Patrick Mullin, co-founder of Mantra, and his team explained that the forced liquidation of OM investors on centralized exchanges led to the crash. More importantly, he clarified that the team was not involved in the crash. The tokens are still locked and subject to the published vesting period. Tokenomics OM remains intact, as shared last week in their latest token report. Their token wallet address is online and visible.

Spell Price Recovery Predictions by Experts

A post from Lookonchain also shed some light on the situation, revealing that 17 crypto traders deposited nearly 4.5% of the circulating OM supply, equivalent to 227 million OM participating in the crash.

Currently, OM’s token price is still down, trading at $0.8 with a market capitalization of $761.45 million. Investors are now directing their attention to the Mantra predictions by experts to see a recovery.

Conclusion: The Future of Spell Pricing

The huge losses suffered by Mantra (OM) investors show how quickly and drastically the crypto market can change. This incident serves as an important lesson for investors to always be aware of the risks involved. Although the Mantra team has taken steps to clarify the situation and maintain the integrity of the token, the market has still not fully recovered.

Crypto investors and traders should now be more cautious and may need to wait longer to see if Mantra (OM) can return to its previous price levels or if these losses will become the new norm. This incident also emphasizes the importance of diversification in crypto investments to reduce the risk of large losses.

Also Read: Will the Ripple vs SEC Case Be Resolved Soon? Check out the Expert Review!

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Coingape. Here’s How Crypto Traders Lost $400M with Mantra (OM) Massive Price Crash. Accessed on April 14, 2025

- Featured Image: Binance Academy