The Sudden Collapse of Mantra (OM): Is This a Repeat of the UST Tragedy?

Jakarta, Pintu News – Mantra, which recently triggered a $1 billion asset tokenization for DAMAC Ventures in the United Arab Emirates, experienced a drastic drop in its token value. In a short period of time, Mantra’s native token plunged from $6.3 to just $0.42 on the evening of Sunday, April 13, erasing nearly $6.6 billion from its previously $9 billion market capitalization.

Main Causes of Collapse

According to analysis conducted by Max Brown on the X platform, the collapse stems from a large deposit of 3.9 million OM into the OKX exchange made by the Mantra team’s wallet. Brown highlighted that the Mantra team owned 90% of the total OM supply, which raised suspicions about their recent activities.

Brown also revealed that there was the use of Market Makers (MMs) to artificially increase the price of OM, but this was not the main cause for concern. Furthermore, Brown stated that a large amount of OM selling started immediately after the deposit. Moreover, it was found that this 90% price drop was triggered by Over-The-Counter (OTC) transactions made at a discount of at least 50%, which forced a sharp drop in whale holdings and triggered panic withdrawals.

Read More: Market Volatility: Mantra Token Plummets 90% in an Hour, Here’s the Explanation

Mantra Team Response

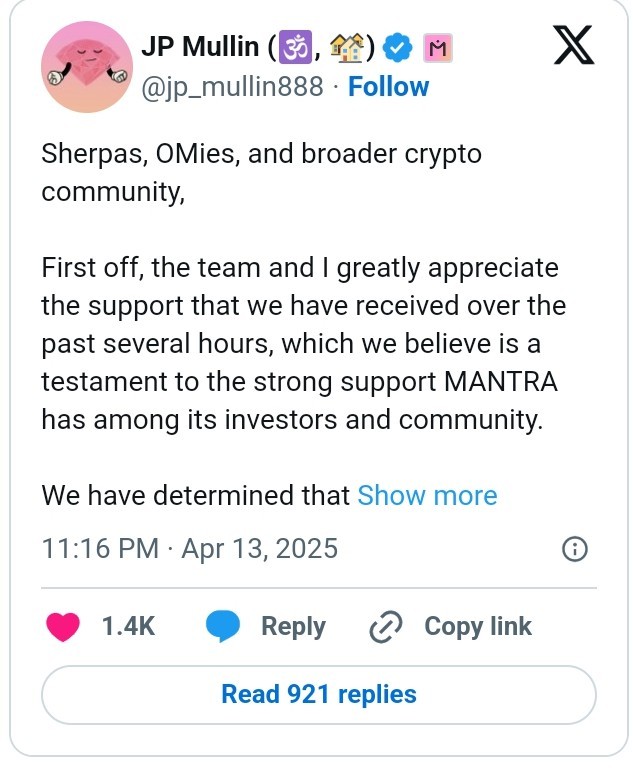

Mantra’s communications team on the X platform called for calm, stating that the token has a strong enough foundation to recover. They attributed the market collapse to “irresponsible liquidation,” which they said had nothing to do with the project or the team. JP Mullin, co-founder and CEO of Mantra, also spoke up.

He explained that the “irresponsible liquidation” mentioned in the previous update came from a centralized exchange, initiated on OM account holders. Mullin added that there was insufficient warning or notification of the “sudden account closure” that occurred alongside the extent and timing of the price collapse, suggesting the possibility of deliberate market positioning or even coordination by a centralized exchange.

Conclusion and Advice for Investors

Mullin emphasized that there is no possibility of a “rug-pull” as the tokens are locked and subject to a publicly accessible vesting period. He advised investors to avoid clicking on fraudulent links and rely only on official accounts for updates.

Mantra, which recently launched a $108,888,888 investment fund to boost the adoption of Real World Assets (RWAs), was previously considered one of the most resilient assets amid the widespread market chaos that brought Bitcoin to its lowest point.

Conclusion

The Mantra (OM) price collapse is reminiscent of a similar incident that happened to TerraUSD (UST), sparking concerns among investors and analysts about the stability and security of crypto assets. This incident shows the importance of greater transparency and oversight in the crypto ecosystem to avoid similar incidents in the future.

Also Read: Will the Ripple vs SEC Case Be Resolved Soon? Check out the Expert Review!

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Crypto News Flash. OM Freefall Mantra: $6.6B Wiped Out, Is a UST-Style Collapse Unfolding? Accessed on April 14, 2025

- Featured Image: Fast company