Starknet (STRK) Shows Signs of Recovery Amid Market Pressure

Jakarta, Pintu News – Starknet , one of the crypto projects that was once in the spotlight, is now back in the conversation as signs of recovery emerge amidst a downward trend.

Although market pressure is still being felt, technical indicators are starting to show a shift in sentiment that could potentially be the start of a positive movement. This happened shortly after the release of 127.6 million STRK tokens to the market, valued at approximately USD 15.71 million or equivalent to IDR 263.94 billion.

Starknet Token Release and Adoption Strategy

The massive release of STRK tokens is part of the token unlock schedule that market participants have been waiting for. Normally, this kind of release can put additional pressure on the price due to increased supply in the market. However, Starknet is trying to cushion the effect by driving real adoption through the integration of STRK payments in more than 15,000 stores around the world.

This move demonstrates the project’s efforts to increase the utility of its tokens in real life. Although the market reacted cautiously, this kind of adoption move could strengthen Starknet’s long-term foundation. On the technical side, the RSI (Relative Strength Index) is currently at 42.92, indicating neutral momentum that is still leaning towards a bearish direction.

Also Read: Massive Spike! Shiba Inu Burn Rate Up 2000%, Will Prices Soar?

RSI and CMF indicators: Signs of Changing Sentiment

RSI is used to measure the strength of price trends and is usually considered overbought above 70 and oversold below 30. With the current RSI value at around 43, STRK is yet to show a strong signal for a reversal, however there is an improvement from the previous day which suggests a potential shift in momentum.

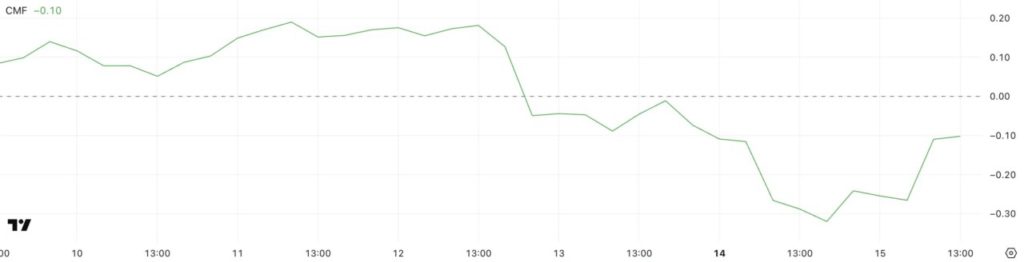

Meanwhile, the Chaikin Money Flow (CMF) indicator showed an improvement to -0.10 from -0.32, signaling that selling pressure is starting to ease. Although this figure is still below zero, its positive trend suggests that buying interest is slowly starting to return. If the CMF continues to increase until it crosses the neutral line, it could strengthen the possibility of a price recovery in the short term.

Challenges and Potential Directions of STRK Price Movement

From another technical perspective, STRK’s Exponential Moving Average (EMA) line still shows a bearish pattern. This can be seen from the position of the short-term average which is below the long-term average – a classic indication of a downtrend that is still dominant. If the selling pressure increases again, the price of STRK could drop to the next support level around USD 0.109 or around Rp1,832.

However, if the positive momentum seen from the RSI and CMF indicators continues to develop, STRK has the opportunity to test the resistance levels at USD 0.137 (around Rp2,303) and USD 0.142 (around Rp2,384). If it is able to break this level, the next target is in the range of USD 0.158 or around IDR 2,656, opening up opportunities for a more significant price recovery.

Conclusion

Although Starknet (STRK) is still under pressure, technical indicators are starting to show a change in the direction of market sentiment. With real-world adoption efforts and improvements in the RSI and CMF indicators, the project has the potential to break out of its bearish phase if this momentum can be sustained. Investors and observers are advised to remain vigilant and monitor market developments closely before making investment decisions in the dynamic world of cryptocurrencies.

Also Read: XRP: Key to the Future of Global Financial Infrastructure

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Starknet (STRK) Eyes Recovery Amid Improving Technical Indicators. Accessed April 16, 2025.

- Featured Image: Footprint Analytics