Bitcoin Stalls at $84,000 — Is a Breakout to $85,000 Just Around the Corner?

Jakarta, Pintu News – Bitcoin has experienced ongoing challenges in recent months, with recent recovery efforts failing to meet market expectations.

Currently (4/17/25), the crypto king is trading at $84,095 and has failed to break the resistance level of $85,000 several times so far this month. This inability has led to increased uncertainty among investors.

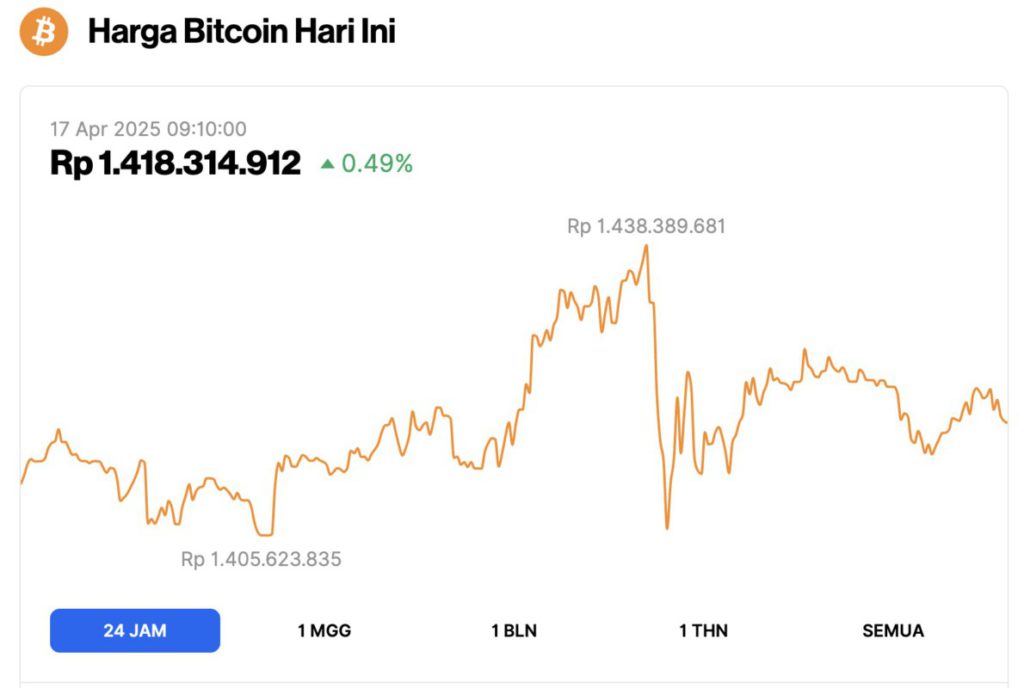

Bitcoin Price Up 0.49% in 24 Hours

On April 17, 2025, the price of Bitcoin (BTC) stood at $84,095, equivalent to approximately IDR 1,418,314,912. Over the past 24 hours, BTC saw a modest increase of 0.49%. During this time, the cryptocurrency dipped to a low of IDR 1,405,623,835 and climbed to a high of IDR 1,438,389,681, reflecting its continued volatility in the market.

According to CoinMarketCap, Bitcoin’s market capitalization now stands at around $1.66 trillion, with trading volume in the last 24 hours also down 0.63% to $$28.41 billion.

Read also: Bitcoin Is an Alternative Global Currency Amid China’s De-Dollarization, Here’s the Explanation!

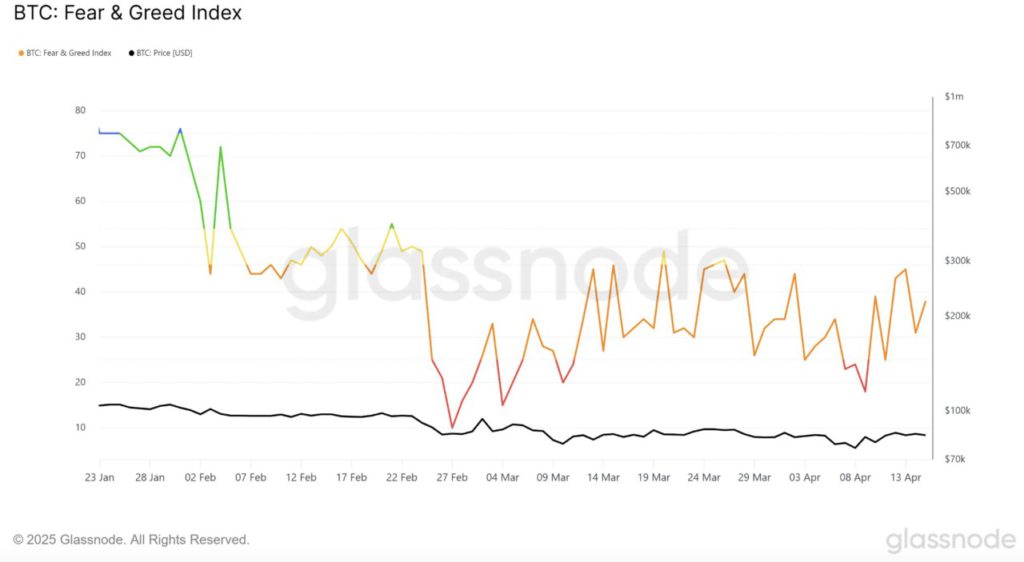

Bitcoin Investors Overcome with Uncertainty

Bitcoin’s Fear and Greed Index shows the dominance of fear among BTC holders. Since early March, this fear has intensified as the market has yet to respond to positive signals.

With Bitcoin’s price stagnating and struggling to return to an uptrend, investor confidence continues to weaken.

The current market sentiment reflects this mood, with many investors choosing not to make major moves. It also suggests that Bitcoin holders are avoiding risky investments and tend to refrain from active involvement in the market.

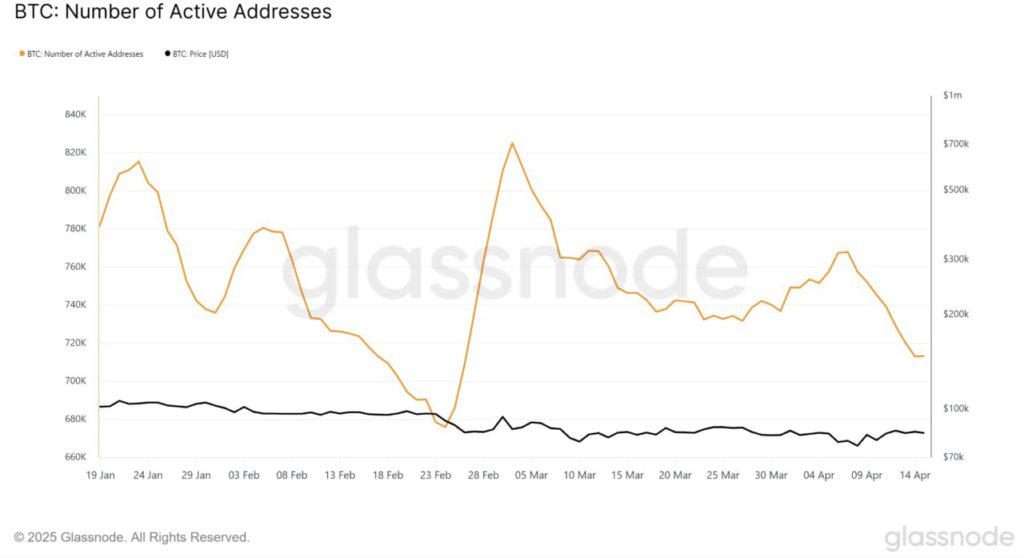

At the macro level, Bitcoin’s momentum also shows hesitation among market participants. Active address activity on the Bitcoin network is at its lowest point in almost two months, indicating a decline in participation.

This decline signals that holders are starting to withdraw and show less interest in making transactions or moving their coins.

The lack of enthusiasm to interact on the network emphasizes that investors are still unsure of the future direction of the market.

Can Bitcoin Price Break $85,000?

Bitcoin is currently experiencing a three-month-long downward trend, with prices hovering around $83,768 (4/16/25).

Read also: Bhutan’s Prime Minister Encourages the Use of Bitcoin for Economic Solutions, Here’s What He Said!

Despite several attempts to break the resistance level at $85,000, Bitcoin has not been able to maintain its upward momentum. Repeated rejections at the level indicate the presence of strong resistance pressure, potentially leading to further price stagnation.

If the negative sentiment continues and fear among investors remains high, the price of Bitcoin could drop below the current support level of $82,619.

A further drop to the $78,481 range becomes a real possibility, extending the downtrend and magnifying potential losses for asset holders. It could also reinforce the uncertainty currently surrounding the market.

However, if Bitcoin manages to break the crucial resistance level of $85,000, it could trigger a rally towards $87,344.

Success in conquering this limit could invalidate the current bearish outlook and pave the way for a move towards $89,800, giving new hope for Bitcoin’s future prospects.

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Bitcoin Price Faces 3-Month Stagnation at $85,000, Fear Plagued Holders Pullback. Accessed on April 17, 2025