Ethereum on the Edge: Can It Hold $1,500 as Whales Begin Massive Sell-Off?

Jakarta, Pintu News – Until now, the price of Ethereum has struggled to recover and has continued to move around $1,700 in recent days. Despite attempts to break higher levels, ETH has not managed to get a significant boost.

This lack of positive movement prompted a massive sell-off from Ethereum whales, which further reinforced the bearish market sentiment.

Then, how will the ETH price move today?

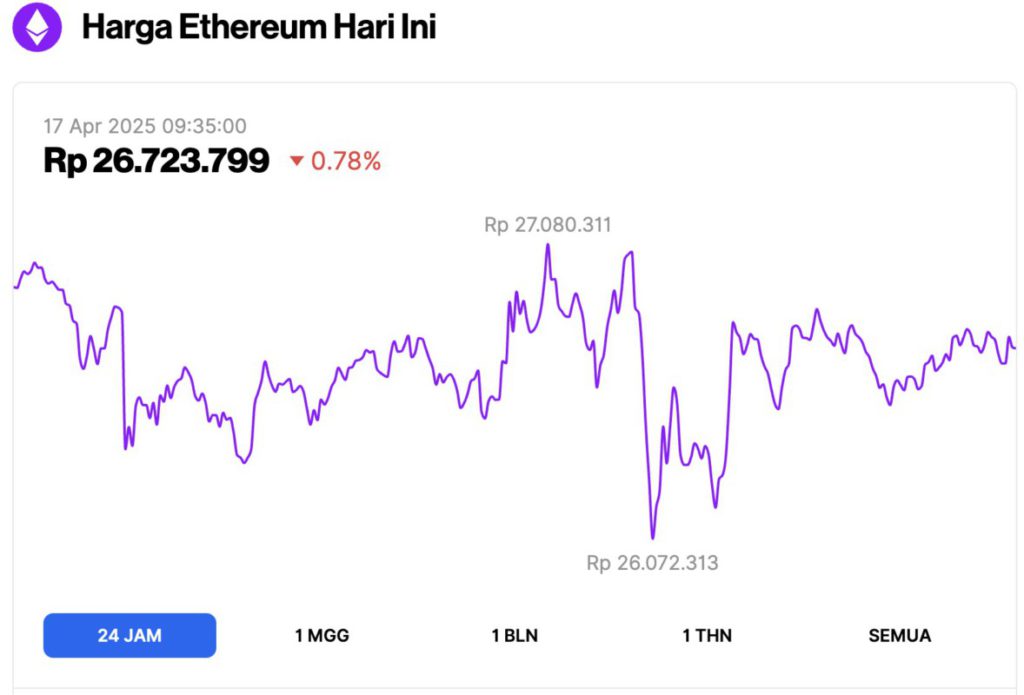

Ethereum Price Drops 0.78% in 24 Hours

As of April 17, 2025, Ethereum (ETH) was trading at approximately $1,587, or around IDR 26,723,799, reflecting a 0.78% decline over the past 24 hours. Within that time frame, ETH reached a daily high of IDR 27,080,311 and dipped to a low of IDR 26,072,313, showing moderate volatility as it continues to navigate uncertain market conditions.

At the time of writing, data from CoinMarketCap shows that Ethereum’s market capitalization stands at around $191.55 billion, with daily trading volume rising 14% to $14.97 billion within the last 24 hours.

Read also: Bitcoin Stalls at $84,000 — Is a Breakout to $85,000 Just Around the Corner?

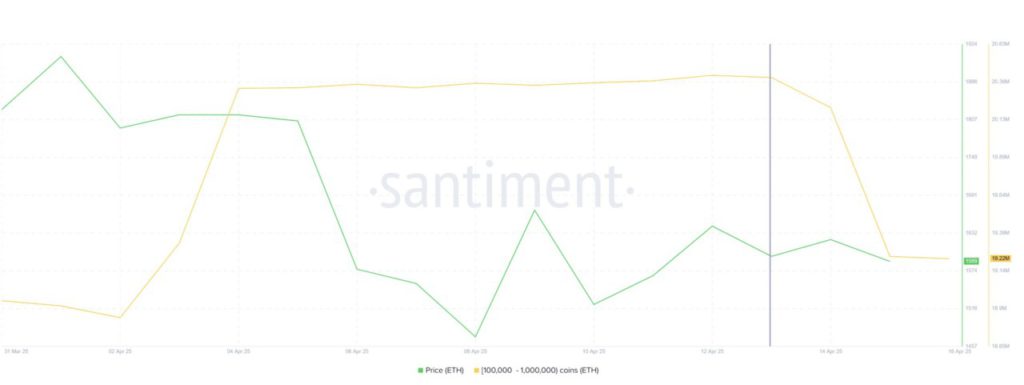

Ethereum Whale Starts Selling Assets

In the past three days, Ethereum wallets holding between 100,000 and 1 million ETH have sold around 1.19 million ETH, worth more than $1.8 billion.

This big move indicates a change in market sentiment from the whales, who seem to want to minimize potential losses due to the slow recovery in prices.

With the price of Ethereum still unable to break the $1,700 barrier, these whales are seen taking advantage of the current price to take profits, which in turn pushes the market price further down.

This sell-off also signals low confidence in Ethereum’s price movement in the short term.

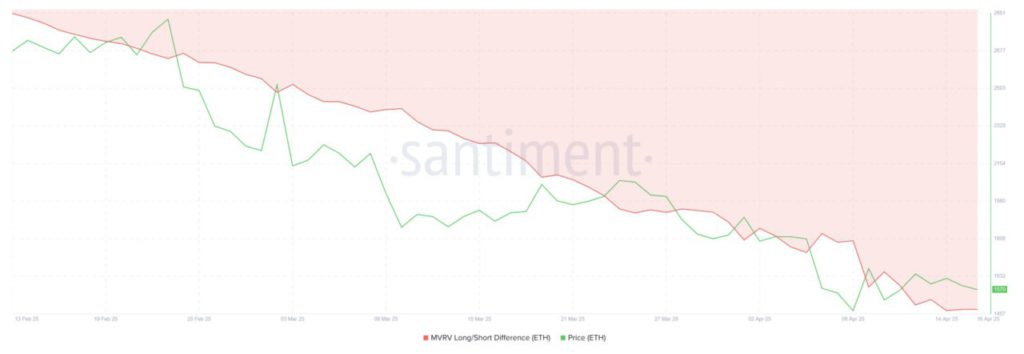

From a technical perspective, Ethereum’s macro momentum is weak. This is reflected in the MVRV Long/Short Difference indicator which is at a negative -29%, indicating that long-term holders (LTH) are having difficulty staying in the profit zone.

On the other hand, short-term investors (STH) tend to sell immediately after taking profits, which adds to the volatility pressure and reinforces the downward trend in prices.

As the current gains are mostly enjoyed by short-term investors, Ethereum is increasingly vulnerable to further declines.

If there are no significant positive triggers, this sell-off from investors will most likely continue to pressure ETH prices in the near future.

ETH Price Holds above $1,500

As of April 16, 2025, the price of Ethereum was around $1,570, after failing to break through the resistance level at $1,700. However, ETH is still holding above the important support level of $1,533.

Read also: Ethereum Price Increase Potential: Latest Analysis and Predictions Mid-April 2025

However, given the overall negative market conditions, further price drops are still possible if the bearish sentiment persists.

Ethereum could potentially face major obstacles to a comeback. Without support from the broader market or any new positive sentiment, a drop below $1,533 could trigger a deeper downward trend.

If this support fails to hold, ETH will likely drop to $1,429, extending the ongoing correction trend.

On the other hand, if ETH is able to break back and make the $1,625 level the new support, this could be a signal that the price is ready to try to break $1,700 again.

If the level is successfully crossed, the upside potential towards $1,745 is wide open, which could also invalidate the bearish sentiment and open up opportunities for a trend reversal.

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Ethereum Whales Sell $1.8 Billion in ETH as Price Fails Recovery. Accessed on April 17, 2025