Selling Pressure Increases, Pi Network (PI) Plunges Almost 10%: Bearish Signals Grow Stronger

Jakarta, Pintu News – The cryptocurrency market is showing volatility again, and Pi Network (PI) is one of the digital assets affected. In the past 24 hours, the price of PI fell by almost 10%, raising concerns among investors and traders. A number of key technical indicators-such as DMI, CMF, and EMA-confirm increasing bearish pressure and point to a potential continuation of the downward trend in the near future.

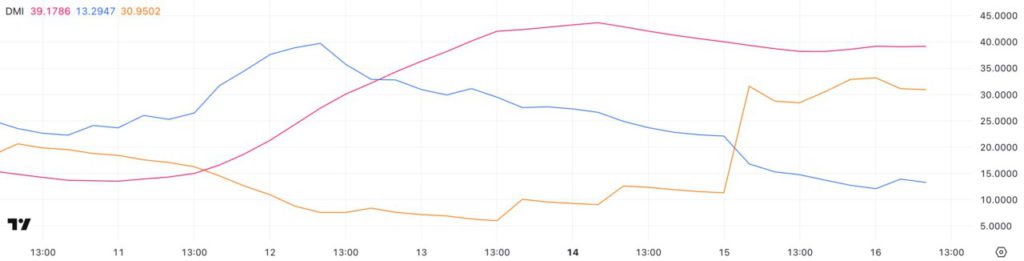

DMI Shows Trend Shift: Bearish Take Control

Pi Network’s Directional Movement Index (DMI) is showing clear signals of a trend shift. The directional strength index, or ADX, dropped from 43.68 to 39.17 in the last two days. While still above 25-which indicates a fairly strong trend-this drop is accompanied by a reversal from an uptrend to a downtrend.

The +DI indicator, which indicates buying strength, declined sharply from 22.11 to 13.29. In contrast, the -DI, which reflects selling strength, surged from 11.32 to 30.95. The intersection of these two indicators, coupled with the widening gap, suggests that sellers are starting to take control of the market. If this condition persists and the ADX strengthens again, selling pressure could become even more dominant, reinforcing the short-term bearish trend.

Also Read: XRP Current State: Price Consolidation and Potential Breakout Amid Ripple and SEC Deal

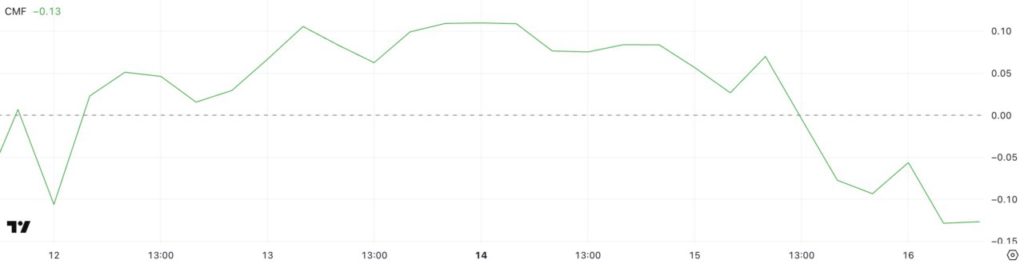

CMF Turned Negative: Fund Outflow Increases

Another volume indicator, the Chaikin Money Flow (CMF), also indicated a significant shift in market sentiment. Pi Network’s CMF plummeted to -0.13, from 0.07 just a day earlier. CMF is an indicator that assesses the inflow and outflow of funds in an asset, with positive values reflecting buying pressure and negative values indicating selling pressure.

This drastic change indicates that outflows are increasing, which usually reflects waning buying interest and growing market distrust of the token’s short-term performance. As long as this indicator remains negative, selling pressure is expected to continue and potentially push prices down further.

Death Cross Signal of EMA: Will Price Fall Below $0.50?

The Exponential Moving Average (EMA) line is now showing signs of a death cross formation, which is when the short-term average crosses the long-term average from top to bottom. This is a classic bearish signal that often precedes a deeper downward trend.

Currently, PI prices are at risk of testing the support level at $0.54 (approx . IDR 9,088, exchange rate IDR 16,820/USD). If this support is broken, then there is a possibility that the price will drop below $0.50 (IDR8,410). The next support points are at $0.48 (IDR8,073) and $0.45 (IDR7,569), which could be important areas for traders to watch.

However, if buyers manage to hold the current support and trigger a rebound, then PI prices could rally back towards resistance at $0.66 (IDR11,101). If this resistance is broken and momentum strengthens, the next medium-term target is $0.789 (IDR13,263), which could mark the return of uptrend strength.

Conclusion

Pi Network’s price drop of nearly 10% accompanied by confirmation from various technical indicators suggests that the market is in a phase of bearish pressure. The DMI and CMF reflect weakening buying power and increasing selling pressure, while signals from the EMA warn of a possible further decline. While a rebound is still possible, investors and traders are advised to remain vigilant, given the current negative market sentiment.

Also Read: XRP Price Outlook After Ripple and SEC Lawsuit Settlement

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Pi Network (PI) Price Drops Nearly 10% as Outflows Surge and Death Cross Looms. Accessed April 17, 2025.

- Featured Image: Mudrex