Bitcoin Buy Volume Strengthens on Binance, Bullish Signal or Over-optimism?

Jakarta, Pintu News – The latest data from the Binance platform shows a significant increase in Bitcoin nettaker volume, signaling high optimism from futures traders.

It records the imbalance between the volume of actively executed buys and sells(takers), and its positive spike is a strong signal that traders are aggressively positioning themselves for a further rally in Bitcoin prices. However, is this really a bullish sign or the beginning of a reversal?

Net Takers Positive Volume: Traders Bet On Up

According to an analysis from the CryptoQuant community shared by Maartunn, the Bitcoin Net Taker Volume indicator shows consistent positive values on Binance since April 11, 2025. This indicates that the incoming buy volume exceeds the sell volume, and the difference is large enough to trigger the attention of crypto market analysts.

In technical terms, a high volume of buy takers means that more traders are willing to buy atmarket prices(market orders), rather than waiting for prices to go lower. This signals an optimistic sentiment that the price will rise in the near future. This movement correlates with Bitcoin’s price recovery efforts after the announcement of the US government’s 90-day tariff pause policy for most trading partner countries.

Also Read: XRP Current State: Price Consolidation and Potential Breakout Amid Ripple and SEC Deal

Positive Sentiment Can Be a Double-Edged Sword

While net buy volume reflects market enthusiasm, the history of Bitcoin’s price movements shows that the asset often moves against the expectations of the majority of market participants. When too many traders are on the same side-in this case bullish-then the potential for a correction increases.

In this context, high buying volumes can be interpreted as an indication of overconfidence among short-term investors. If not accompanied by sufficient fundamentals and liquidity, the Bitcoin price is at risk of a sharp reversal in the short term.

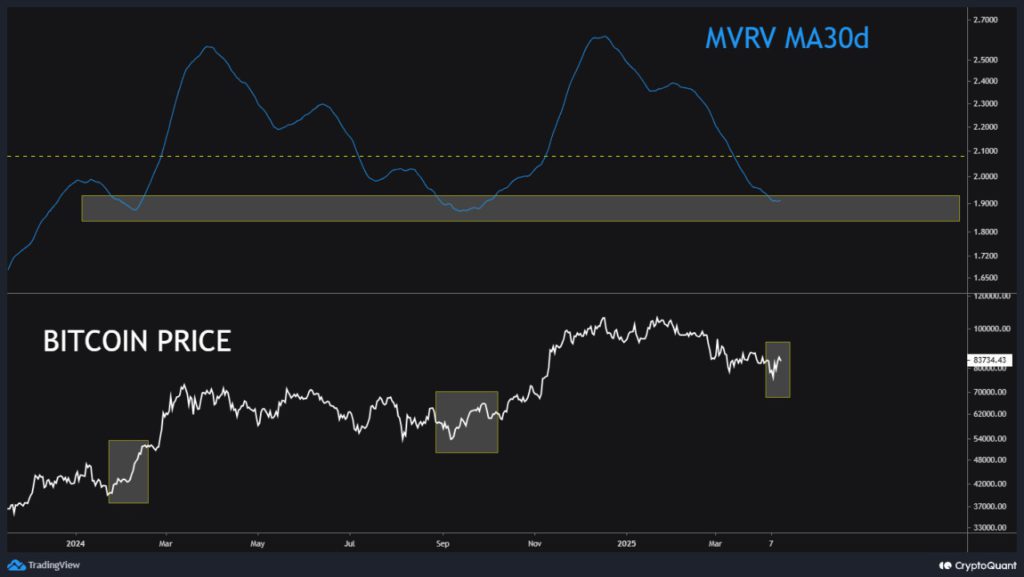

MVRV Indicator Shows Decline in Investor Profitability

On the other hand, the 30-day Market Value to Realized Value (MVRV) Ratio indicator shows a downward trend and has now reached its lowest level in the past six months. This indicator is used to assess investors’ profit/loss status based on the current price versus their historical purchase price.

A drop in MVRV signals a decline in investor profitability, which historically has often been followed by the formation of a price bottom. In two previous instances last year, when the MVRV touched this level, Bitcoin started to bounce back and experienced significant gains.

This opens up the possibility that, despite the extreme bullish sentiment, the on-chain fundamentals are giving room for a medium-term price rally.

Current Price and Potential Next Directions

Currently, the price of Bitcoin is at $85,800 or around Rp1.44 billion (using an exchange rate of Rp16,820/USD). In the past seven days, BTC recorded a gain of more than 8%, which is quite significant amid global macroeconomic uncertainty.

If the net buying volume remains high and is not followed by a surge in selling volume in response, then the opportunity for further upside remains open. However, if the MVRV continues to decline and selling pressure starts to emerge, then investors should prepare for a potential consolidation or even a correction.

Conclusion

Data from Binance indicates that Bitcoin traders are in aggressive mode, positioning themselves for a continued rally. However, history shows that crypto markets don’t always move as the majority expects. With the MVRV indicator pointing to a potential bottom forming and buying volume increasing, investors and traders need to remain cautious, apply strong risk management, and not rely on just one technical signal.

Also Read: XRP Price Outlook After Ripple and SEC Lawsuit Settlement

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- NewsBTC. Bitcoin Bulls Positioning Aggressively on Binance. Accessed April 17, 2025.

- Featured Image: Generated by AI