Bitcoin’s Silent Bullish Signal: On-Chain Data Points to Further Upside Potential

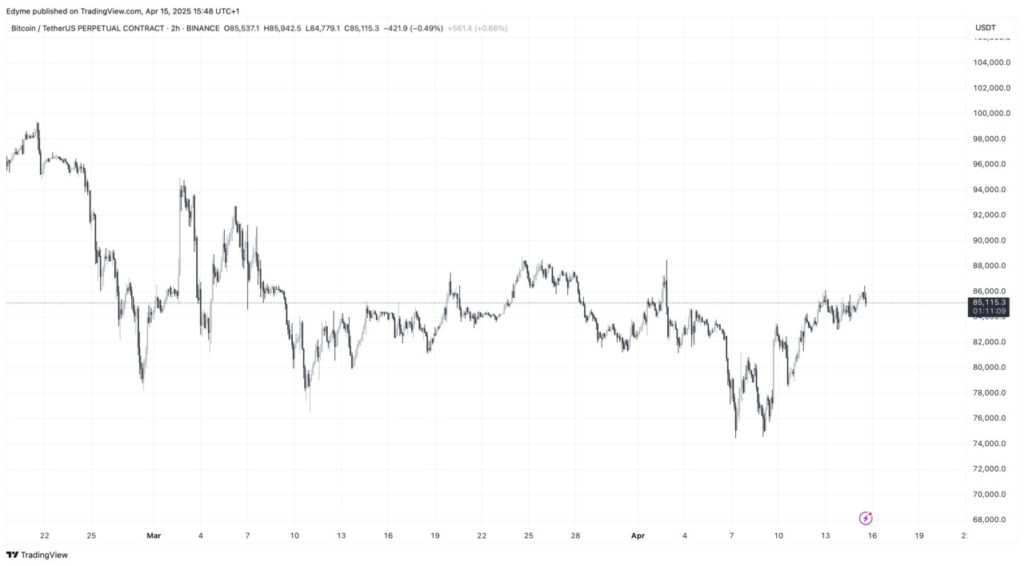

Jakarta, Pintu News – In the past week, Bitcoin has experienced a significant recovery after experiencing price pressure due to global tariff policy turmoil. After dipping below $80,000, BTC is now trading above $85,000 (around Rp1.43 billion, at an exchange rate of Rp16,820/USD), registering a gain of almost 10% in seven days. But behind this movement, a number of on-chain indicators hint that there are fundamental forces underlying Bitcoin’s potential uptrend continuation.

On-Chain Data: Strong Signals from Within the Ecosystem

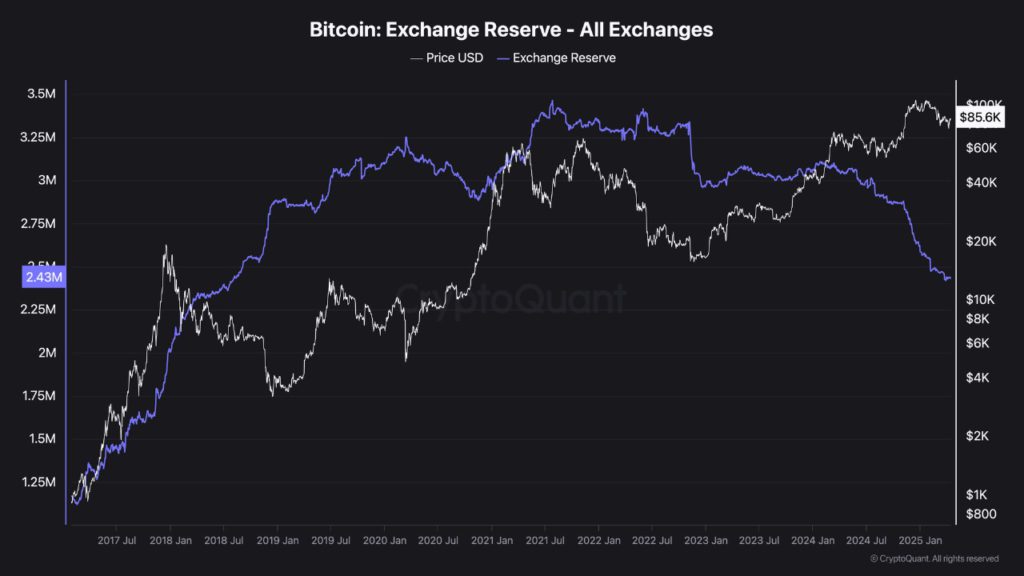

According to a CryptoQuant analyst named BorisVest, a number of key metrics suggest that Bitcoin is likely still undervalued at the current phase of the cycle. One important indicator is the Bitcoin reserves on exchanges, which continue to decline. Currently, the amount of BTC stored on exchanges is around 2.43 million, much lower than the 2021 bull market peak of 3.4 million.

This decline reflects a shift in investor behavior towards a long-term holding strategy, which reduces the supply of Bitcoin ready for sale in the market and could potentially push prices upwards if demand increases. With reduced seller liquidity, there is also less spontaneous selling pressure.

Also Read: XRP Current State: Price Consolidation and Potential Breakout Amid Ripple and SEC Deal

Stablecoin Supply Ratio and Potential Buying Power

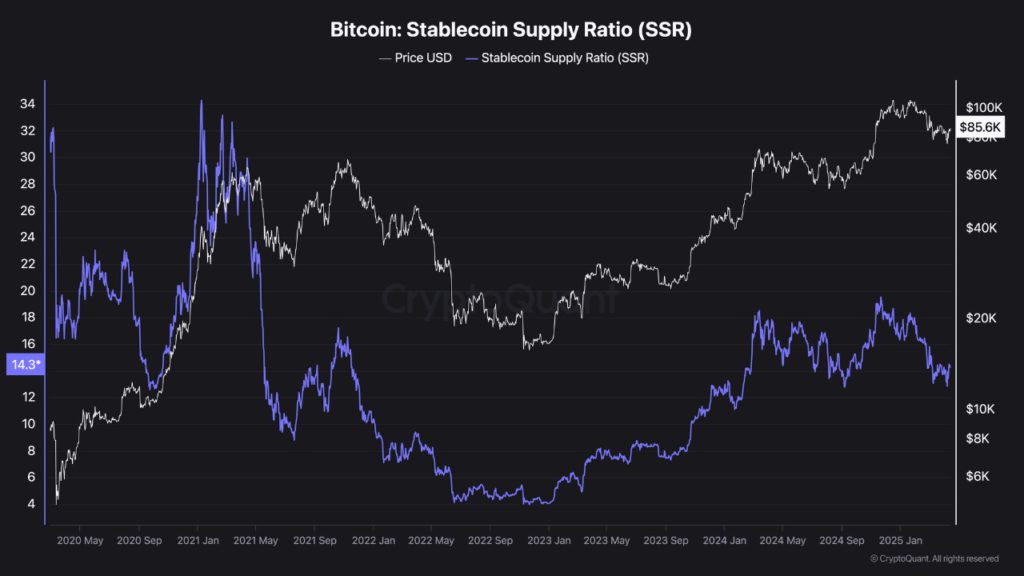

Another indicator that supports the positive outlook is the Stablecoin Supply Ratio (SSR), which currently stands at 14.3. SSR is used to measure the purchasing power of the market using stablecoins. The lower the SSR number, the greater the potential unutilized purchasing power.

Since the current SSR is still well below the extreme levels seen at the peak of the previous cycle, it suggests that a lot of capital-in the form of stablecoins-is still outside the market and ready to be deployed. This signals that the potential for additional buying is still wide open if Bitcoin price shows consistency or stability in its uptrend.

Funding Rate Normalization: Overleverage Risk Eases

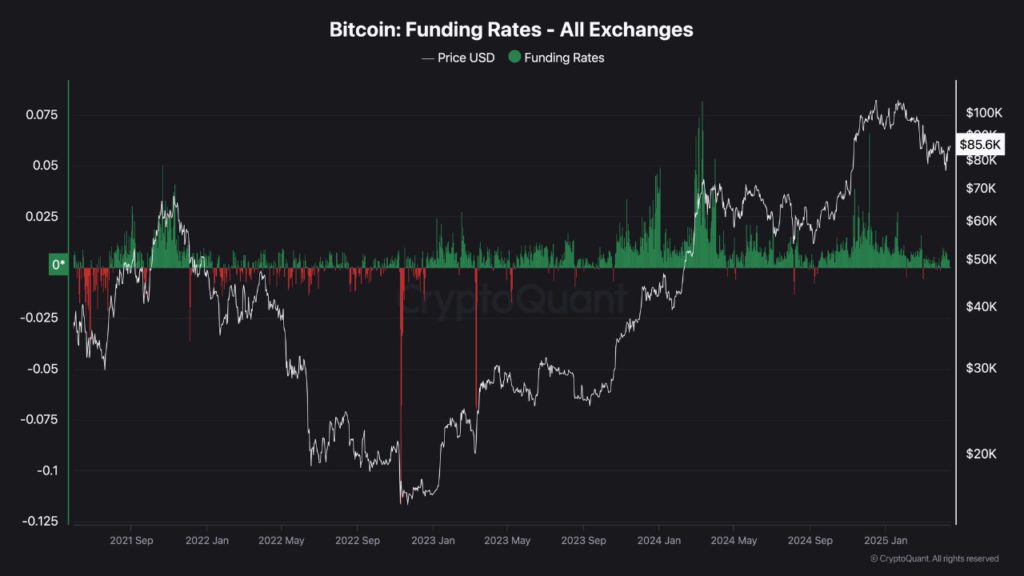

During the previous price spike, the funding rate spiked high as a large number of long positions were accumulated. This reflected overheated market conditions and increased the risk of a sharp correction. However, the funding rate has now returned to a neutral level between 0.00% to 0.01%.

This indicates that market sentiment is starting to rebalance, with a reduction in short-term risk due to excessive long positions. For investors, this signals that the market is now in a healthy stabilization phase before the next potential breakout.

Will the Momentum Continue?

Taken together, the combination of three key factors – falling Bitcoin reserves on exchanges, a stable SSR, and a neutral funding rate – form a strong foundation for Bitcoin’s near-term upside prospects. While external factors such as monetary policy and geopolitical dynamics remain key determinants of market direction, on-chain data indicates that investor confidence in the asset remains solid.

However, it remains to be seen whether this will be immediately followed by a significant move to the upside or if it will precede a longer consolidation phase before a new breakout occurs. The market is currently in a crucial zone that requires further confirmation from trading volumes and global sentiment.

Conclusion

While Bitcoin price is showing a convincing recovery, on-chain data provides deeper insights into the overall health of the crypto market. Falling BTC reserves on exchanges, stability in stablecoin indicators, and a manageable funding rate form a combination that favors a potential continuation of the uptrend.

Keeping macro factors in mind, investors are now advised to watch market dynamics more closely and consider on-chain data as part of their investment analysis strategy.

Also Read: XRP Price Outlook After Ripple and SEC Lawsuit Settlement

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- NewsBTC. Bitcoin’s Quiet Bull Signal: On-Chain Trends Hint at Another Price Breakout. Accessed April 17, 2025.

- Featured Image: Finbold