Mantra (OM) Rises After Falling 90%: Will the Positive Trend Continue?

Jakarta, Pintu News – After experiencing a drastic price drop of more than 90% in a short period of time, Mantra is showing surprising signs of resurgence. The altcoin had fallen from $6.30 to under $0.50 (around Rp106 to Rp8,410, at an exchange rate of Rp16,820/USD) in just a few hours on April 13, 2025. But in the last 24 hours, OM managed to record a 25% surge in price, making it one of the best-performing crypto assets in the market today.

Mantra (OM) Leads Market Rise

Mantra’s (OM) resurgence was triggered by the announcement of Mantra’s CEO, John Patrick Mullin, who revealed plans to conduct a team allocation token burn. Although the details of the burn are still being finalized, this news was enough to ease market concerns and revive positive sentiment among traders.

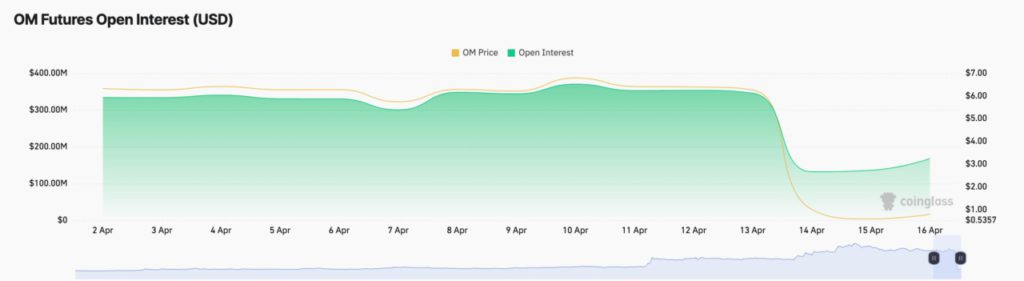

In the past 24 hours, OM accumulation volume increased considerably, with prices surging by more than 25%. Open interest in OM futures also rose 9%, indicating a significant flow of new capital into long positions. In total, open interest reached $156.74 million, indicating traders are increasingly confident in OM’s recovery potential .

Also Read: XRP Current State: Price Consolidation and Potential Breakout Amid Ripple and SEC Deal

Long/Short Ratio Data Supports Bullish Trend

One important metric that supports OM’s positive momentum is the long/short ratio which currently stands at 1.02. This means that more traders are opening long positions, betting that OM’s price will continue to rise, compared to short positions anticipating a price drop.

A long/short ratio above one is a classic signal that market sentiment favors a continuation of the price rally. However, a thin ratio like this also warns of the possibility of high volatility if sentiment changes quickly.

Next Price Target: Up to $2.64 or Down to $0.09?

Currently, Mantra (OM) is trading around $0.78 (approx . IDR13,120), up 29% from its low of $0.50 on April 13. With increasing buying pressure, there is a possibility of OM maintaining its momentum and targeting prices around $2.64 (approx . IDR44,404).

However, risks remain. If selling pressure dominates the market again, OM could slip to its previous support level of $0.09 (around Rp1,514), a low last reached in January 2024. This shows that, while the current trend appears bullish, the market remains sensitive to changes in sentiment.

Sentiment Dynamics: Euphoria Beware

Although OM’s price movement suggests a strong recovery, investors need to remain cautious. Quick rallies are often followed by corrections, especially when most of the gains are driven by news sentiment, such as token burning plans. Short-term traders may take profits faster, which may add to volatility in the next few days.

In a broader context, DeFi projects like Mantra must continue to demonstrate strong fundamentals to sustain investors’ long-term interest, especially after the crisis of confidence arising from the previous price crash.

Conclusion

Mantra (OM) proved its resilience by bouncing back from a drastic price fall, leading the crypto market gains in the last 24 hours. With support from the token burn announcement and firming on-chain data, OM seems to have a chance to continue its recovery. However, the risk of volatility remains high, so investors are advised to remain cautious and consider all factors before making decisions in this fast-moving crypto market.

Also Read: XRP Price Outlook After Ripple and SEC Lawsuit Settlement

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Mantra (OM) Climbs 25%, Leads Market Gains After Historic Crash. Accessed April 17, 2025.

- Featured Image: Medium