Bitcoin Still Undervalued? On-Chain Data Hints at Bullish Potential

Jakarta, Pintu News – According to the latest analysis from CryptoQuant, Bitcoin may still be below its fair value based on a number of on-chain indicators. BorisVest crypto analysts revealed that current data shows bullish sentiment towards this major cryptocurrency remains strong, even though the price has yet to experience a major surge. This has prompted speculation that the next Bitcoin price rally may be just around the corner.

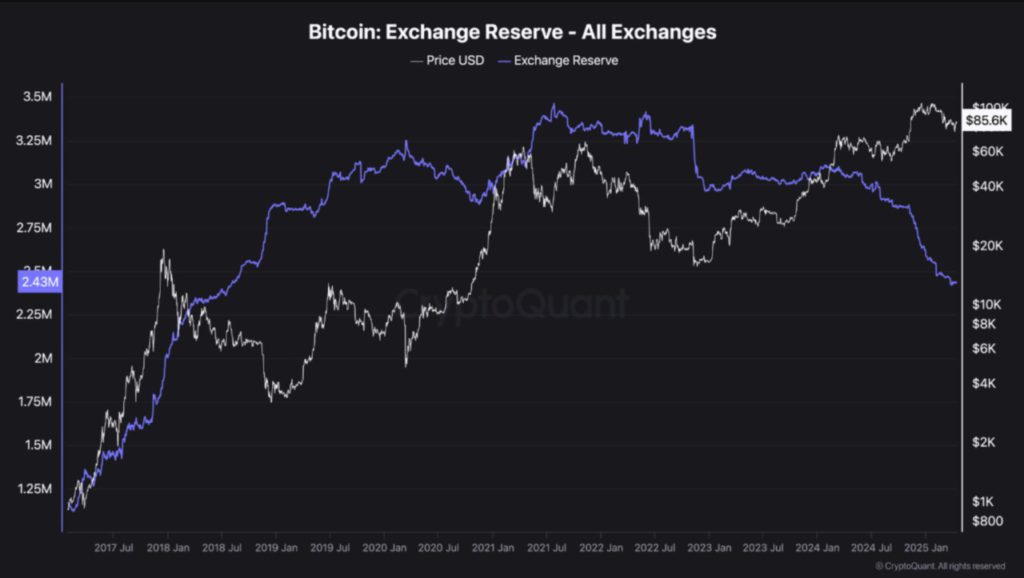

Exchange Reserve Data: Bitcoin is Getting Scarcer

One of the key indicators in the spotlight is the drastic decline in Bitcoin reserves on exchanges. Currently, the amount of BTC available on exchanges stands at around 2.43 million BTC, down sharply from the 3.40 million BTC recorded during the peak of the bull market in 2021.

This decline indicates that more Bitcoin is being withdrawn from exchanges and stored for the long term, rather than traded. In theory, the reduced supply of Bitcoin on exchanges reduces selling pressure and has the potential to push prices up as demand increases. This phenomenon reflects investors ‘ growing confidence in Bitcoin’s long-term value.

Also Read: XRP Current State: Price Consolidation and Potential Breakout Amid Ripple and SEC Deal

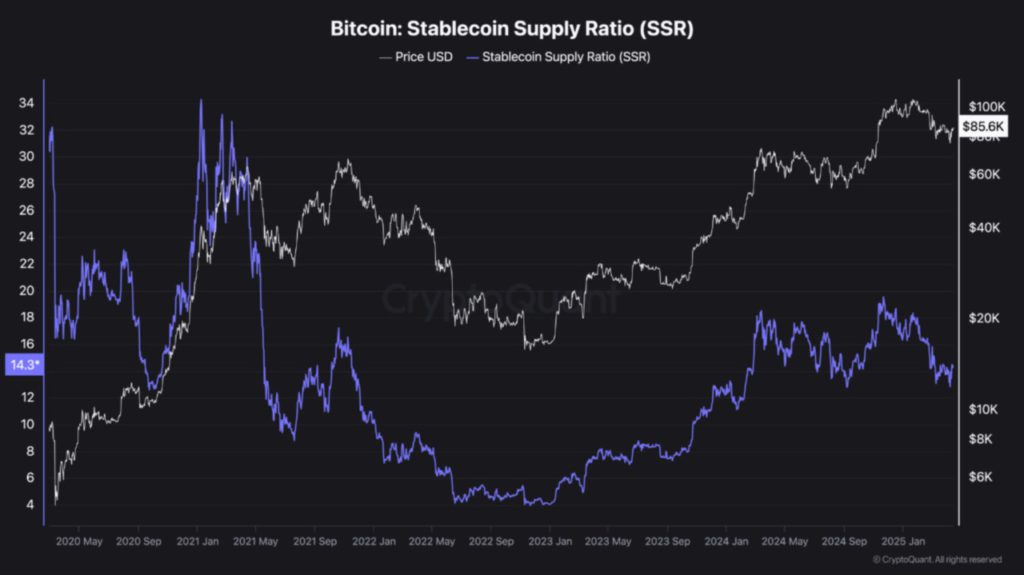

Stablecoin (SSR) Supply Ratio Remains Conducive for Purchases

BorisVest also highlighted the Stablecoin Supply Ratio (SSR), which currently stands at 14.3. The SSR measures the purchasing power of stablecoins compared to the value of Bitcoin available in the market. A low SSR indicates that there is still plenty of liquidity available to buy BTC, supporting the potential for further price increases.

In previous market cycles, the SSR reached a level of around 34 before Bitcoin reached its peak price. As the current SSR figure is still far from that level, it signals that Bitcoin may still be undervalued at the current price, and there is still room for price growth.

USDT Dominance and Indications of Shifting Market Sentiment

Another analyst, Titan of Crypto, noted a hidden bearish divergence on the Tether dominance chart on the weekly timeframe. A decline in the dominance of stablecoins like USDT often indicates that investors are starting to leave defensive assets and re-enter riskier assets like Bitcoin and altcoins.

This divergence could be an early signal of the return of risk-on sentiment in the cryptocurrency market. In other words, if this trend continues, investors will probably start shifting their funds back into crypto assets, pushing Bitcoin and altcoin prices higher.

Bitcoin’s Weekly RSI Signals Recovery

In addition, Bitcoin’s weekly Relative Strength Index (RSI) indicator recently managed to break out of a long-standing downtrend. This raises hopes that Bitcoin could start a price recovery phase, with some analysts even forecasting a new price target of above $100,000 in the medium term.

Exchange net flow data also shows that less Bitcoin is being sent to exchanges, reinforcing the bullish scenario. At the time of writing, the Bitcoin price is hovering around $85,550, up 0.5% in the last 24 hours.

Conclusion

Although Bitcoin has seen a modest recovery, various on-chain indicators suggest that the cryptocurrency may still be priced lower than its fair value.

With exchange reserves continuing to decline, stablecoins’ purchasing power still high, and technical signals such as the RSI improving, many analysts believe that Bitcoin has room for further growth. However, as always in the crypto market, caution and thorough analysis are still required in making investment decisions.

Also Read: XRP Price Outlook After Ripple and SEC Lawsuit Settlement

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- NewsBTC. Bitcoin Undervalued? Analyst Breaks Down Bullish On-Chain Metrics. Accessed April 17, 2025.

- Featured Image: Generated by AI