Why Does the Price of Gold Keep Rising During an Economic Crisis?

Jakarta, Pintu News – Gold prices continue to rise amid the economic crisis, driven by gold buying from the world’s central banks and several other factors. This is because, according to Money Control, on April 16, 2025, the world gold price again set an all-time record high, reaching IDR 53,600,000 per 10 grams on the MCX.

In the last six weeks alone, the price of gold has surged by more than 25%, and is now trading above US$3,350 or about Rp56,950,000 per ounce.

With stock market volatility on the rise, gold has become a safe haven for many investors, including crypto players. What are the factors driving this gold rally?

World Central Banks Buy Gold

One of the main drivers of the surge in gold prices is massive buying by global central banks. According to a report by Tata AMC, gold demand from emerging economies such as China, India, and Turkey continues to rise rapidly as their reserves are lower compared to developed economies such as the US, Germany, and France.

These purchases are expected to average 100 tons per month through 2025, creating a strong price foundation. Central banks in Asia are accelerating gold accumulation in response to worsening geopolitical tensions.

Read also: How to Check Gold Price 24 Karat Gold Price

Economic Uncertainty Drives Gold to Become a ‘Safe Haven’ Asset

Amidst the shadow of global recession, slow economic growth, and international trade tensions, gold is sparkling again. Investors, including crypto market participants, are seeking refuge in safe assets amid growing uncertainty.

In this situation, crypto assets exhibit a high level of volatility, causing discomfort for some investors.

On the other hand, gold, which offers stability, has again become a top choice for maintaining investment value. Therefore, the combination of cryptocurrency and gold is now increasingly being considered as an effective diversification strategy.

Also read: 5 Memecoins that rise when the market crashes in April 2025, FART is one of them?

Weakening US Dollar Index Adds to Gold’s Appeal

The weakening of the US Dollar Index (DXY) in early 2025 provided an additional boost to gold prices. Currently, the DXY is trading at 99.56, much lower than previous years, which makes gold cheaper for international buyers.

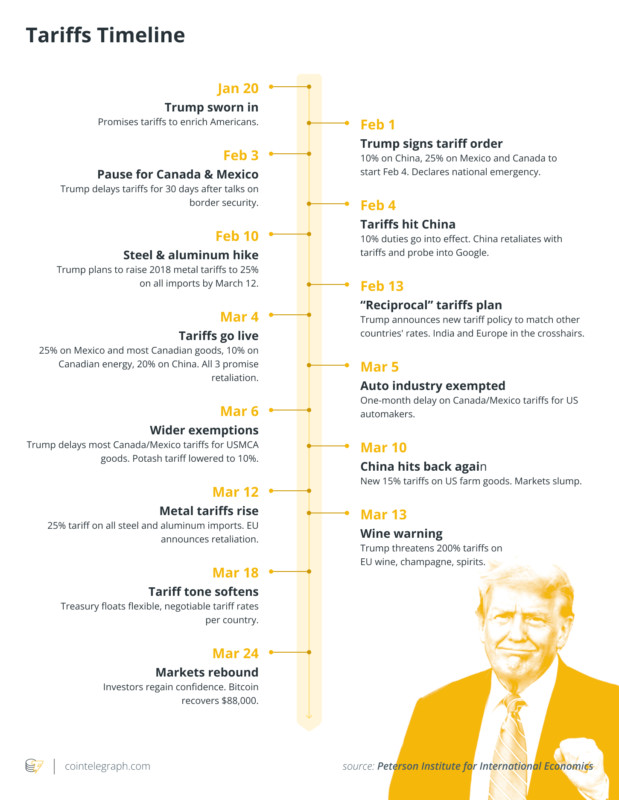

The Trump administration’s policy of favoring a weak dollar and increasing tariffs exacerbated this weakness. As a result, global demand for gold surged, providing a significant price boost.

Also read: Shiba Inu vs Dogecoin: Who Will Explode If Bitcoin Reaches $100,000?

Global inflation concerns trigger gold surge

Fears of global inflation through 2025 are another strong reason behind the rise in gold prices. Factors such as trade tariffs, a weakening dollar, and supply disruptions are making inflationary pressures more pronounced in different parts of the world.

Gold has traditionally been a hedge against inflation, thus attracting more interest from both institutional and retail investors. According to UBS projections, inflows into gold ETFs are expected to reach 450 metric tons this year.

Meanwhile, What is the Price of Bitcoin (BTC) Amidst the Economic Crisis?

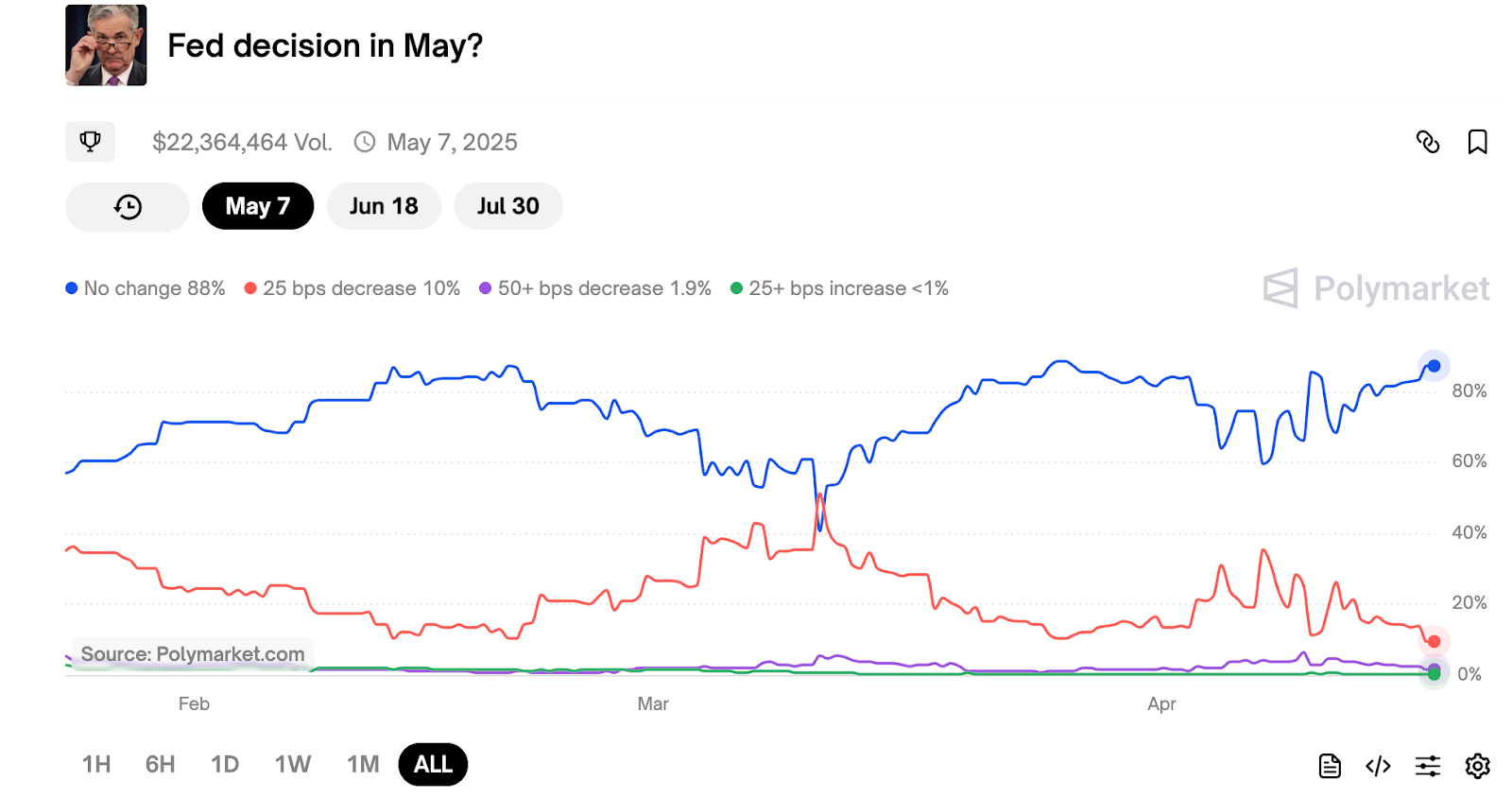

According to Cointelegraph, on April 16, 2025, Jerome Powell confirmed that the Federal Reserve will maintain a “wait-and-see” approach regarding interest rate policy.

He highlighted the risk of inflation due to Trump’s new tariffs being higher than expected, while slowing economic growth. Powell emphasized that the Fed needs more economic data before deciding to ease monetary policy. This immediately hit crypto market sentiment, including Bitcoin and Ethereum .

According to prediction platform Polymarket, there is now an 88% chance that interest rates will stay put in the range of 4.25% to 4.50%. This means that the expectation of a rate cut shortly has become very small, only about 10%.

Since April 9, 2025, Bitcoin price has formed a pattern of ranging between $75,000 and $86,400, without managing to print a close above $86,000. To aim higher, Bitcoin needs to turn this resistance into strong support.

Next, Bitcoin should break the 200-day Exponential Moving Average (EMA) again around $87,740. Above that, there is a major supply area up to $91,240 which coincides with the 100-day Simple Moving Average (SMA).

If this zone can be crossed, Bitcoin’s chances of reaching $100,000 will be further opened. However, if it fails, bears will try to hold Bitcoin below the resistance, opening up the potential for a deeper correction.

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Cointelegraph. Bitcoin price levels to watch as Fed rate cut hopes fade. Accessed April 19, 2025

- Money Control. Gold prices hit an all-time high: Here are the key reasons driving the surge. Accessed April 19, 2025

- Featured Image: Generated by Ai