Will Jerome Powell step down? Markets Predict Fed Chair’s Fate!

Jakarta, Pintu News – Amid harsh criticism from US President Donald Trump against Federal Reserve Chairman Jerome Powell, prediction markets such as Polymarket are showing interesting trends.

Although Trump has repeatedly attacked Powell regarding interest rate policy, the chances for Powell’s removal this year remain low. This analysis will delve deeper into the dynamics between monetary policy, presidential criticism, and crypto market reactions.

Check out the full analysis here!

Market Predictions on Powell’s Fate

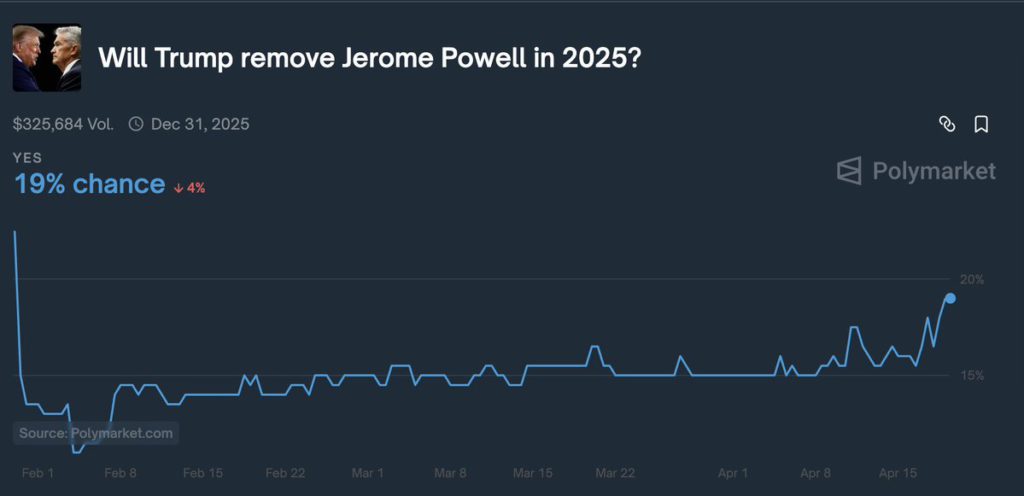

The latest data from Polymarket shows that the chances of Donald Trump removing Jerome Powell within this year are only 19%. This figure has decreased by 4% in the last 24 hours, despite reports from the Wall Street Journal that Trump has been privately discussing Powell’s removal for several months.

This possibility is all the more intriguing given that Trump has expressed dissatisfaction with Powell, who he says is always “late and wrong”. Trump also emphasized that Powell’s dismissal “can’t come soon enough”, a statement that added to tensions between the White House and the Federal Reserve.

Also read: 7 Ways to Get Passive Income from Crypto 2025, Simple!

Implications for the Crypto Market

Jerome Powell has shown a conservative stance towards interest rate cuts, which has indirectly affected the price of Bitcoin and other altcoins. Crypto markets, which tend to react sensitively to monetary policy, could benefit from a change in leadership at the Fed if it means interest rates will be cut.

However, Powell in his latest speech emphasized that the Federal Reserve will likely hold interest rates steady for the time being, while monitoring the impact of Trump’s tariffs on inflation.

This suggests that looser monetary policy may not materialize soon, although Bank of America predicts there will be four Fed rate cuts this year, with the first likely to occur at the May FOMC meeting.

Read also: After Unlocking 212 Million Tokens, How is the Price Movement of Pi Network (PI)?

Replacement Candidates and Market Reaction

Discussions about possible Powell replacements, such as Kevin Warsh, have also attracted attention. Warsh, who is known to be more crypto-friendly, once supported central bank digital currencies (CBDCs) but appears to be against private stablecoins.

This goes against the policies of Trump, who has signed an executive order banning the creation of CBDCs. Nonetheless, crypto markets and other financial market participants will continue to monitor any developments from the Federal Reserve. Policies taken by the Fed will greatly affect the dynamics of global financial markets, including the crypto market.

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Traders Bet Against Fed Chair Jerome Powell’s Removal Despite Donald Trump’s Criticism. Accessed on April 21, 2025

- Featured Image: CNBC