Bitcoin continues to prosper amid crypto market fears: The Impact of Inflation Fears on Crypto

Jakarta, Pintu News – The crypto market is currently plagued by deep fear, but Bitcoin still seems to be able to attract investors. In the past two weeks, capital flows into the crypto market have seen a drastic drop of more than 70%, from $8.2 billion on April 4 to just $2.38 billion on April 18.

This sharp decline reflects a wave of investor caution amid rising market volatility and intensifying macroeconomic pressures.

Why the crypto market is filled with fear again

Market sentiment data showed that the Fear and Greed index remained at 33, indicating “Fear”. This figure has been stable for several weeks, with little change from 32 last week and 31 the previous month. This creates a psychological stalemate in the market, where buyers are reluctant to enter aggressively.

Historically, this prolonged fear phase has preceded both sharp rebounds and deeper corrections. However, the lack of volatility in sentiment suggests hesitation rather than panic, indicating that market participants are waiting for stronger macro or price signals before taking decisive action.

Also Read: 7 Ways to Save Dollars (USD) for Maximum and Effective Use

The Impact of Inflation Fears on Crypto Confidence

Macroeconomic pressures intensified with one-year inflation expectations jumping 1.7 percentage points in April, reaching 6.7%-the highest level since 1981. This was the fourth consecutive monthly increase, with inflation expectations rising by a total of 4.1 percentage points since November 2024.

Meanwhile, five-year inflation expectations now stand at 4.4%, the highest level since June 1991. At the same time, consumer sentiment fell to its second lowest level in history. This combined data points to potential stagflation, and naturally, crypto-which is still considered a high-risk asset class-has been hit by this heightened fear.

Can ETF Fund Flows Prevent Massive Withdrawals?

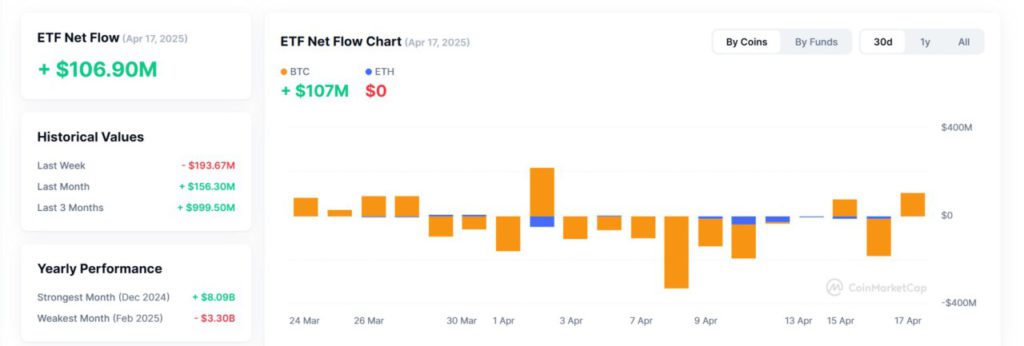

However, there are bright spots amidst the darkness. The Bitcoin (BTC) ETF recorded a net inflow of $107 million on April 17 alone, raising the monthly total to $156 million. In fact, over the past three months, the ETF’s net inflows have surpassed $1 billion-suggesting that institutions haven’t completely abandoned crypto.

Although the Ethereum ETF remains stagnant, this divergence highlights the strength of Bitcoin (BTC) as a safer option. Moreover, the continued inflow of funds into ETFs can provide stability to the market and prevent panic-induced selling in the short term.

Conclusion

The sharp drop in capital flows and persistent fear signals indicate increased caution. However, the steady flow of institutional funds through ETFs suggests that investors are not abandoning the crypto market. This appears to be a short-term reset driven by macro fear, not a structural collapse. If inflation expectations stabilize and sentiment improves, the crypto market might find a foothold for a renewed rally.

Also Read: 7 Ways to Get Passive Income from Crypto 2025, Simple!

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. The Crypto Market is Frozen in Fear, But How Bitcoin Keeps Cashing In. Accessed on April 21, 2025

- Featured Image: The image created by AI