Canary Capital Files First-Ever TRON (TRX) ETF with Staking Rewards, Game-Changer or Controversy?

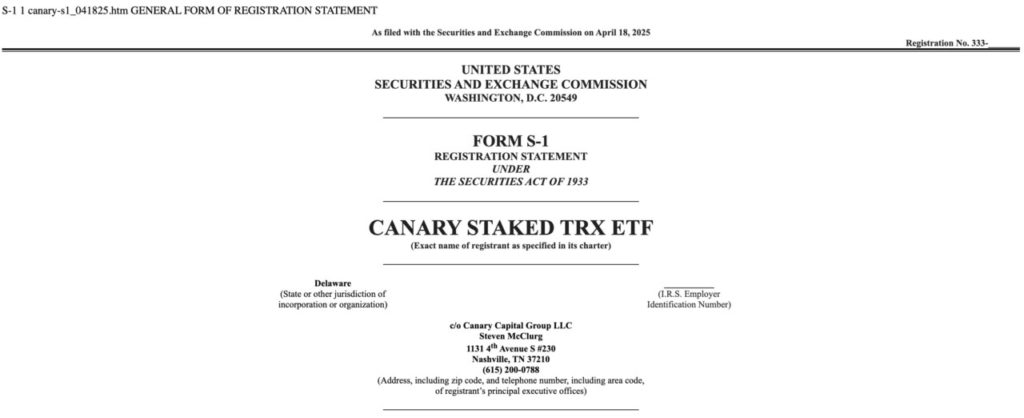

Jakarta, Pintu News – Canary Capital recently filed a Form S-1 with the US Securities and Exchange Commission (SEC) to launch an exchange-traded fund (ETF) focused on Tron (TRX).

This filing is the first step in providing investors with the opportunity to engage directly with TRX’s market performance while earning staking rewards. This unique proposition sets this ETF apart from previous spot crypto ETF proposals that have been filed with the SEC.

TRON ETF: Potential and Challenges

The ETF proposed by Canary Capital designates BitGo Trust Company as the custodian of TRX assets and Canary Capital as the fund sponsor.

Read also: Dogecoin to Explode? Analysts Predict DOGE Could Soar to $2 Before Year’s End – Here’s Why!

Tron founder Justin Sun has voiced his support for this development, emphasizing TRX’s long-term growth potential and attracting strong institutional interest if the ETF is approved. Currently, Tron is ranked as the ninth crypto with the largest market capitalization, reaching approximately $22.94 billion.

According to data from DeFiLlama, the Tron blockchain has become the top choice for stablecoin settlement, trailing only Ethereum in this regard. Tron’s efficiency in processing fast and cheap transactions has made it the preferred choice for Tether .

Regulation and Controversy

While this ETF proposal has created excitement in the market, questions remain regarding its chances of gaining regulatory approval. The addition of a staking component in an ETF is a bold move, but the SEC has historically opposed similar features in other crypto investment products.

The SEC has characterized staking services in investment products as unregistered securities, which increases scrutiny. Ethereum ETF proposals in the past have been forced to remove the staking component to meet regulatory expectations.

Nonetheless, some companies, including Grayscale, continue to push altcoin ETFs that incorporate staking or offer broader asset exposure.

However, regulatory uncertainty still looms over the TRX Canary ETF proposal, especially in light of past controversies involving Justin Sun and allegations of network use by illegal actors, which the network has publicly denied.

Read also: Solana Open Interest Soars 10% — Are Whales Preparing for a Major SOL Rally?

Implications for Investors

If approved, Canary Capital’s ETF will be a milestone by combining exposure to TRX with staking rewards.

This structure can attract retail and institutional investors who seek returns alongside market performance. It marks a new era in crypto investment products, where investors can directly benefit from the growth and returns of crypto assets.

The success or failure of these ETFs in gaining approval will be an important indicator of regulators’ attitude towards innovative crypto-based financial products. It will also provide insight into the future of crypto regulation and how digital assets will be integrated into the mainstream financial ecosystem.

Overall, [Canary Capital’s] TRON ETF proposal marks an important step in the evolution of crypto-based financial products. Despite regulatory challenges and controversies, the potential for growth and institutional adoption remains high.

Investors and market watchers will be awaiting the SEC’s decision with great anticipation, as this will greatly affect the future direction of the crypto market.

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Canary Capital Aims to Launch Tron-Focused ETF. Accessed on April 21, 2025

- Cointelegraph. Canary Files for Staked TRX ETF. Accessed on April 21, 2025

- CryptoNews. Canary Capital Files for Spot Tron ETF with Staking Feature. Accessed on April 21, 2025