Bitcoin (BTC) is predicted to dominate the ETF market, why?

Jakarta, Pintu News – The cryptocurrency market continues to evolve with Bitcoin maintaining strong dominance among various other crypto assets. Despite the emergence of many altcoin ETFs, analysts predict that Bitcoin (BTC) will continue to dominate the market.

Market Domination by Bitcoin (BTC)

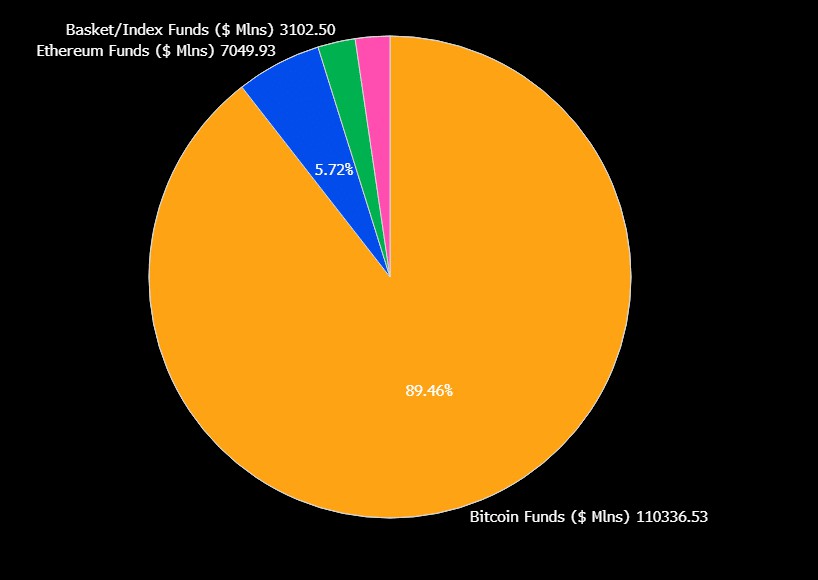

According to Eric Balchunas, an analyst from Bloomberg, Bitcoin (BTC) currently controls 90% of total global crypto fund assets. Although many ETFs for altcoins and memecoins are expected to launch this year, their impact on Bitcoin’s (BTC) dominance is expected to be minimal.

Balchunas asserted that Bitcoin (BTC) is likely to maintain market dominance of between 80-85% in the long term. Bitcoin’s (BTC) dominance in the spot market currently reflects the size of the major asset markets. Ethereum’s market share has declined to 7% from a peak of 19% in 2024, while Bitcoin’s (BTC) dominance increased to 64.5% from 50%, including the market capitalization of stablecoins.

Also Read: Trump Attacks Powell, Stock Markets Fall, But Bitcoin (BTC) Surges!

Projected Market Dominance and Performance

Benjamin Cowen, another analyst, supported Balchunas’ projections by stating that Bitcoin (BTC) could extend its superior performance against altcoins and reach a dominance of up to 66%. Cowen explained that the ALT/BTC pair is likely to continue to decline, as it did last year when the Federal Reserve announced it would slow down its Quantitative Tightening Policy.

Meanwhile, spot Bitcoin (BTC) ETFs in the US saw massive sales in 2025. Amid tariff uncertainty, more than $4 billion was withdrawn from such products between February and April. However, on April 21, the product recorded daily inflows of $381 million, which was the highest since February.

Technical Analysis and Price Outlook

Bitcoin (BTC) is currently trading at $88.4K. The next step is to cross the 200-day Moving Average at $88.3K and the previous lower limit at $92K to sustain the recovery. The increased interest in Bitcoin (BTC) comes after the selling of the US dollar and a flight to ‘safe haven’ assets such as gold and digital assets.

At the time of writing, the total net assets of Bitcoin (BTC) ETF products stand at $97 billion. This shows that despite fluctuations, institutional interest in Bitcoin (BTC) remains strong.

Conclusion

With in-depth analysis and projections from experts, Bitcoin (BTC) looks set to continue dominating the crypto ETF market. Despite challenges and volatility, the strong institutional trust and adoption of Bitcoin (BTC) shows that it is still a top choice for many investors.

Also Read: Ethereum User Increase: A Sign of Price Recovery in May 2025?

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Bitcoin will retain 80-85% of ETF market share, analyst reveals how. Accessed on April 23, 2025

- Featured Image: Crypto Economy