US Political Tensions Strengthen Bitcoin, Stock Markets Fall!

Jakarta, Pintu News – On Monday, US financial markets experienced a sharp decline, while cryptocurrency prices remained stable. This came after US President Donald Trump escalated his feud with Federal Reserve Chairman Jerome Powell. The conflict between the country’s top political and monetary leaders has rattled traditional markets but has not affected crypto markets.

US Stock Market Plunges

American stock indices suffered big declines on April 21, with broad losses across all major benchmarks. The S&P 500 Index fell by 2.3%, the tech-dominated Nasdaq lost 2.4%, and the Dow Jones Industrial Average plunged nearly 1,000 points or 2.4%.

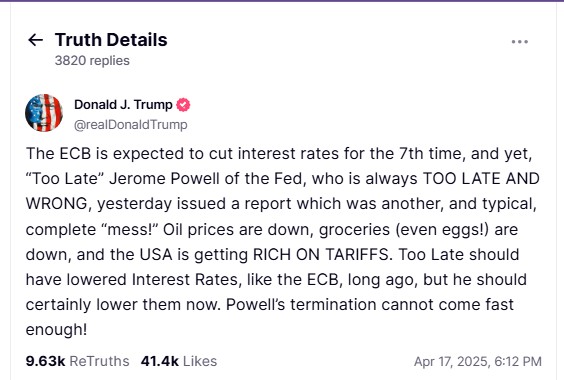

This decline reflects the high uncertainty in the financial markets. This instability was triggered by President Trump’s recent comments calling for interest rate cuts. Trump stated through the Truth Social forum that a preventive cut in interest rates is being requested by many.

The President argued that the rate cut was justified because “Energy costs are falling dramatically, food prices are substantially lower, and most other ‘goods’ are showing a downward trend.”

Also Read: Trump Attacks Powell, Stock Markets Fall, But Bitcoin (BTC) Surges!

Trump-Powell tension sparks volatility

The increasingly intense conflict between President Trump and Federal Reserve Chairman Powell is a major cause of market volatility. Trump has repeatedly criticized Powell, calling him “Late and wrong” for not cutting interest rates which currently remain at 4.5%. Tensions escalated after Powell warned that Trump’s tariffs could cause stagflation, which then prompted Trump to demand his dismissal.

President Trump asserted that “the firing can’t come soon enough,” indicating deep dissatisfaction with Powell’s policies. Meanwhile, markets are pricing that the central bank will stick to its position in its next meeting on May 7, with interest rate markets now only forecasting a 13% probability of a rate cut at that session.

The Power of Crypto Amid Political Turmoil

In contrast to traditional markets, cryptocurrencies like Bitcoin are showing impressive resilience. The total market capitalization of cryptocurrencies, based on data from TradingView, remained stable at $2.74 trillion. Bitcoin (BTC) price, according to data from Coingecko, reached a four-week peak of $88,428.

Meanwhile, the US Dollar experienced weakness, with the US Dollar Index (DXY) dropping below 98, registering a three-year low. This follows a downward trend that has seen the dollar lose more than 10% of its value since the start of 2025. On the other hand, crypto industry figures such as Anthony Pompliano warned against presidential intervention in the leadership of the Federal Reserve.

Conclusion

The dynamic between President Trump and Federal Reserve Chairman Powell has created a wave of uncertainty in the financial markets, yet cryptocurrencies have proven resilient to this turmoil. Continued political tensions may continue to affect markets going forward, but the strength shown by crypto markets signals a potential shift in global financial dynamics.

Also Read: Ethereum User Increase: A Sign of Price Recovery in May 2025?

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- NewsBTC. Trump Attacks Fed, Wall Street Shudders, But Bitcoin Draws Strength. Accessed on April 23, 2025

- Featured Image: The image created by AI