Bitcoin (BTC) Breaks $93K, Will the Rise Last?

Jakarta, Pintu News – Bitcoin recently reached a new peak of $93,000, attracting the attention of investors large and small. Amid the significant price increase, there is a stark difference of opinion among the big players in the market. Some are strengthening their positions by buying more Bitcoin (BTC), while others are placing big bets on an impending price drop.

Big Investors Have Different Opinions

A major investor just bought over $91 million worth of Bitcoin (BTC) from Binance, just minutes before the price of Bitcoin (BTC) reached the $90,000 level again. However, not long after that, two other wallets opened massive short positions with 6x leverage at $92,469.1 and $92,664.8, with the total position value reaching $74.5 million.

These positions indicate an expectation of a price correction in the near future, with liquidation levels above $107,000. Large investors seem to be divided in their strategies. While some are doubling down on their investments amid rising prices, others are bracing for a potential sharp drop. This suggests a widening divergence in sentiment among major players in the Bitcoin (BTC) market.

Also Read: 7 Ways to Save Dollars (USD) for Maximum and Effective Use

Retail Speculation and Potential Short Squeeze

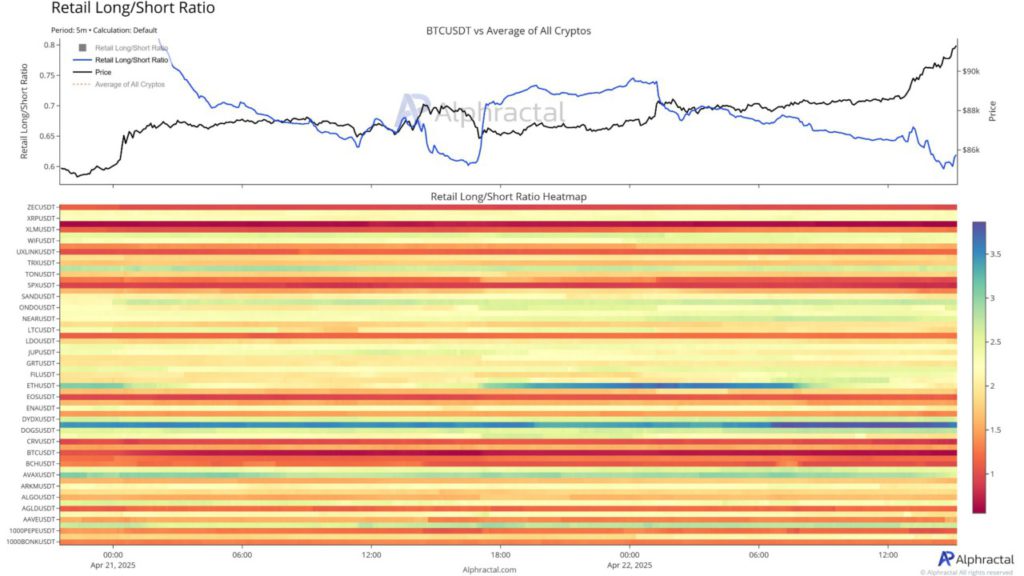

On the other hand, retail sentiment seems to go against the current trend. The Retail Long/Short Ratio is showing a decline, with more and more traders opting to short Bitcoin (BTC) despite the price continuing to rise. The accumulation of short positions during price rallies creates conditions for a short squeeze to occur, where a sharp price increase may force short traders to buy back Bitcoin (BTC) to recoup their losses.

This phenomenon is not just limited to Bitcoin (BTC), but is also seen in other assets. While this may boost profits in the short term, the re-emergence of heavy buying interest could signal market exhaustion. This change could be an indicator of the formation of a local top, which coincides with the peak of euphoria among traders.

Bitcoin (BTC) Momentum is Still Strong, But There are Signs of Overheating

Bitcoin (BTC) continues to show gains by forming consecutive green candles and a bullish gap of $88,000. The Relative Strength Index (RSI) indicator is currently near 68, indicating that the bullish momentum is still strong, but may be approaching saturation point. Meanwhile, the On-Balance Volume (OBV) continues to show an upward trend, signaling strong buying pressure supporting the price movement.

If Bitcoin (BTC) manages to close above $94,000 on increased volume, it could open up opportunities towards $96,000 and higher. However, a drop in RSI or the appearance of a bearish divergence could indicate a weakening of strength, making $91,000 a key support to watch in case of a price pullback.

Conclusion

With ever-changing dynamics and diverging strategies among major investors, the Bitcoin (BTC) market is currently at a critical juncture. Whether this rise will continue or we will witness a significant correction, only time will tell.

Also Read: 7 Ways to Get Passive Income from Crypto 2025, Simple!

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Whale Bets Big Against Bitcoin: $74.5M Short Positions Placed After BTC Hits $92k. Accessed on April 23, 2025

- Featured Image: Generated by AI