Bitcoin (BTC) Is a Safe Harbor Amid Global Market Turmoil

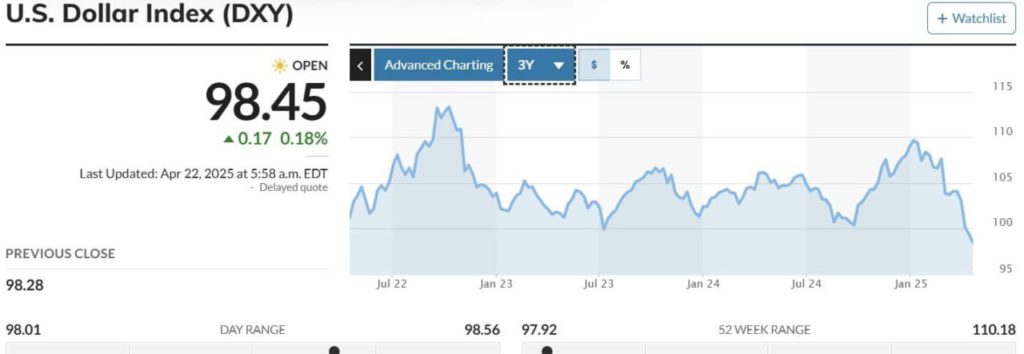

Jakarta, Pintu News – Amid global market uncertainty triggered by Donald Trump’s policies, global liquidity has increased significantly. This has prompted investors to turn to Bitcoin as a perceived safer asset. With the decline in the US Dollar Index (DXY) and increased investor interest in Bitcoin (BTC), the question that arises is whether this is a golden moment for Bitcoin (BTC)?

Global Liquidity Increases, Bitcoin (BTC) Shines

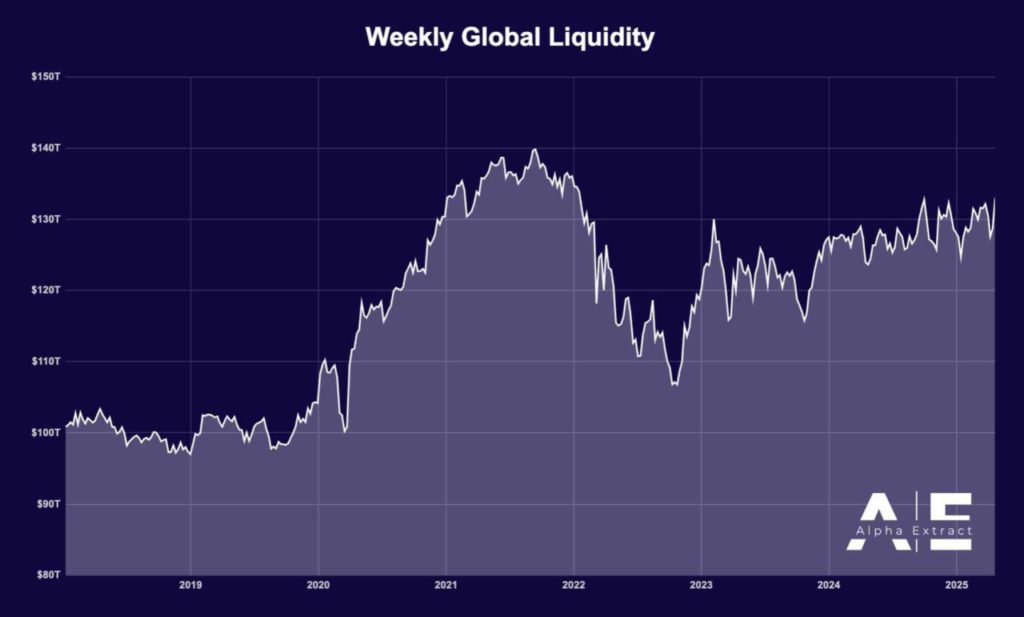

According to a report from Alpha Extract, global market liquidity has reached a new high, with the Global Liquidity Index rising by $4.175 trillion or 3.31%. This increase coincided with a rise in the price of Bitcoin (BTC) from $78,000 to $88,000. This shows that the increased capital flow into the global market has had a positive impact on the price of Bitcoin (BTC).

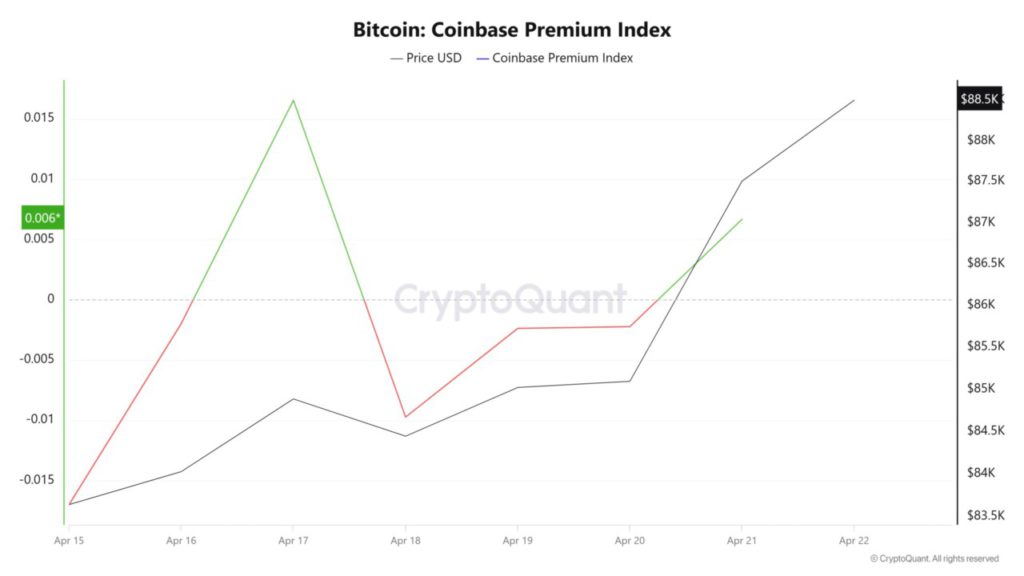

Investors are back to accumulating Bitcoin (BTC), with institutional buyers from the US re-entering the market. Coinbase’s premium index, which turned positive after three days of negativity, signaled institutional interest in Bitcoin (BTC) amid market uncertainty.

Also Read: Gold or Bitcoin: Which is a Safe Investment Amid US-China Tensions?

Bitcoin (BTC) as a Safe Harbor

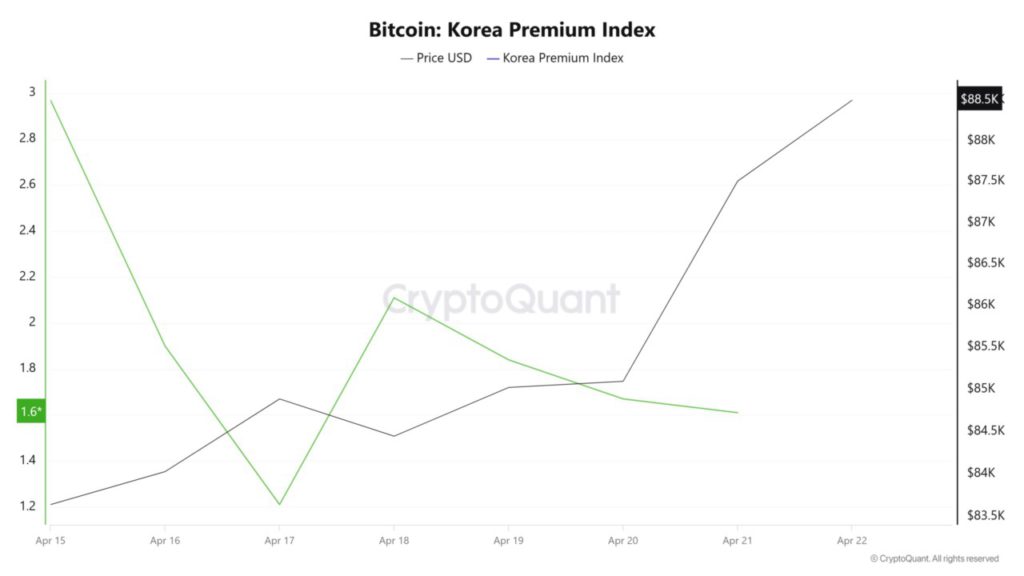

With the Korean Premium Index remaining in positive territory, it reinforces evidence that large investors see Bitcoin (BTC) as a safe haven amid extreme market volatility. As uncertainty increases, Bitcoin (BTC) is seen as a reliable store of value, placing it in a favorable position in the current market landscape.

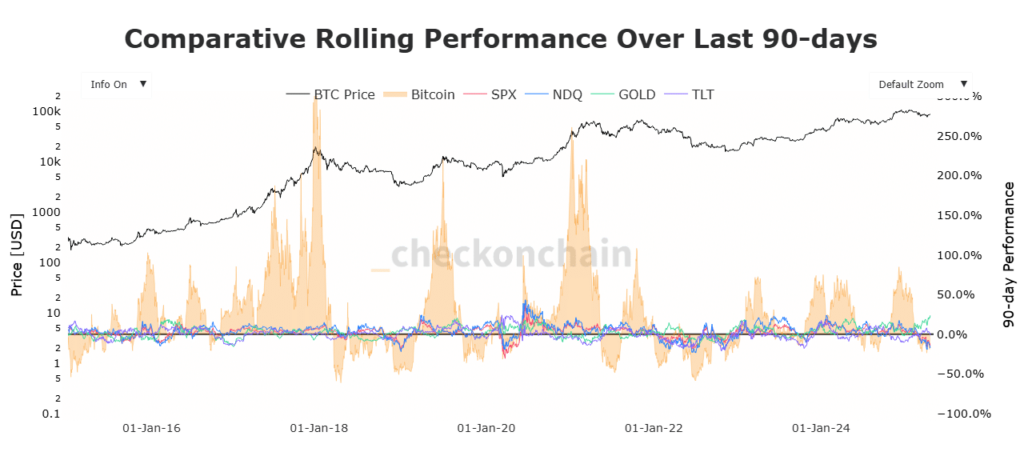

Among store-of-value assets, only gold has outperformed Bitcoin (BTC). Currently, Bitcoin (BTC) is holding above the SPX, NDQ, and NLT indices, highlighting its strength compared to equities. Bitcoin (BTC)’s comparative rolling performance shows its superiority, indicating further growth potential if market turmoil continues due to US policy uncertainty.

Bitcoin’s (BTC) Future Growth Potential

If the state of global markets continues to provide uncertainty, Bitcoin (BTC) could potentially reach back to $90,000 and possibly even rally to $100,000. However, if the Federal Reserve (FED) intervenes to address the impact of Trump-era policies, financial markets may stabilize, which could lead to Bitcoin (BTC) pulling back to $85,000.

With increasing uncertainty in traditional finance, investors are increasingly turning to Bitcoin (BTC), setting the stage for further growth. If Bitcoin (BTC)’s lead continues, the asset could become a very attractive investment option in the future.

Conclusion

With market conditions constantly changing, Bitcoin (BTC) is showing its resilience as a store of value. Increased global liquidity and strong investor interest make Bitcoin (BTC) a promising investment option amid global uncertainty. Investors looking for security in their investments may find that Bitcoin (BTC) offers a stable and profitable solution.

Also Read: Polkadot (DOT) Preparing to Surpass Resistance, Is it Time to Buy?

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Global Liquidity Soars, Investors Flock to Bitcoin: Is BTC the Safer Bet Now? Accessed on April 23, 2025

- Featured Image: Generated by AI