Ethereum (ETH) Breaks $1.6K: Is $2K the Next Target?

Jakarta, Pintu News – Ethereum has managed to break out of a downward trend that lasted for several months. This trend break, marked by the yellow arrow, is Ethereum’s (ETH) first major technical turnaround since February 2025. Now, Ethereum (ETH) has managed to hold above the crucial $1,600 support. If this level continues to hold, analysts predict that a push towards the $2,000 mark could be imminent.

Ethereum’s (ETH) success in maintaining its position above $1,600 shows strong potential to reach $2,000 resistance next. If it manages to break through this resistance, Ethereum (ETH) might continue its rise towards the $2,500 to $3,000 range in the medium term. However, it’s important to remember that support at $1,600 is crucial; a drop below this level could indicate a possible trend reversal.

Return of Capital to the Main Chain

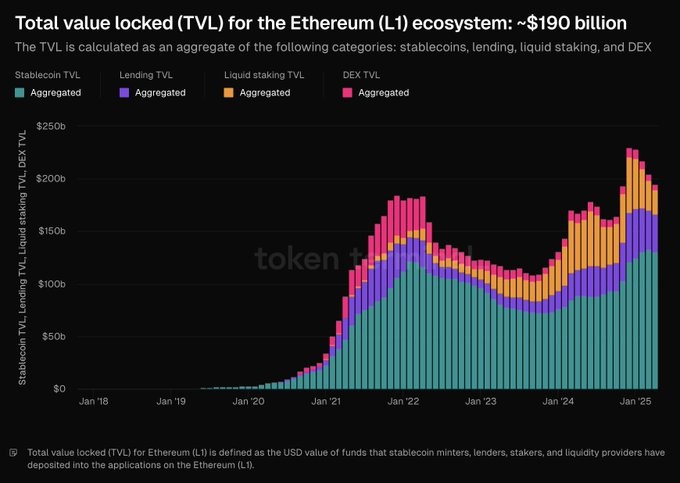

The Layer 1 ecosystem of Ethereum (ETH) is showing signs of resurgence, with Total Value Locked (TVL) now approaching $190 billion, the highest figure since late 2022. According to data from Token Terminal, this resurgence is being driven by a balanced increase among stablecoins, lending protocols, liquid staking, and DEX protocols.

Liquid staking and lending protocols in particular, showed a significant increase, indicating investor interest in yield-generating applications. This suggests that capital is starting to rotate back into Ethereum (ETH)’s underlying infrastructure, which reinforces bullish sentiment in line with Ethereum’s (ETH) technical breakthrough.

Also Read: Gold or Bitcoin: Which is a Safe Investment Amid US-China Tensions?

Things to Watch Out for

With Ethereum (ETH) stabilizing above $1,600 after its recent breakout, traders are starting to set their sights on the $2,000 resistance as the next big hurdle. Success in breaking this barrier could pave the way towards $2,500 to $3,000 in the medium term.

Upcoming macroeconomic events, especially indications about an interest rate cut by the Federal Reserve in June, could affect the direction in which Ethereum (ETH) moves. A controlled decline in inflation increases the chances of such a cut, potentially supporting risky assets such as Ethereum (ETH). However, it is worth being aware that the recent transfer of 1,000 Ethereum (ETH) by a wallet associated with the Ethereum Foundation to Kraken raises concerns about a possible massive sell-off.

Conclusion

Ethereum’s (ETH) significant and steady price increase above $1,600 shows strong potential for further growth. With strong support from infrastructure and growing interest from investors, Ethereum (ETH) will probably continue to show positive performance. However, it is important to remain alert to changes in the macroeconomic environment and activity within the network that could affect price stability.

Also Read: Polkadot (DOT) Preparing to Surpass Resistance, Is it Time to Buy?

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Ethereum crosses $1.6k, is $2k now within reach for ETH?. Accessed on April 23, 2025

- Featured Image: Generated by AI