Ethereum Stuck at $1,700—But Whales Are Quietly Buying Up ETH! What Do They Know?

Jakarta, Pintu News – At the start of April 23, Ethereum saw a sharp 13% jump in price, briefly climbing to around $1,787. This rally also triggered a surge in trading activity, with 24-hour volume rising by 73%.

Following the price spike, on-chain data from Lookonchain revealed a noticeable uptick in activity from ETH whales.

Then, how will Ethereum price move today?

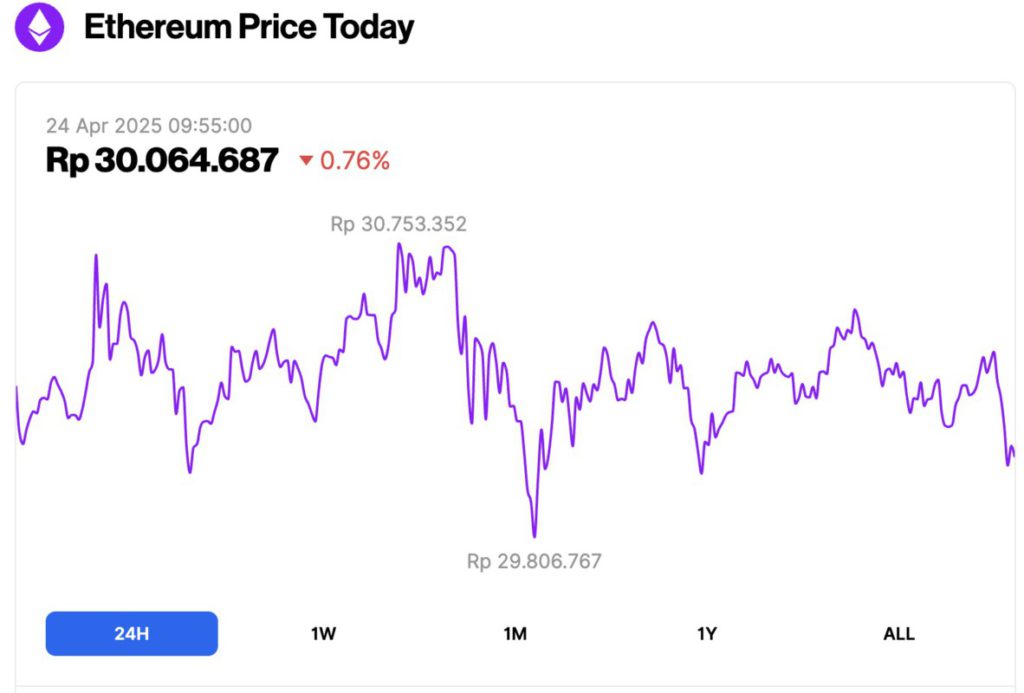

Ethereum Price Drops 0.76% in 24 Hours

As of April 24, 2025, Ethereum (ETH) was trading at around $1,780, or approximately IDR 30,064,687. The price saw a modest dip of 0.76% over the past 24 hours. During that time, ETH reached a high of IDR 30,753,352 and a low of IDR 29,806,767.

At the time of writing, data from CoinMarketCap shows that Ethereum’s market capitalization stands at around $215.05 billion, with daily trading volume falling 20% to $19.17 billion in the last 24 hours.

Read also: Dogecoin Dips 3% (April 24), But This Analyst Says a Major Breakout Could Be Coming Soon!

Increased ETH Whale Activity

Yesterday’s spike in Ethereum price coincided with increased whale activity. One of the large investors who previously lost $40 million when the ETH price fell to $1,400 on April 9, re-entered the market to accumulate.

According to data from Lookonchain, the whale borrowed 34.75 million USDT through the Aave platform and bought 19,973 ETH at $1,740 – a bold move that shows confidence in the potential price increase.

Another large investor, with wallet number 0x2088, bought 2,568 Ether worth about $4.61 million at $1,794.

Meanwhile, address 0xD20E withdrew 5,531 ETH – equivalent to nearly $9.8 million – from Binance, a move that usually signals an intention to hold the asset for the long term.

Analysts Predict a Bullish Rally for ETH

Additionally, on April 22, funds pouring into spot Ethereum exchange-traded funds (ETFs) recorded net inflows of $38.74 million, breaking the previous 10 consecutive days of stagnant or outflow trends.

It should be noted that Ethereum has been trading within a descending trend channel since mid-December 2024. The recent price breakout from this pattern has many analysts predicting a bullish rally ahead.

Read also: Ethereum Foundation sends 1,000 ETH to crypto exchanges, will ETH price drop again?

A popular crypto trader at X named Christiaan even set ETH’s short-term price target at $2,690.

Another analyst known as “Ash Crypto” also voiced similar optimism, comparing ETH’s chart pattern to Bitcoin’s price surge at the end of 2024.

On April 22, Rekt Capital analysts noted that ETH market dominance had dropped to the crucial support level from 2019 of 7%, but has since recovered.

If ETH is able to maintain and increase its dominance, the currency could potentially reclaim its strong position in the overall crypto market.

Ethereum (ETH) Price Outlook

On the daily chart of ETH prices (23/4/25), the RSI indicator is currently around the 54.75 level with an upward trend. This indicates that the bullish momentum still has the potential to continue, especially if the buying volume remains high.

As of April 23, ETH price is moving close to the upper band of the Bollinger Band indicator at around $1,800.

If the price manages to break this upper band, it could trigger further buying – although such a move could also signal an overbought condition in the short term.

As long as Ethereum is able to stay above the middle band of the Bollinger Band and the RSI remains above the neutral level of 50, the chances of a more sustained price breakout will increase.

Meanwhile, the MACD indicator shows a bullish crossover, which is supported by the ever-increasing green histogram – reflecting the increasingly positive market sentiment towards ETH.

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto retail and futures trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coinspeaker. Whales Continue to Accumulate Ethereum, ETH Rally Ahead? Accessed on April 24, 2025