AVAX Upside Potential of Up to 21%: What are the Key Conditions?

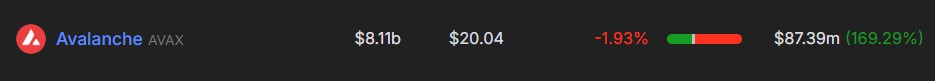

Jakarta, Pintu News – Recent analysis from IntoTheBlock shows a significant increase in large transactions on Avalanche , signaling high interest from large investors. This increase, which reached 169%, may be an early indicator of a potential surge in the price of AVAX. However, there are some critical conditions that must be met for this bullish prediction to materialize.

Big Transaction Spike: A Bullish Signal?

IntoTheBlock, an on-chain analytics firm, reported a huge transaction spike on Avalanche (AVAX) of 169%. This suggests that whales and large investors are starting to show high interest in AVAX. This increase in transaction volume is often interpreted as a bullish signal, especially when it coincides with a favorable price pattern.

At the same time, AVAX managed to break out of a bullish price pattern indicating further upside potential. This combination of increased large transactions and a positive price pattern adds to the belief that AVAX may experience a significant price increase in the near future.

Also Read: Gold or Bitcoin: Which is a Safe Investment Amid US-China Tensions?

AVAX Price Analysis and Key Levels

According to technical analysis from AMBCrypto, AVAX is showing bullish signals on various time frames. On the weekly time frame, AVAX appears to be in a descending channel pattern and recently managed to retest the lower boundary by forming a strong bullish engulfing candlestick pattern.

Meanwhile, on the daily time frame, AVAX has managed to break out of the descending channel pattern and is currently approaching the breakout point of the bullish cup and handle pattern. If AVAX manages to break and close above the critical level, it will be a confirmation of a significant upside potential.

Technical Indicators Show Mixed Sentiment

At the moment, AVAX is trading below the 200-day Exponential Moving Average (EMA), which suggests that the asset is still in a downtrend with weak momentum. However, this situation is not entirely negative, as there are other indicators that give positive signals.

AVAX’s Relative Strength Index (RSI) is at around 56, indicating that there is still ample room for an upward rally. This RSI having crossed the neutral zone signals that AVAX could gain further bullish momentum. However, all this bullish analysis will only remain valid if AVAX manages to close the daily candle above the $21 level.

Conclusion: AVAX Upside Opportunities and Conditions

AVAX’s potential price increase of up to 21% is highly dependent on several key factors. An increase in large transactions and a bullish price pattern provide hope, but AVAX still needs to demonstrate the ability to break and hold above critical price levels to ensure a sustained rally.

Investors and market watchers should pay attention to technical indicators and transaction volumes to make informed investment decisions. AVAX’s success in meeting these requirements will be a key determinant in the realization of the predicted significant price increase.

Also Read: Polkadot (DOT) Preparing to Surpass Resistance, Is it Time to Buy?

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. AVAX could soar by 21% but on one major condition. Accessed on April 23, 2025

- Featured Image: The Merkle News