Bitcoin Holds Strong at $93,300 — But Analysts Warn of a Sharp Drop to $83K Ahead

Jakarta, Pintu News – The price of Bitcoin experienced a slight decline after experiencing a significant bullish spike on April 23, 2025.

On April 24, Bitcoin was trading around the $92,000 level. Analysts think that the $94,000 to $95,000 zone is an important resistance area that must be broken for BTC to continue its further rise.

Let’s analyze whether BTC will manage to break through the resistance zone or will experience another decline to a lower level.

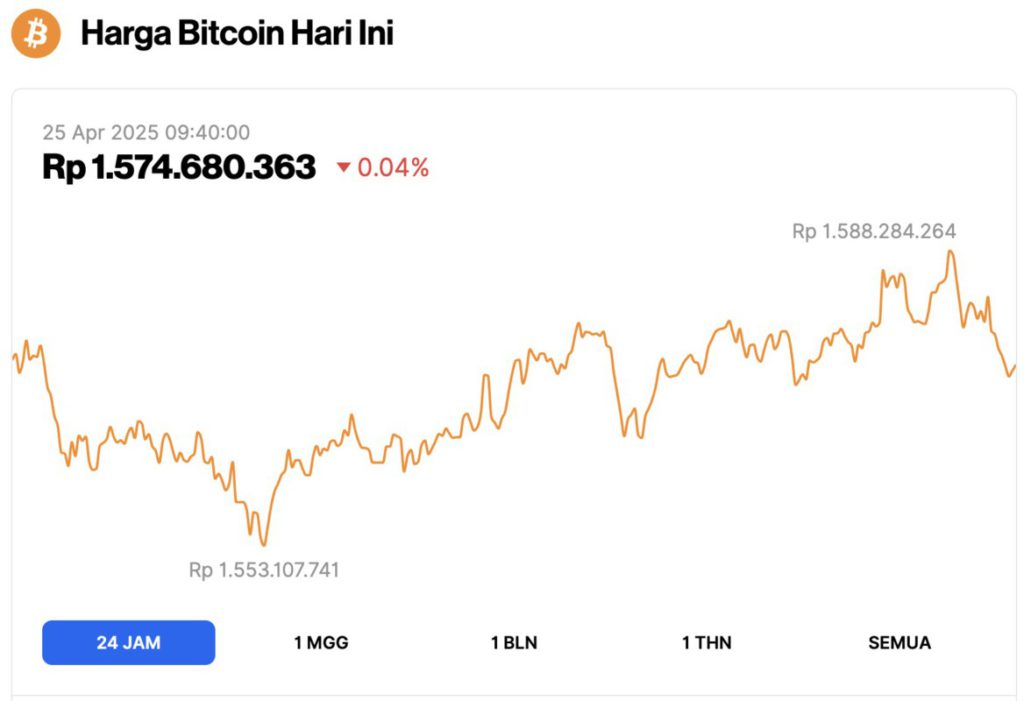

Bitcoin Price Drops 0.04% in 24 Hours

As of April 25, 2025, Bitcoin (BTC) is trading at $93,300, or approximately IDR 1,574,680,363. The price has dipped slightly by 0.04% over the past 24 hours. Within that timeframe, BTC hit a low of IDR 1,553,107,741 and climbed to a high of IDR 1,588,284,264, reflecting mild intraday fluctuations in an otherwise steady market.

According to CoinMarketCap, Bitcoin’s market capitalization now stands at around $1.85 trillion, with trading volume in the last 24 hours also down 12% to $33.33 billion.

Read also: Top 3 AI Agent Cryptos Everyone’s Watching as April 2025 Comes to a Close

Will Bitcoin Price Fall to $83,000?

Analysts such as Swissblock predict a possible correction in Bitcoin price to the $89,000-$90,000 range, noting that the $94,000-$95,000 area is crucial resistance.

According to the analyst, the “next logical step” for Bitcoin is to make a correction to gather momentum before heading back up. This temporary correction is expected to give buyers a chance to consolidate and build new strength to push the price even higher.

If a price correction does occur, then the $89,000-$90,000 range could be a potential support zone. Analysts also mentioned that the range of $83,000-$85,000 is the last reliable support level.

Given the strength of Bitcoin’s long-term trend, this drop is considered a buying opportunity.

As of April 24, 2025, Bitcoin’s price stands at $92,349, down 1.89% on the day. This drop comes after a huge spike yesterday, where BTC shot up from around $87,000 to almost touching $95,000.

In the past week and month, Bitcoin price has risen by 9.5% and 5.7% respectively. Several factors such as the appointment of Paul Atkins as SEC Chairman and the influx of funds into ETFs have also supported the positive market sentiment.

Bitcoin Turns Resistance Level into Support: A Positive Sign?

Significantly, crypto analyst Belle observed an unusual pattern in Bitcoin’s price movement, where the previous resistance point at $92,000 has now turned into a support level.

Read also: Despite Falling Car Sales, Tesla Still Holds $1 Billion Worth of Bitcoin!

The fact that buyers are actively defending the price at these levels indicates strong demand, which in turn could push the Bitcoin price up further.

Meanwhile, crypto expert Ali Martinez noted that the previous strong support level of $94,000 has now turned into a resistance level.

Looking at these two analyses, Bitcoin is currently experiencing a shift in market dynamics. This shifting position between support and resistance indicates a potential change in market sentiment.

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Analyst Predicts Bitcoin Price Dip To This Level: Here’s Why It Matters. Accessed on April 25, 2025