Bitcoin (BTC) Surges, Is it a Sign of Rally or Just a Double Peak?

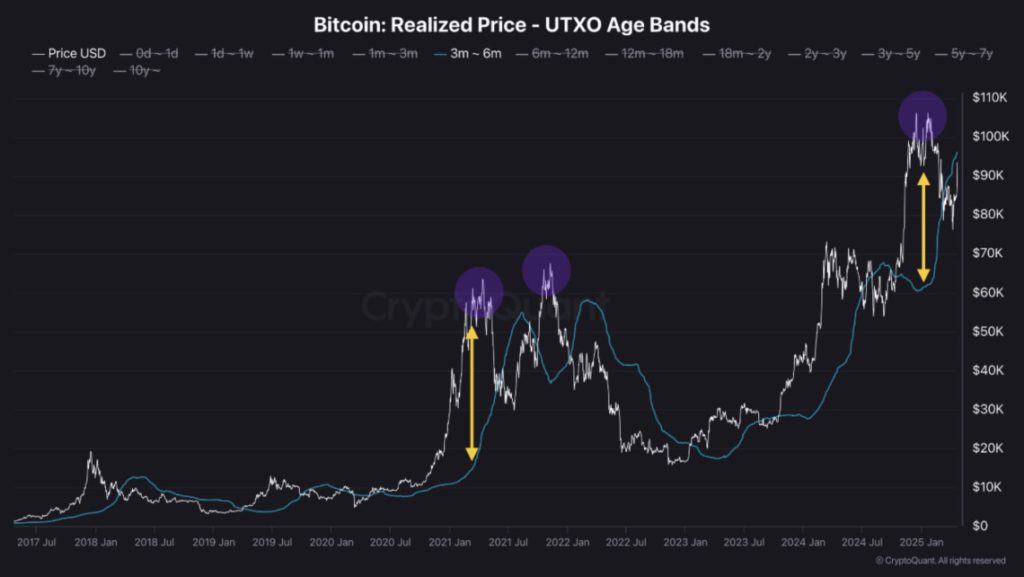

Jakarta, Pintu News – Bitcoin has recently surpassed the realized price of short-term holders at $91,000. This price increase has sparked discussion among crypto analysts about whether Bitcoin’s (BTC) newfound strength will last or if it is just a bull trap before a massive drawdown.

Is Bitcoin (BTC) About to Rally?

US President Donald Trump recently announced that tariffs against China will be “much lower” than the previously proposed 145%. This statement provided a boost to risk assets. Stock and crypto markets showed a positive response, with Bitcoin (BTC) up 5.6% in the last 24 hours.

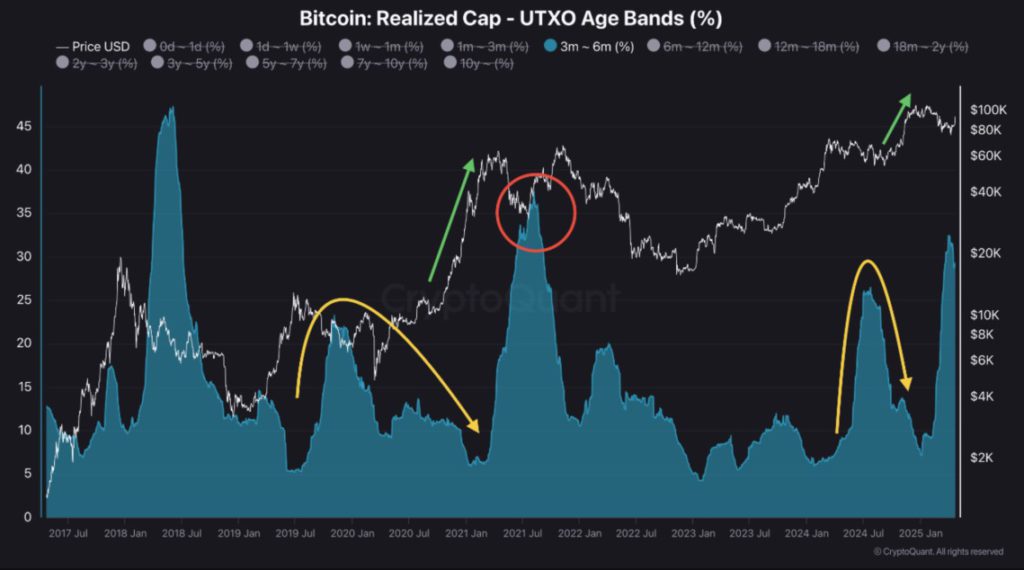

Bitcoin (BTC) is now trading in the low $90,000s, a figure that hasn’t been seen since March. This has raised hopes for a sustained rally that could possibly push the price past the $100,000 mark. However, CryptoQuant contributor Avocado_onchain advises caution.

Read More: Crypto Price Surge: What’s Driving Today’s Increase?

Macro Headwinds May Hinder BTC Momentum

Avocado_onchain added that limited market liquidity and macroeconomic factors, such as US-China tariff tensions, could weigh on risky assets like Bitcoin (BTC). Nonetheless, market sentiment can change quickly, and an influx of new liquidity could reignite the bull market in full.

On the other hand, Xanrox crypto analysts recently warned that Bitcoin’s (BTC) breakout from a falling wedge pattern may be a whale-driven trap to attract retail investors before another price drop. Currently, Bitcoin (BTC) is trading at $93,754, up 5.6% in the last 24 hours.

Bitcoin (BTC) Following in Gold’s Footsteps? Analyst Sets Medium-Term Target at $155,000

Xanrox crypto analysts also set a medium-term target for Bitcoin (BTC) at $155,000, following a similar pattern to gold. If this prediction holds true, it would be a significant increase from the current price. However, investors should remain wary of potential volatility and rapid changes in market conditions. Technical analysis and continuous monitoring of external factors will be crucial in determining the future direction of Bitcoin (BTC) price.

Conclusion

With various factors affecting the Bitcoin (BTC) market, investors and analysts alike must remain vigilant. Whether this is the beginning of a major rally or just a double top, time will tell. However, one thing is for sure, Bitcoin (BTC) dynamics always provide important lessons about the volatility and potential of the crypto market.

Read More: Aave Breaks $150 Resistance, What’s Next?

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- NewsBTC. Bitcoin Surpasses Realized Price of Recent Buyers, Rally Incoming or Double Top? Accessed on April 24, 2025

- Featured Image: Generated by AI