Revealed! Bitcoin (BTC) supply is actually lower than expected

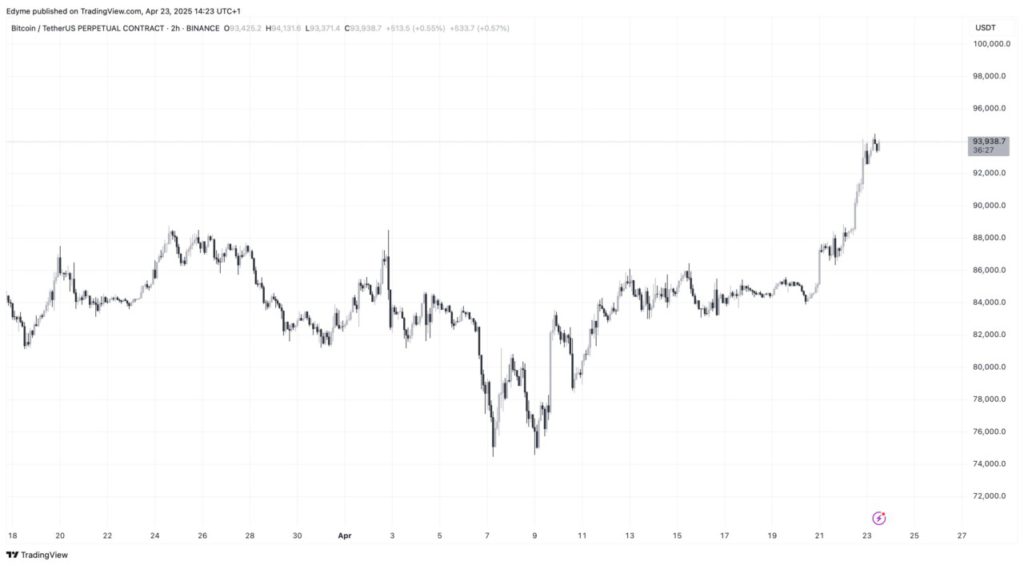

Jakarta, Pintu News – Bitcoin has recently managed to recover its position after a sharp decline, with prices now hovering above $93,000. This price increase reflects an increase of 5% in the last 24 hours and more than 20% in the last two weeks.

This recovery has drawn attention to market sentiment and the behavior of the underlying network, especially after last year’s Halving event which turned out to be a major influence on Bitcoin (BTC) mining dynamics.

Post-Halving Emission Rate Deviations

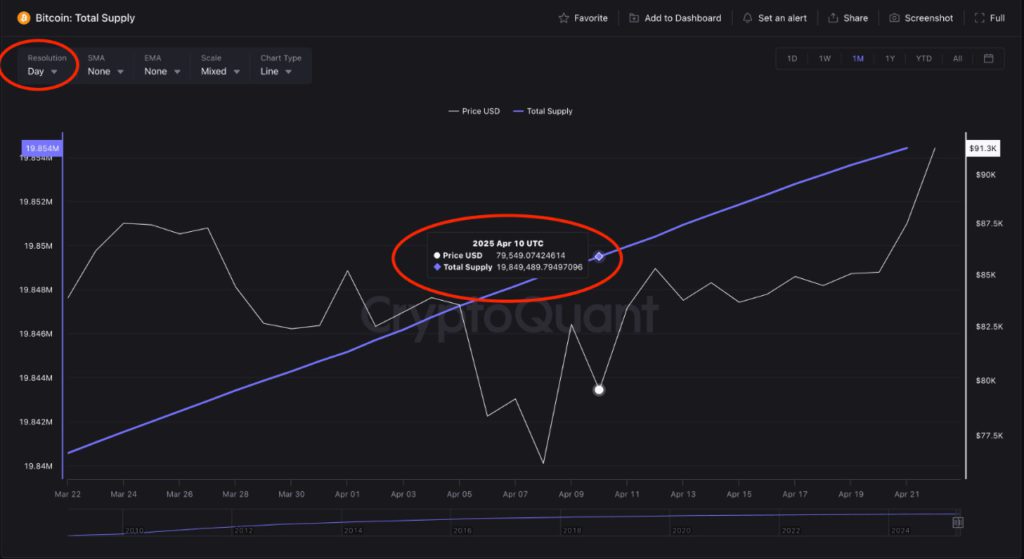

Carmelo Alemán, a contributor from CryptoQuant, has revealed new insights regarding Bitcoin (BTC) block issuance and total daily mining output. The findings show a discrepancy between theoretical assumptions and real-world data. According to the Bitcoin (BTC) protocol, one block is expected to be mined every 10 minutes.

However, Alemán’s analysis shows that the number of newly mined coins is often lower than the theoretical estimate. After the Halving in April last year, the reward for each block was reduced from 6.25 BTC to 3.125 BTC. This should have resulted in about 450 BTC entering circulation every day (3.125 BTC × 144 blocks). However, using the “Bitcoin: Total Supply” metric from CryptoQuant, Alemán found a discrepancy between the expected output and the reality on the blockchain.

Read More: Crypto Price Surge: What’s Driving Today’s Increase?

Bitcoin (BTC) On-Chain Metrics for Real-Time Supply Monitoring

Alemán’s findings are significant because they provide new implications for how Bitcoin (BTC) supply is monitored and understood by investors, miners, and analysts. Rather than relying solely on theoretical projections based on protocol rules, on-chain metrics provide a picture of actual blockchain activity.

These insights can help refine market models, especially during transition periods such as post-halving adjustments. Halving events, which reduce block rewards by 50%, are designed to limit Bitcoin’s (BTC) inflation rate and enforce its fixed supply limit. However, data from Alemán suggests that monitoring total supply growth through blockchain records offers a more detailed understanding of how much BTC goes into circulation each day.

Conclusion

With a deeper understanding of the true dynamics of Bitcoin (BTC) supply, market participants can make more informed decisions. Analyses like the one conducted by Alemán of CryptoQuant are not only important for investors and analysts, but also for the entire crypto ecosystem to understand the trends and dynamics affecting the value and stability of this digital currency.

Read More: Aave Breaks $150 Resistance, What’s Next?

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- NewsBTC. Post-Halving Twist: Why Bitcoin’s Actual Supply May Be Lower Than Expected. Accessed on April 24, 2025

- Featured Image: Generated by AI