Bitcoin Holds Strong at $93K — ARK Invest Predicts Jaw-Dropping 2.400% Surge!

Jakarta, Pintu News – Asset manager ARK Invest has updated its Bitcoin price projections for 2030, with an optimistic scenario estimating Bitcoin prices could reach $2.4 million per coin. This prediction represents a potential increase of more than 2,400% compared to the current BTC price.

This revised projection comes after an earlier estimate that pegged the price at $1.5 million. This 60% increase reflects ARK Invest’s increased confidence in Bitcoin’s growth potential.

Then, how will the Bitcoin price move today?

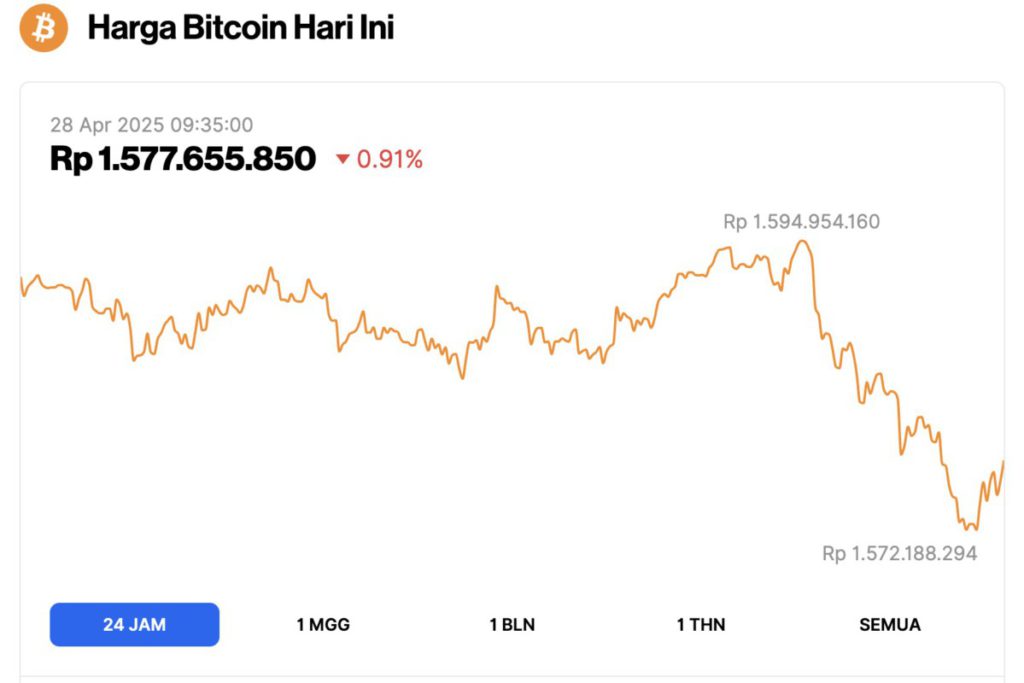

Bitcoin Price Drops 0.91% in 24 Hours

On April 28, 2025, Bitcoin (BTC) was trading at $93,528, or around IDR 1,577,655,850, marking a 0.91% drop over the past 24 hours. During this time, BTC reached a high of IDR 1,594,954,160 and dipped to a low of IDR 1,572,188,294.

According to CoinMarketCap, Bitcoin’s market capitalization now stands at around $1.85 trillion, with trading volume in the last 24 hours also down 4% to $18.21 billion.

Will Bitcoin Jump 2,400% by 2030?

Based on a recent report, ARK Invest expects Bitcoin to experience a compound annual growth rate (CAGR) of 72% in an optimistic scenario.

Research analyst David Puell also revealed the latest Bitcoin price projections for the pessimistic scenario and the baseline scenario.

In the pessimistic scenario, the price projection is raised from $300,000 to $500,000, with an estimated CAGR of about 32%. Whereas in the base scenario, the price projection increases from $710,000 to $1.2 million, reflecting a CAGR of approximately 53%.

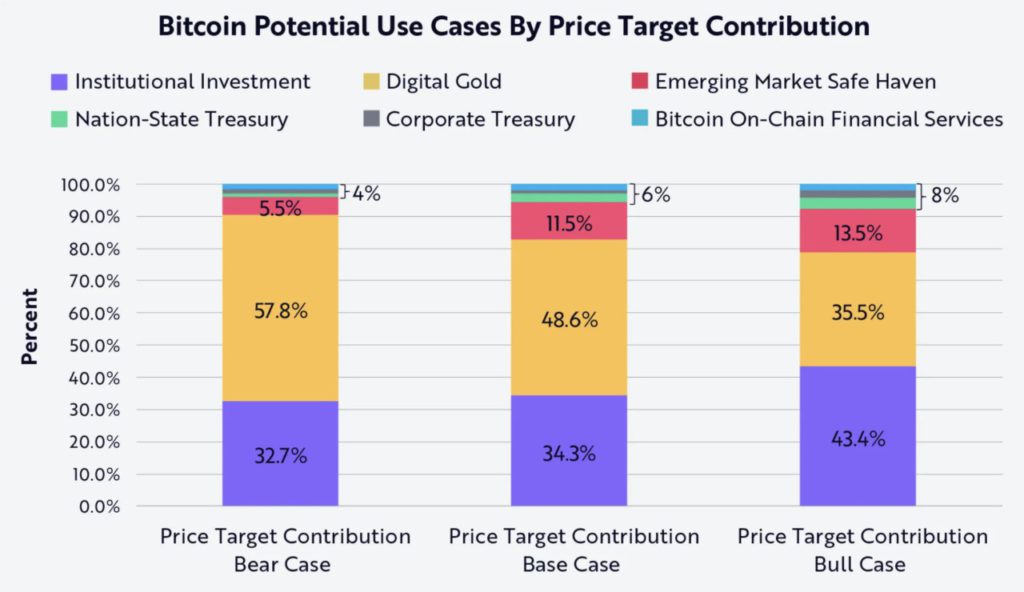

The report highlights six key factors that could potentially drive Bitcoin’s price up.

These factors include institutional investment, Bitcoin’s role as a hedge against inflation and currency devaluation, as well as Bitcoin’s status as “digital gold” which also amplifies its potential price increase.

More countries and companies are looking at Bitcoin

Additional supporting factors include the growing number of countries – including the United States – adopting Bitcoin as a reserve asset.

In addition, many companies are starting to diversify their cash into Bitcoin, inspired by the moves of companies like Strategy (formerly MicroStrategy).

Bitcoin blockchain-based financial services also have the potential to attract new capital flows by replacing the traditional financial system.

“While institutional investment is the largest contributor in our optimistic scenario, interestingly, contributions from state treasuries, corporate treasuries, and Bitcoin decentralized financial services are relatively small in each,” said David Puell.

Ark’s Bitcoin price prediction for 2030 is based on an analysis of Total Addressable Markets (TAMs) and penetration rates of various key factors. The projections also take into account the deterministic Bitcoin supply schedule, which is expected to reach around 20.5 million units by 2030.

Read also: Dormant Bitcoin (BTC) Movement Surges: A Sign of Changing Market Sentiment?

One important innovation in this year’s model is the use of Bitcoin’s “active supply” data, which excludes coins that are missing or have not moved for a long time. This approach results in a price target that is about 40% higher than the base model.

“The estimates generated by this experimental method tend to be more aggressive than projections under pessimistic, baseline, or optimistic scenarios,” the report added.

Optimistic Bitcoin Price Predictions

On the other hand, Ark Invest is not the only one who is optimistic about Bitcoin. Michael Saylor, founder and chairman of Strategy (formerly MicroStrategy), recently predicted that Bitcoin’s market capitalization will one day reach $500 trillion.

He expects Bitcoin to surpass gold, property, and long-term financial assets to become the ultimate store of value.

This ambitious prediction was conveyed at the Digital Asset Summit, March 2025. If Bitcoin really reaches a market capitalization of $500 trillion with a total supply of 21 million coins, the price per Bitcoin is expected to touch around $23.8 million.

Meanwhile, Standard Chartered estimates that the price of Bitcoin could reach $500,000 by 2028.

Adding to the positive sentiment, IREN CEO, Daniel Roberts, also emphasized that Bitcoin could reach $1 million in the next five years. A similar view is shared by Thomas Fahrer, co-founder of Apollo.

Not only that, Samson Mow, CEO of Pixelmatic, projects that the price of BTC could jump to $1 million by the end of 2025. In addition, investment bank H.C. Wainwright has updated its Bitcoin price target for 2025, from $145,000 to $225,000.

Finally, despite Bitcoin’s notoriously volatile price, Tom Lee, co-founder of Fundstrat, stated that BTC is likely to surpass $150,000 by 2025.

While these figures reflect the market’s optimism towards Bitcoin as the largest crypto asset, time will tell if these predictions will come true.

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Bitcoin Could Surge to $2.4 Million by 2030, ARK Invest’s New Price Prediction Reveals. Accessed on April 28, 2025