Pi Network (PI) Prepares for Breakout Amid Rising Trading Sentiment, Here’s the Analysis!

Jakarta, Pintu News – Pi Network (PI) has recorded a 5% gain in the past week, despite a decline of more than 17% over the past 30 days.

This suggests a consolidation phase between key levels, with technical indicators such as Ichimoku Cloud, RSI, and EMA lines showing uncertainty. PI’s reaction to resistance at $0.68 and support at $0.617 in the coming sessions will determine the next direction.

Check out the full analysis below!

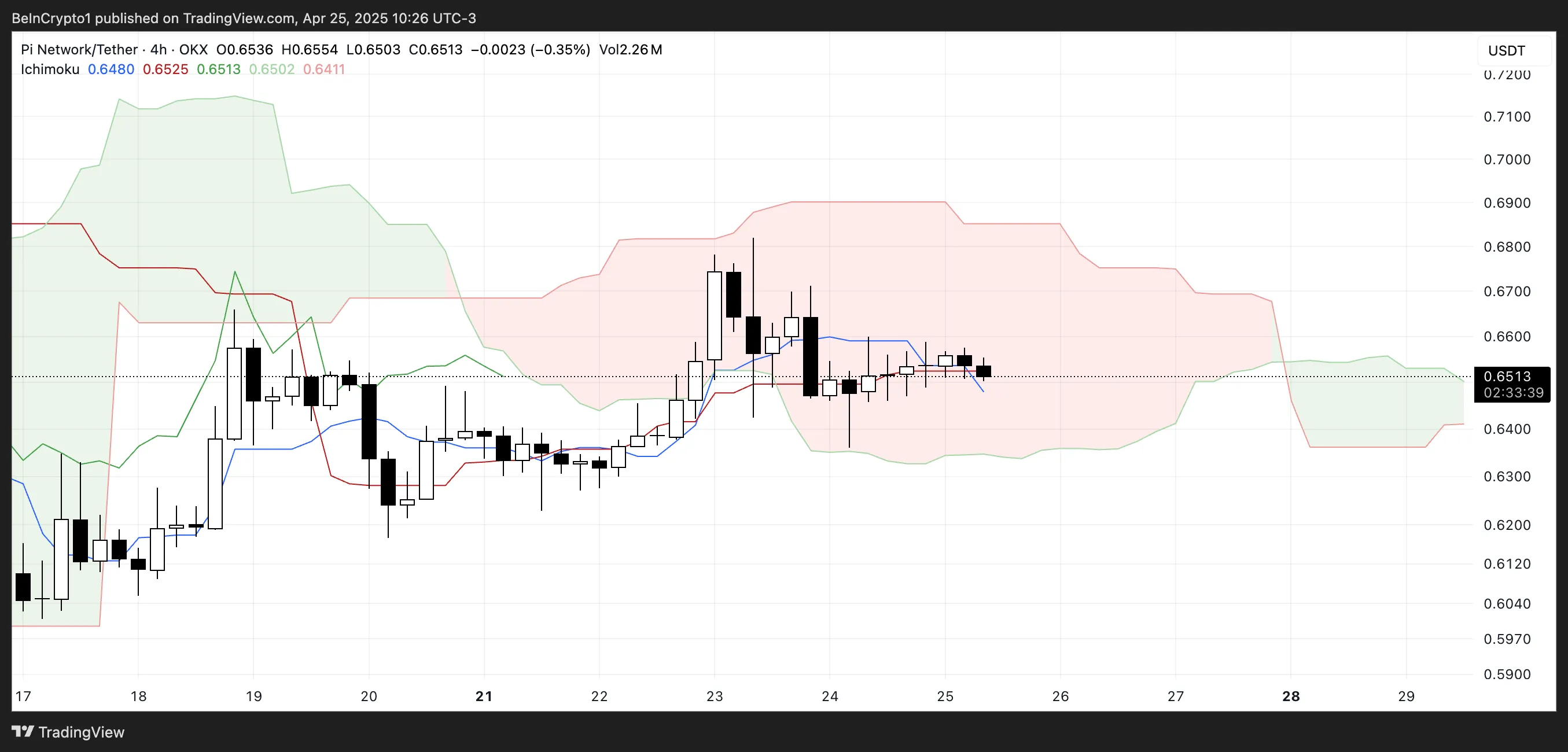

Ichimoku Cloud: Signals Uncertainty for PI

Pi Network is currently trading inside a red Ichimoku Cloud, reflecting uncertainty and a lack of strong directional bias. Price is between the red baseline (Kijun-sen) and slightly above the blue conversion line (Tenkan-sen), indicating weak short-term momentum with no clear signs of decline.

The presence of the red cloud indicates that the prevailing trend is still slightly bearish, and price movements within the cloud generally signal consolidation or neutrality. However, going forward, the clouds turn green, indicating that sentiment may begin to shift.

The future green cloud points to a potential bullish transition, but only if the price manages to break out of the cloud with strong support. A decisive move above the cloud will favor a trend reversal, while rejection and a move below the Tenkan-sen and Kijun-sen will reinforce bearish pressure.

Read also: 3 Altcoins to Watch Ahead of Trump Gala Dinner

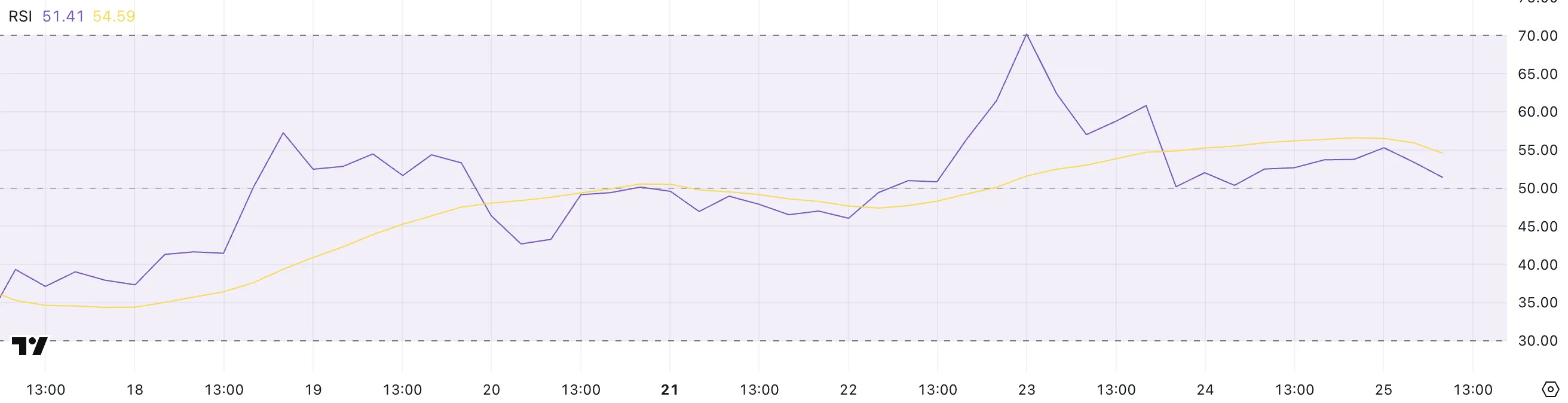

RSI PI Soothes: What Will Happen Next?

Pi Network’s Relative Strength Index (RSI) currently stands at 51.41, down from a peak of 70 just two days ago. This decline reflects a significant cooling of momentum, as the asset moves from near-overbought territory to more neutral levels.

RSI measures the speed and magnitude of recent price changes to evaluate overbought or oversold conditions. The RSI at 51.41 places the PI right in the middle of the range, indicating that there is currently no clear advantage for either buyers or sellers.

This neutral reading often coincides with a consolidation phase, where prices stabilize before determining their next direction. If the RSI is trending again, it could indicate renewed bullish momentum.

On the other hand, a sustained drop towards 40 or below could signal growing weakness and open the door for a deeper drawdown.

Read also: Near Protocol gets more attention, Bitwise submits NEAR ETF to regulators!

PI Consolidation-Is a Breakout Coming?

Pi Network’s price has been consolidating over the past few days, currently trading within a range defined by resistance at $0.68 and support at $0.61. This sideways movement is reflected in the EMA lines, which are tightly clustered – a classic sign of low volatility and a lack of strong directional momentum.

The market seems to be waiting for a decisive push from buyers or sellers before committing to a new trend. Until then, PI remains in a waiting pattern, with price action stuck between key levels. If bullish momentum returns, a breakout above $0.68 could signal the start of a new rally.

In that case, the following resistance levels to watch are $0.789 and $0.85. If the uptrend gets stronger, PI could target $1.04-marking its first move above $1 since March 23. However, a drop below the $0.617 support could lead to renewed bearish pressure, with $0.59 and $0.54 as the following potential downside targets.

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. Pi Network Trades Sideways, Market Awaits. Accessed on April 29, 2025

- Featured Image: Coin Backyard