Is the Withholding of Sales by Bitcoin Miners a Good Sign?

Jakarta, Pintu News – Suppressed selling by Bitcoin miners has reached its lowest point since May 2024, a phenomenon that is rare and may indicate a significant change in the market. But is this really good news for the market, or just the calm before the storm?

Miners Sales Pressure Analysis

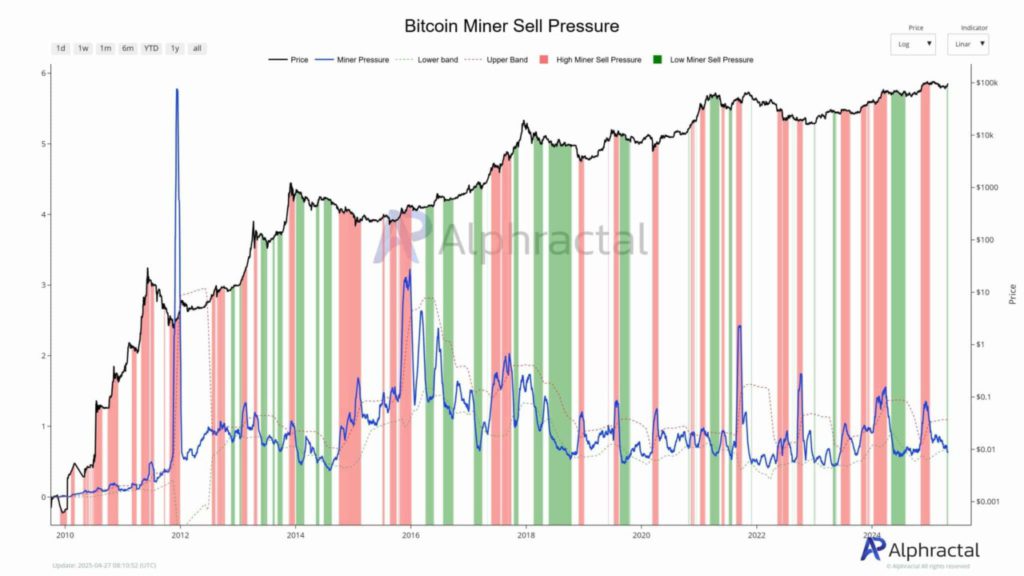

Bitcoin (BTC) miners are now showing the lowest sales pressure since May 2024, a condition that is historically rare. Data shows that similar conditions in the past were often followed by periods of consolidation or significant price declines. Positive market reactions to this decrease in selling pressure have only been recorded a few times, such as in December 2012, September 2013, parts of 2016, and July 2021.

However, in most cases, Bitcoin (BTC) struggles to maintain its momentum. While miners choose to hold off on selling, this is often an indication of hidden instability. This begs the question, is this a sign of strength or just the calm before the storm?

Also Read: Will Cardano (ADA) Surge? Check out the Latest Analysis!

Hashrate Trends and Their Implications

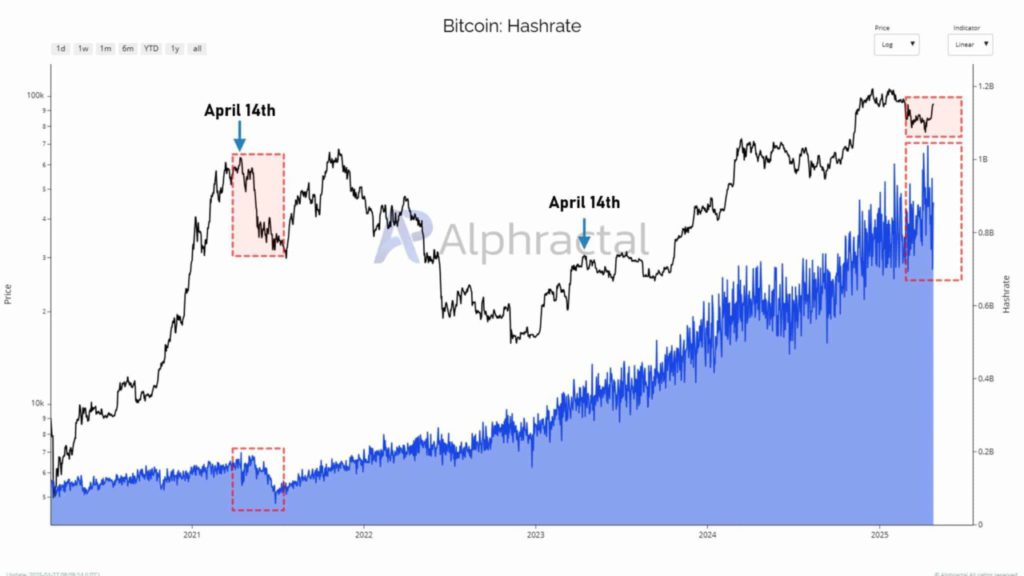

Bitcoin (BTC) hashrate reached a new peak in April 2025, reminiscent of the situation that occurred in April 2021. Both periods saw a peak in mining activity followed by a significant decline, a pattern that has previously been a precursor to major Bitcoin (BTC) price corrections.

Although 2025 has yet to see a corresponding price peak, the recent decline in hashrate is raising red flags. Is this the early stage of miner stress starting to rear its ugly head again, as it did before the sharp Bitcoin (BTC) price drops in the past?

Year-Round Miner Behavior and Price Outlook

Throughout 2025, miners appear to have sold strategically, capitalizing on price strength earlier in the year. The current low selling pressure can be seen as a sign of resilience. However, it could also be an indication of complacency. If stress starts to set in, a new wave of forced selling may emerge, which could destabilize the Bitcoin (BTC) balance and trigger new volatility.

Currently, Bitcoin (BTC) price is hovering around the $95,000 mark, but momentum indicators suggest caution. Although Bitcoin (BTC) has maintained its recent gains, the lack of strong volume support and increased RSI stress increase the risk of a short-term drawdown. Unless the bulls reclaim aggressive momentum soon, BTC may face consolidation or even a minor correction before attempting a clean breakout above $95,500.

Conclusion

With ever-changing market conditions and pressure from a variety of factors, investors and market watchers must remain vigilant. Understanding miner behavior and hashrate trends can provide important insights into the future direction of Bitcoin (BTC).

Also Read: Trump’s Dinner Party Triggers Big Waves in Crypto Market!

That’s the latest information about crypto news today. Get more information about crypto academy from beginner to expert level only at Pintu Academy and enrich your knowledge about the world of crypto and blockchain.

Follow us on Google News to get the latest information about crypto and blockchain technology. Enjoy an easy and secure crypto trading experience by downloading Pintu Crypto via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Click Register Pintu if you don’t have an account or click Login Pintu if you are already registered.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Bitcoin miners are holding back, is that good news for you?. Accessed on April 29, 2025

- Featured Image: Generated by AI