Bitcoin Stalls at $94K — Is a Major Price Correction Just Around the Corner?

Jakarta, Pintu News – The supply of Bitcoin that is in profit continues to increase steadily despite recent challenges and market pressures.

On-chain data shows that more than 85% of the total BTC supply in circulation is currently in favorable conditions. This is a historically bullish signal, but it often also signals the beginning of a euphoric phase in the market cycle.

Then, how will the Bitcoin price move today?

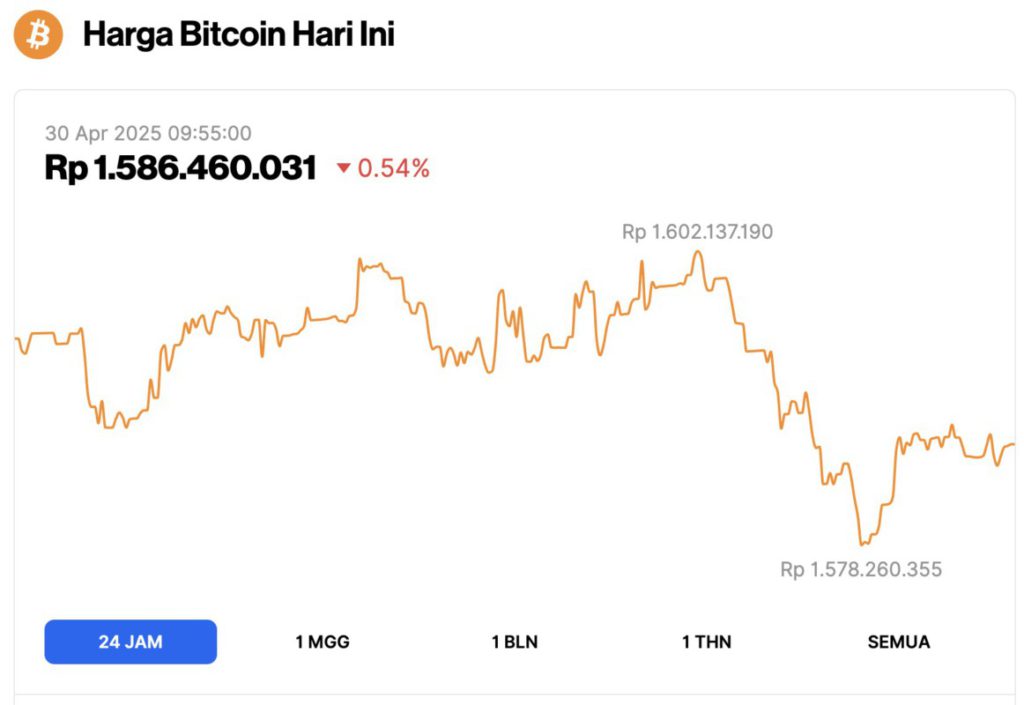

Bitcoin Price Drops 0,54% within 24 Hours

As of April 30, 2025, Bitcoin (BTC) was trading at $94,657, or around IDR 1,586,460,031, after slipping slightly by 0.54% over the past 24 hours. During this timeframe, BTC reached a daily high of approximately IDR 1,602,137,190 and dipped to a low of IDRP 1,578,260,355.

According to CoinMarketCap, Bitcoin’s market capitalization now stands at around $1.87 trillion, with trading volume in the last 24 hours also down 14% to $26.72 billion.

Read also: Arizona Officially Passes Bill, Ready to Build the First Strategic Bitcoin Reserve in the US!

Bitcoin enters bullish territory, but analysts warn of potential correction

The percentage of Bitcoin supply that is in profit measures how many coin holders purchased their asset at a price lower than the current market value. When this number increases, it signals widespread investor confidence as well as strong capital flows into the asset.

In its latest report, CryptoQuant analysts using the pseudonym Darkfost found that more than 85% of the current circulating BTC supply is in profit. While this trend is showing bullish signals, there are things to watch out for.

“Having most of the supply at a profit is actually not a bad thing – quite the opposite. Of course, there are certain levels that are more ‘comfortable’ than others, but in general, a rise in supply at a profit tends to drive a bullish phase,” Darkfost wrote.

In his note, the analyst explained that the market is now entering the euphoria zone, a phase that usually occurs when the percentage of profit supply approaches or passes 90%.

Although this level is considered bullish, history shows that this phase often coincides with local price peaks, where many traders start to realize profits, triggering corrections in the short to medium term.

“Historically, when supply in profit conditions crosses the 90% threshold, it almost always triggers a euphoric phase. We are currently approaching that level. However, this euphoric phase usually doesn’t last long and is often followed by a short to medium-term correction,” he added.

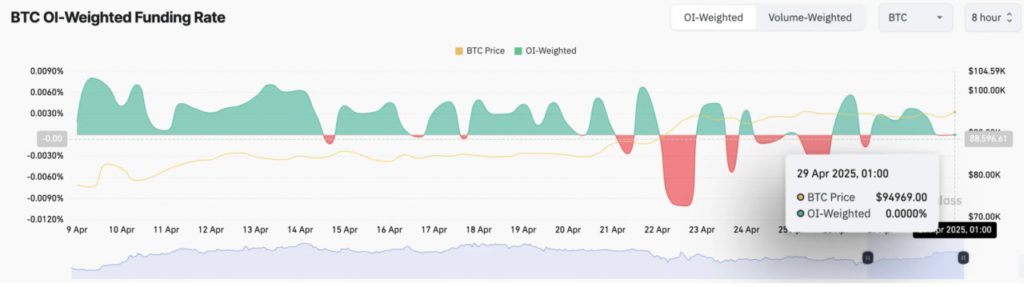

Funding Rate Shows Market Still in Waiting Mode

Interestingly, Bitcoin’s current funding rate remains relatively balanced, signaling that the market is in a wait-and-see state. As of April 29, 2025, Bitcoin’s funding rate was recorded at 0%.

The funding rate is a periodic payment between traders in the perpetual futures market, which serves to keep the contract price in line with the spot market price. As is the case with Bitcoin, when the funding rate is at 0%, it indicates a neutral market sentiment, where there is no dominance between long (buy) and short (sell) positions.

Read also: Bitcoin to Hit $50 Trillion? Bitwise CEO Drops a Shocking Prediction!

This situation suggests that Bitcoin investors are waiting for a catalyst that could provide a clearer market direction. This neutral sentiment, coupled with the increasing supply of Bitcoin that is in profit, creates the potential for price volatility in the near future.

Bitcoin price stays below key resistance levels, RSI hints at upside potential

As of April 29, Bitcoin (BTC) was trading at $95,125, just below the key resistance level of $95,971.

Despite recent high market volatility, demand for BTC in the spot market remains strong, as reflected by the Relative Strength Index (RSI) value, which currently stands at 68.21.

RSI is an indicator that measures the overbought and oversold condition of an asset. The RSI scale ranges from 0 to 100, with a reading above 70 signaling that the asset is overbought and has the potential to decline in price.

Conversely, a reading below 30 indicates the asset is oversold and has the potential for price increases.

BTC’s current RSI reading indicates that there is still room for price increases before Bitcoin enters overbought territory. If demand continues to strengthen, BTC could potentially break the resistance at $95,971 and continue its rally until it reaches $98,983.

However, if the bearish sentiment strengthens, BTC could resume the downward trend and drop to the $91,851 level.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Get a web trading experience with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Bitcoin (BTC) Approaches Euphoria Zone With 85% of Supply in Profit. Accessed on April 30, 2025