Tom DeMark’s Bear Market Signal: What does it Mean for Bitcoin Valuation?

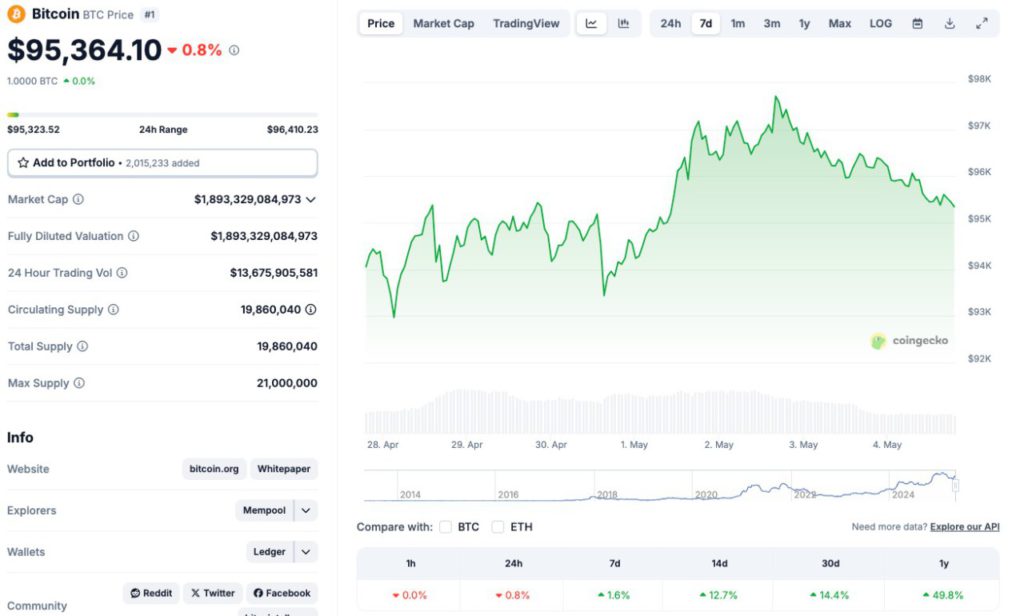

Jakarta, Pintu News – Bitcoin has experienced a price drop after reaching a peak of $98,200 (around Rp1,606,000,000) last Friday. This drop comes amid warnings from veteran technical analyst, Tom DeMark, regarding a potential bear market in the United States. This article will take a neutral and informative look at the bear market signals identified by DeMark and their implications for Bitcoin’s valuation.

Bear Market Signals from Tom DeMark

Tom DeMark, creator of the TD Sequential indicator, states that the S&P 500 index is showing signs of technical exhaustion. According to his analysis, if the index records two more daily closing highs, it will complete a 9-count exhaustion cycle, which often signals a trend reversal. DeMark estimates that a drop below the 4,835 level on the S&P 500 could trigger a bear market, with a potential drop of more than 20% from the February peak.

This warning is based on historical patterns where stock markets tend to peak when optimism is high and experience sharp declines when sentiment turns negative. DeMark emphasizes that too much technical damage has been done, and the market is in a vulnerable position to changes in global economic conditions.

Also Read: Potential Impact of Dogecoin ETF on Crypto Price and Market

Bitcoin’s Correlation with the Stock Market

Bitcoin currently shows a high correlation with the S&P 500 index, with the correlation value reaching 0.82. This suggests that BTC price movements are increasingly influenced by traditional stock market dynamics. However, in certain situations such as geopolitical tensions or aggressive trade policies, Bitcoin can serve as a hedging asset and experience independent price movements.

For example, last February, when China imposed retaliatory tariffs and global markets experienced a downturn, the correlation between Bitcoin and the S&P 500 decreased to 0.27. At the time, BTC showed resilience and even experienced price increases, highlighting its potential as an asset that is not completely tied to traditional markets.

Potential Impact on Bitcoin Valuation

If DeMark’s prediction of a bear market in the US proves to be true, then Bitcoin’s valuation, which currently stands at around $2 trillion, could come under pressure. A stock market decline could trigger a sell-off in various assets, including cryptocurrencies, as investors seek liquidity and reduce risk exposure.

However, if the stock market decline is caused by factors such as geopolitical tensions or loose monetary policy, Bitcoin may attract interest as a hedging asset. In this scenario, BTC could potentially maintain or even increase its valuation, depending on investors’ perception of its role in an investment portfolio.

Considerations for Investors

Investors need to pay attention to technical signals and macroeconomic conditions when making investment decisions. DeMark’s bear market signal indicates the need for caution against a potential broader market downturn. However, it is also important to consider other factors that could affect Bitcoin’s price, such as institutional adoption, regulation, and technological developments.

Portfolio diversification and risk management remain important strategies in the face of market uncertainty. Investors are advised to continuously monitor market developments and adjust investment strategies according to changes in economic and market conditions.

Conclusion

The bear market signals identified by Tom DeMark highlight the potential risks for the stock market and the implications for other assets such as Bitcoin. Although BTC shows a high correlation with the stock market, certain situations can lead to independent price movements. Investors need to remain vigilant and consider various factors in making investment decisions amid complex market dynamics.

Also Read: Ethereum Outperforms Bitcoin: The Impact of Vitalik Buterin’s Proposal and Adam Back’s Response

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Ibrahim / Coingape. Bitcoin Price Outlook: Veteran Analyst Tom DeMark Issues Bear Market Signal, Is Bitcoin’s $2 Trillion Valuation at Risk?. Accessed May 5, 2025.

- Featured Image: BEAR