Notcoin’s Upside Potential: RSI Analysis and Telegram Ecosystem Support

Jakarta, Pintu News – Notcoin , a cryptocurrency integrated into the Telegram ecosystem, is showing significant upside potential. Recent technical analysis and developments in the Telegram ecosystem are the main factors supporting this positive outlook. This article will neutrally and informatively discuss the factors that may affect Notcoin’s price movement in the near future.

RSI Analysis and Market Momentum

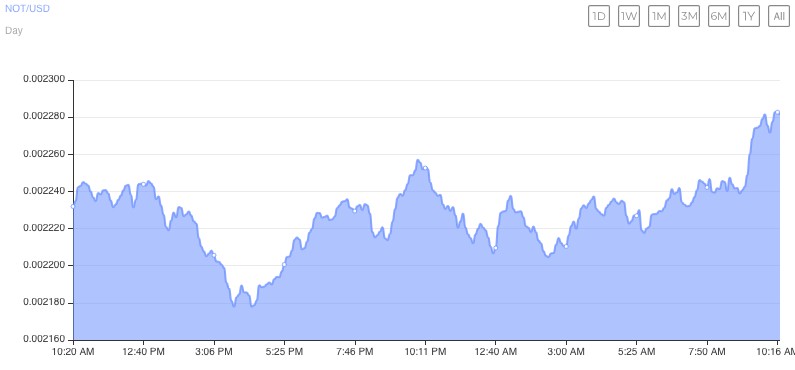

Crypto analyst Master Ananda noted that Notcoin’s Relative Strength Index (RSI) reached 71, indicating strong buying momentum. An RSI above 70 is often considered a signal that an asset is overbought, but in this context, it reflects the dominance of buyers in the market. Most other altcoins have an RSI between 50 to 60, making Notcoin one of the standouts in terms of current momentum.

Master Ananda suggests that a large price movement is likely to occur in the near future, with a peak expected by the end of May. Although Notcoin is currently in the resistance area, there is no indication of a significant price drop, so the upside potential remains open.

Also Read: Potential Impact of Dogecoin ETF on Crypto Price and Market

The role of the Telegram Ecosystem and TON

Notcoin gets strong support from the Telegram ecosystem and the TON network (The Open Network). “Tap-to-earn” apps like Notcoin make it easy for users to participate in the crypto world without needing to understand the concepts of digital wallets, gas fees, or recovery phrases. This approach has attracted great interest in the Asian and CIS regions, as indicated by the MEXC survey in April 2025.

In addition, the launch of the Not Games platform by Notcoin founders Sasha and Vladimir Plotvinov aims to bring back classic games with a Web3 twist, all based on Telegram. Their focus is on fair gameplay and a balanced in-game economy, rather than on “pay-to-win” mechanics.

Financial Integration and Institutional Support

The Telegram ecosystem has been further strengthened with the appointment of Maximilian Crown, former CFO and COO of MoonPay, as the new CEO of the TON Foundation. With a regulatory background in the US and Europe, Crown is expected to drive the expansion of payment services within Telegram, which is now developing into a “super app” of sorts.

In addition, the partnership between Ethena and the TON Foundation to integrate USDe and sUSDe stablecoins into Telegram wallets like TONNHub and Tonkeeper is making access to financial services easier for over a billion users. Initiatives like the Telegram Bond Fund also allow institutional investors to access $2.35 billion worth of bonds through blockchain-based tokenization.

Conclusion

With a combination of technical analysis showing positive momentum and strong support from the Telegram ecosystem as well as the TON network, Notcoin has the potential to experience significant price increases in the near future. However, investors are advised to remain cautious and conduct a thorough analysis before making investment decisions, given the high volatility of the crypto market.

Also Read: Ethereum Outperforms Bitcoin: The Impact of Vitalik Buterin’s Proposal and Adam Back’s Response

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Muhammad Syofri Ardiyanto / Crypto News Flash. Can Notcoin Really Climb 490%? Signals Say It Might. Accessed May 5, 2025.

- Featured Image: Bitcoin News