Dogecoin Dips 3% Today—But Massive Whale Buys Signal a $5 Surge Could Be Coming Soon

Jakarta, Pintu News – The Dogecoin price appears to be regaining momentum this week, as a significant accumulation phase by whale wallets is taking place. In addition, technical formations also indicate the potential for an explosive breakout in the near future.

Over the past week, major wallets added more than 100 million DOGE. Analysts highlighted a long-term cup pattern that could potentially push the token’s price up to $5 in the long run.

So, how is the Dogecoin price moving today?

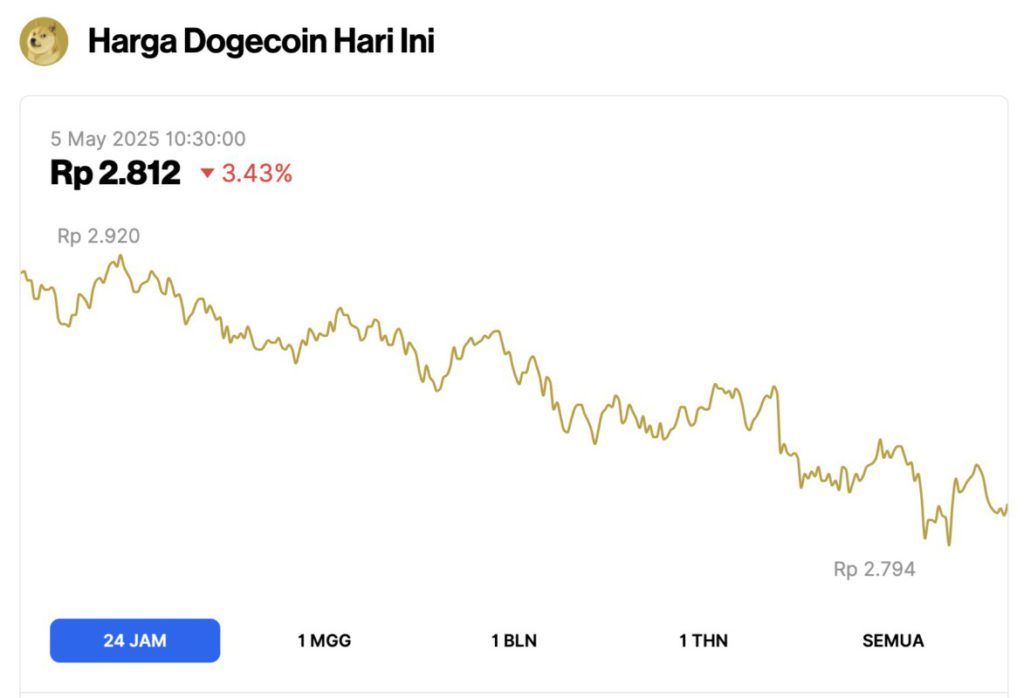

Dogecoin Price Drops 3.43% in 24 Hours

On May 5, 2025, Dogecoin (DOGE) saw a 24-hour decline of 3.43%, trading at $0.1706 (approximately IDR 2,812). During the day, DOGE reached a high of IDR 2,920 and dipped to a low of IDR 2,794.

At the time of writing, Dogecoin’s market cap stands at around $25.45 billion, with trading volume rising 16% to $667.73 million within 24 hours.

Read also: Ethereum Dips 2% Today (May 5) — Is a Major Rebound Just Around the Corner?

Dogecoin Whale Accumulation Strengthens

Large-scale Dogecoin transactions have been happening at a high intensity again this week. Based on on-chain data shared by analyst Ali Martinez, wallets holding between 10 million and 100 million DOGE have purchased as many as 100 million tokens in the past seven days. This activity comes after a period of lower inflows in April.

This increase in whale holdings indicates growing confidence among large investors. A similar accumulation pattern occurred in 2021 and preceded a massive price spike, which pushed the price of DOGE through $0.70.

During the accumulation process, the Dogecoin price was hovering around $0.14 with increased trading volume on top-tier exchanges.

It should be noted that the newly accumulated DOGE has not been returned to the exchange. Instead, the tokens are held in a long-term wallet, according to available data.

This effectively reduces the supply available for trading. This trend favors bullish signals as it can limit downside volatility and increase the likelihood of supply scarcity.

Cup Formation Shows Long-term Bullish Structure

The CryptoELITES account shared a technical analysis via a post on the X platform, which highlighted a multi-year “cup” pattern on Dogecoin’s weekly chart.

Read also: Bitcoin Crashes to $93,000 — Massive Liquidations Rock the Crypto Market!

This formation features a wide curved bottom and a neckline as an area of resistance around $0.225. This level previously served as both a resistance and support zone.

This structure is in line with Dogecoin’s historical pattern, where a long consolidation phase is often followed by a significant upward movement.

The breakout targets of this pattern are projected to be at $0.75, $1.50, and $2.70. In the event of a full extension supported by macro market momentum, DOGE prices could potentially even reach $5.

Furthermore, CryptoELITES emphasizes that the Dogecoin price base formation phase is likely complete.

Supporting indicators such as increased volume and rising moving averages reinforce the validity of this pattern. To confirm the continuation of the bullish trend, DOGE prices need to stay above the neckline.

Short-Term Target of $0.225 Is the Nearest Resistance for Dogecoin Price

Analyst Andrew Griffiths from Whalehunt gave a short-term Dogecoin price prediction of $0.225. He re-entered the DOGE market at $0.14 after previously taking profits at the local peak.

In his analysis, he identified a breakout zone of 25% with potential gains of up to 40% if the pattern is confirmed.

Griffiths noted that Dogecoin has formed a curved bottom pattern between $0.14 to $0.19, which resembles the early stages of a larger weekly “cup” pattern.

If the price of DOGE is able to hold above $0.14, then a move towards $0.225 is expected to become more likely in the near future.

The volume trend is also in favor of this setup. An accumulation phase has been seen on both the 4-hour and daily charts, with trading volumes continuing to increase.

Nevertheless, Griffiths warns that if the price drops below $0.12, the current pattern could be broken. This could extend the time needed before a potential breakout occurs.

Dogecoin Price Sentiment and On-Chain Data Show Growing Confidence

Community sentiment towards Dogecoin is increasingly optimistic. The number of mentions of Dogecoin on various social platforms has increased, reflecting a renewed interest from retail.

Read also: Nasdaq and 21Shares Shake Up the Market with the First Dogecoin ETF in the US!

Engagement metrics also showed a surge in individual investor interest. In addition, open interest on DOGE futures rose by 8% this week, indicating an increase in speculative positioning in the market.

On-chain data shows an increase in DOGE outflows from exchanges. This trend indicates that DOGE holders are moving their assets into cold storage, thereby reducing short-term selling pressure and strengthening the price increase scenario. The decreased supply of DOGE on exchanges supports the accumulation theory.

Meanwhile, the funding rate on major trading platforms continues to show positive numbers. This indicates that more traders are opening long (buy) positions compared to short (sell) positions. The combination of increased volume and whale activity reinforces the current bullish market view.

If the Dogecoin price is able to stay above $0.20 and successfully break $0.225, then the movement towards the target price of $0.75 and $1.50 could potentially take place more quickly.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coin Republic. Can Dogecoin Price Surge To $5 Amid Whale Accumulation? Accessed on May 5, 2025