Bitcoin (BTC) Miners Refrain from Post-Halving Sales, What’s the Reason?

Jakarta, Pintu News – After the latest halving event, Bitcoin miners showed an unusual reaction. Although the daily block reward has been reduced to 3,125 BTC, these miners are in no hurry to sell their assets. Stable on-chain data and minimal selling pressure suggest that miners have strong confidence in the potential future price rise of Bitcoin (BTC).

Reason for Ordinary Sale and Current Detention

The operational costs of Bitcoin (BTC) mining are not cheap, including electricity costs, hardware maintenance, and employee salaries. Therefore, miners usually sell some of their Bitcoin (BTC) to cover these costs. However, the current situation is different, with miners choosing to hold onto their assets despite economic pressure to sell.

The strategic behavior of these miners suggests a change in their tactics. They may be waiting for much higher prices before deciding to sell. The current price level does not seem attractive for them to exit this investment, so they choose to wait and see how the market develops.

Also Read: Potential Impact of Dogecoin ETF on Crypto Price and Market

Miner Reservation Data Shows Stability

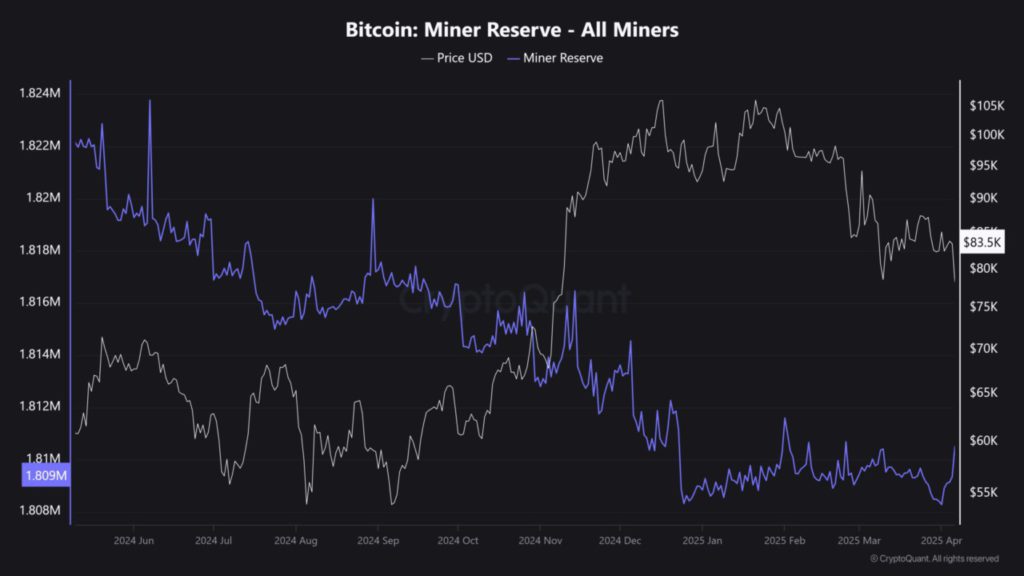

Bitcoin (BTC) miner reservation data shows a very stable trend. From 1,808,315 BTC on December 25, 2024 to 1,808,674 BTC on May 3, 2025, the change in reservation was less than 0.02%. This shows that miners are not actively distributing coins to the market.

This stability has often preceded major price spikes in the past, signaling that miners are in no hurry to exit the market. They may be preparing themselves for the next bullish leg, with the expectation that there will be a significant price increase in the future.

Multiple Puell Data Analysis

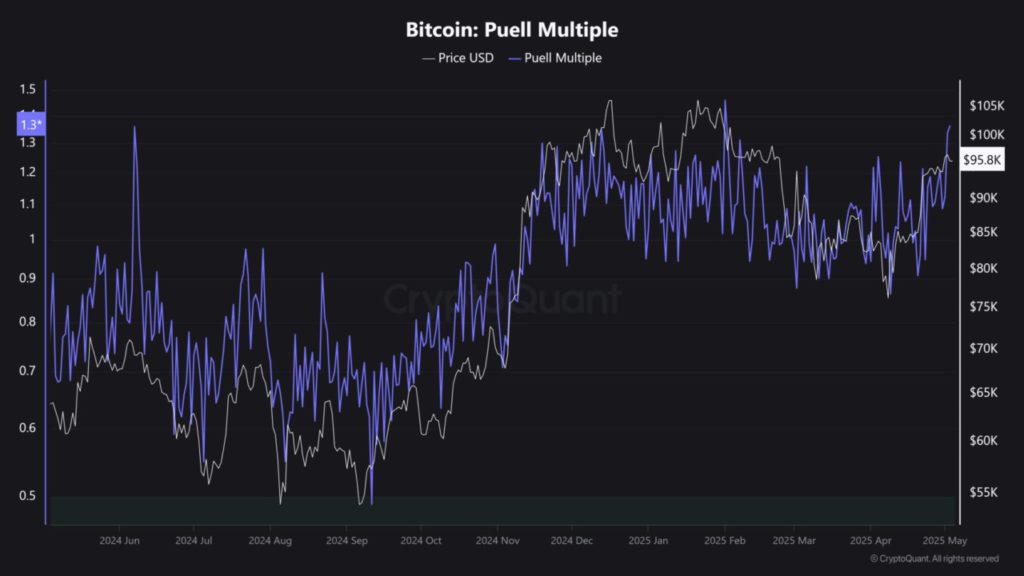

The Puell Multiple, which compares daily mining revenue in US dollars to the 365-day average, is at a moderate level. Readings above 2 often coincide with market peaks and heavy selling by miners. However, the current moderate value suggests that miners are not feeling pressured or overly euphoric. This suggests that miners are content to wait.

Historically, when Puell Multiple stabilizes and reservations remain, the market still has room to grow before peaking. This suggests that as long as miners continue to hold back, the upside potential of Bitcoin (BTC) price is still preserved.

Conclusion

By holding onto their assets and not rushing to sell, Bitcoin (BTC) miners are currently acting more like long-term investors than forced sellers. This stability not only shows their confidence in the future value of Bitcoin (BTC), but it can also be a strong indicator of upcoming price trends.

Also Read: Ethereum Outperforms Bitcoin: The Impact of Vitalik Buterin’s Proposal and Adam Back’s Response

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Bitcoin: Despite the Halving, BTC Miners Refuse to Sell, Here’s Why. Accessed on May 5, 2025

- Featured Image: Crypto Briefing