Chainlink has the potential to rise to $29, check out the supporting factors!

Jakarta, Pintu News – Chainlink is showing some strong indications that it could reach $29 again. Based on daily chart analysis, LINK is moving in a range formation between $10.8 and $15.5. The decline in reserves on the exchange and the bullish trend according to the SuperTrend indicator add to the optimism.

Reduction of Selling Pressure on Chainlinks

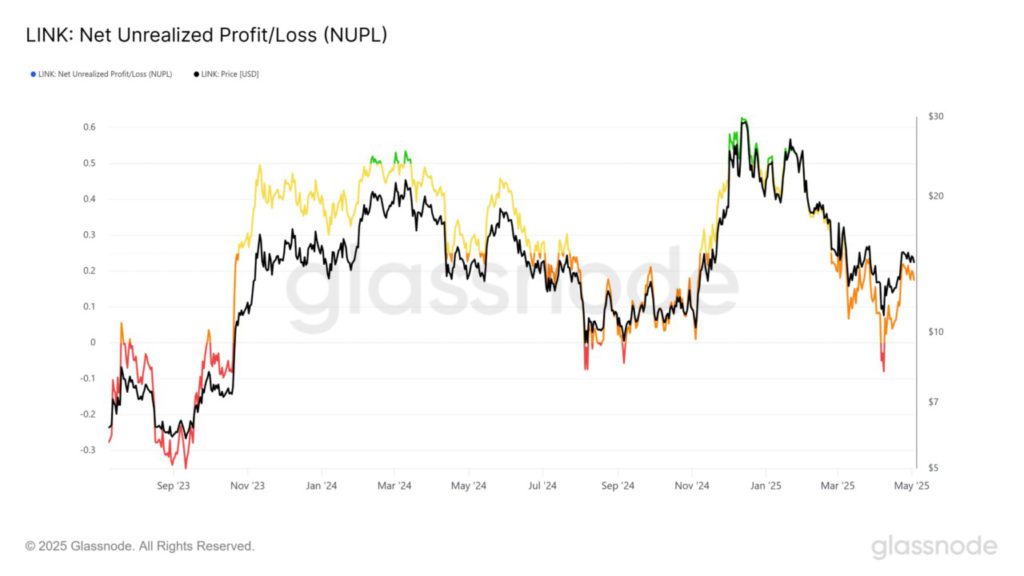

Chainlink (LINK) experienced a decline in reserves on the exchange, signaling a reduction in selling pressure. The SuperTrend indicator on the daily chart shows a bullish trend, providing a positive signal for investors. The Net Unrealized Gain/Loss (NUPL) metric reached capitulation levels in early April when LINK was trading at $11. This NUPL movement is similar to the August-September 2024 period, which previously marked a local market bottom before a significant price surge.

Also Read: Potential Impact of Dogecoin ETF on Crypto Price and Market

Indications of Accumulation from Investors

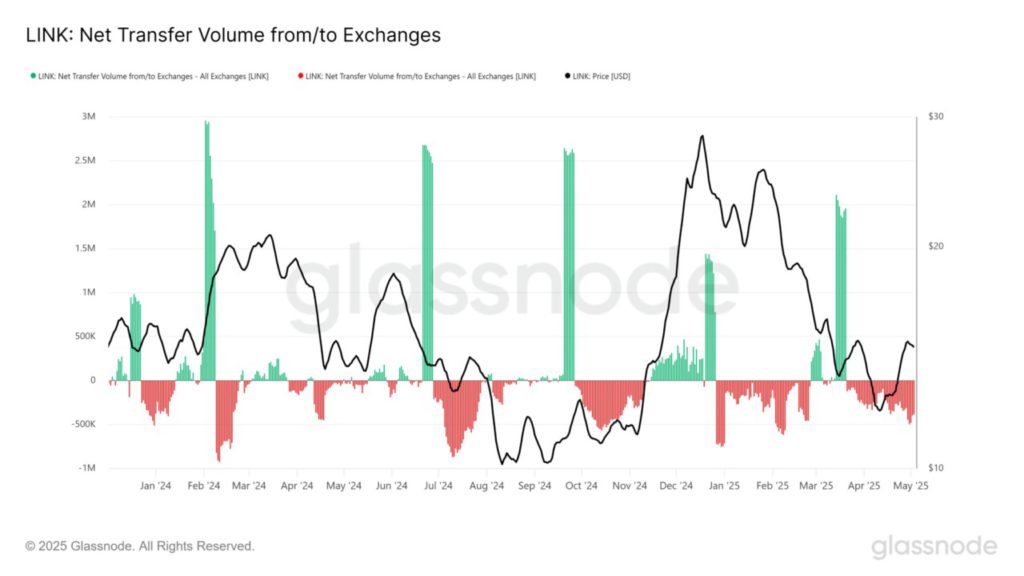

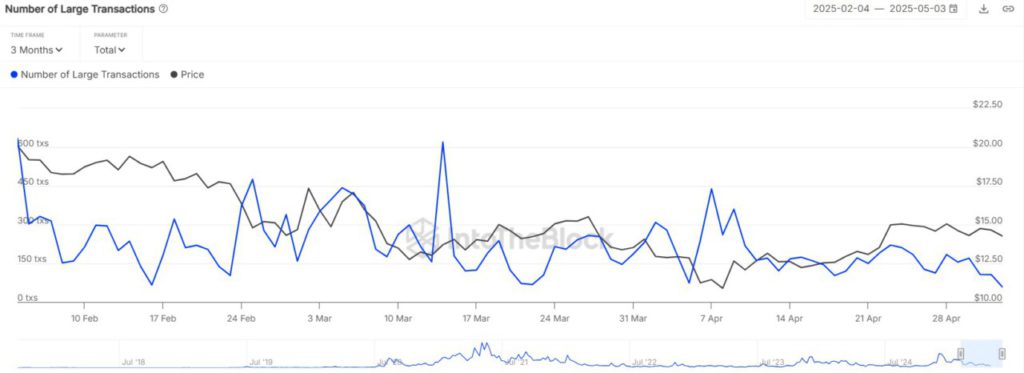

The 7-day moving average of net transfer volume to/from the exchange shows a negative value since late March, signaling LINK outflows from the exchange. This indicates investors’ desire to hold (HODL) their assets, a bullish signal. However, this does not necessarily promise an immediate price increase. Data from IntoTheBlock shows a decrease in large transactions in the last three weeks, indicating that selling pressure from big players is easing and there is steady accumulation.

Long-term Outlook and Challenges

Despite the bullish indications, investors still need to be cautious. The daily price chart shows that Chainlink was rejected near the top of the range and is likely to drop towards the mid-range support at $13.18. However, the On-Chain Balance Volume (OBV) shows an upward trend since March, signaling an increase in buying volume. A rising OBV trend during a long consolidation phase is a bullish signal for Chainlink, which promises a possible rally past the top of the range in the coming weeks.

Conclusion

With various indicators showing positive potential, Chainlink (LINK) has a chance to reach the $29 price again. However, investors are advised to remain vigilant and monitor market indicators to make informed investment decisions. Dynamic market conditions require careful analysis and timely responses.

Also Read: Ethereum Outperforms Bitcoin: The Impact of Vitalik Buterin’s Proposal and Adam Back’s Response

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Chainlink could $29 be in sight again, traders watch out for. Accessed on May 5, 2025

- Featured Image: CryptoSlate