BONK Freefalls 8% in 24 Hours: Check out the Price Levels that Can Prevent More Declines!

Jakarta, Pintu News – In the past 24 hours, Bonk experienced a significant decline of 8.67%, deepening its weekly loss. Although the monthly performance shows a price increase of 41%, recent analysis shows that BONK’s decline is not over yet. Several bearish indicators point to further downside potential, although there is one bullish factor still standing.

Demand Zones as Catalysts

Currently, BONK is approaching a major demand zone that often serves as a price jump point. This zone is located between $0.00001546 and $0.00001405, where there is usually a large accumulation of buy orders. If this zone manages to trigger buyer interest, there is a chance that the price will rise. However, if this zone is unable to arrest the decline, BONK may continue to drop to lower levels such as $0.00001178, $0.00001043, and $0.00000888, each of which could serve as support if the decline continues.

Also Read: Potential Impact of Dogecoin ETF on Crypto Price and Market

Uncertain Market Momentum

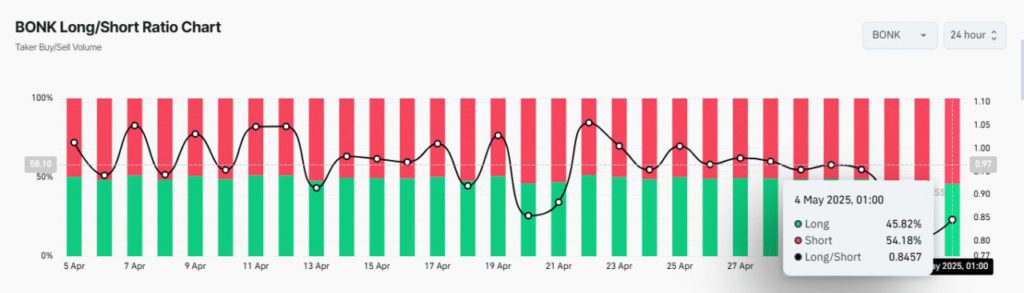

The current market momentum shows a strong bearish tendency towards BONK, which could cause the price to fall from the demand zone. One important metric, the Buy/Sell Taker Ratio, shows that 54.18% of traders opt for short positions, while only 45.82% hold long positions.

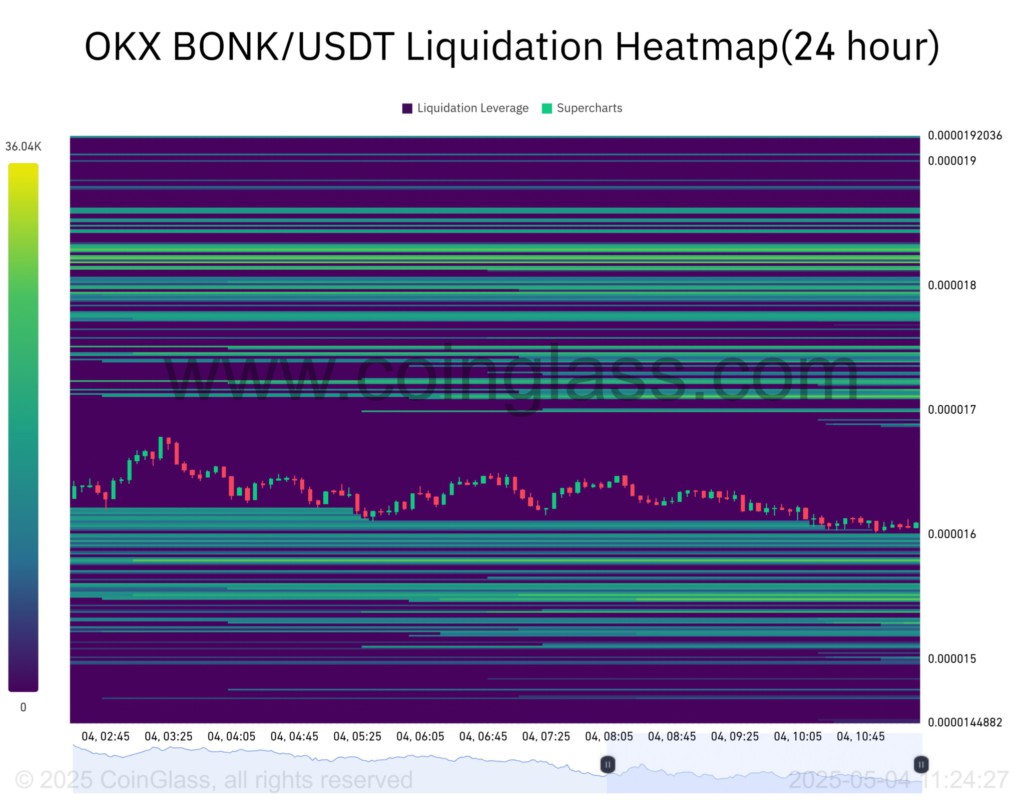

This ratio, which stands at 0.8457, indicates that the market sentiment is trending towards sellers. Liquidation data shows that $1,990 worth of short positions have been forcibly closed, while $205,000 worth of long positions have been liquidated, indicating that the market is currently very bearish.

Spot Purchases as a Determining Factor

Despite the bearish indications, BONK still has a chance of not falling below the demand zone thanks to the buying activity in the spot market. Currently, BONK records daily spot market purchases of $2.55 million, with total weekly purchases reaching $18.63 million. This is the highest weekly buying amount recorded between January 27 and February 3. If this buying activity continues, especially as BONK enters the demand zone, the asset may experience a stronger bullish impulse that could push the price up.

Conclusion

Despite facing significant bearish pressure, BONK still has a chance for a rebound if spot buying continues and the demand zone serves as effective support. Investors and traders should monitor these indicators to make informed decisions in the face of current market volatility.

Also Read: Ethereum Outperforms Bitcoin: The Impact of Vitalik Buterin’s Proposal and Adam Back’s Response

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Bonk falls 8% in 24 hours, but this price level can prevent a further dip. Accessed on May 5, 2025

- Featured Image: CoinPedia