Ethereum Holding Above $1,770: Could it Reach $2,030 Next?

Jakarta, Pintu News – Ethereum managed to maintain support at the $1,770 level, with strong indications of network activity and market sentiment driving further upside potential.

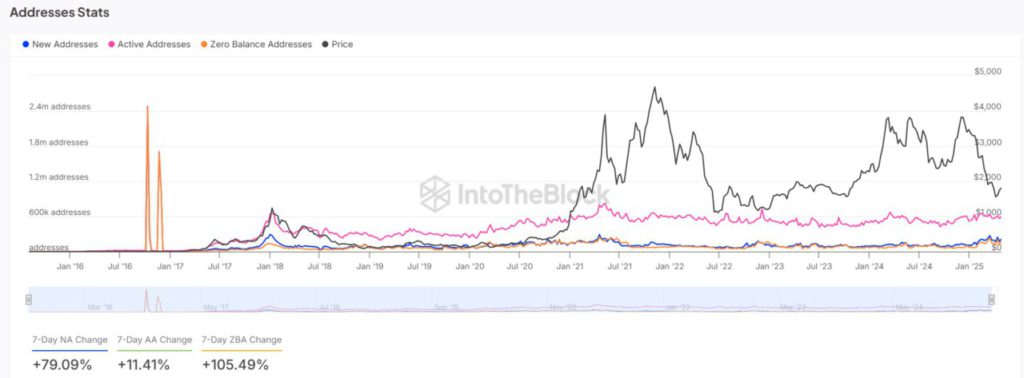

New Wallet Growth Boosts Ethereum Network Activity

Ethereum (ETH) network fundamentals show a significant increase in on-chain interactions. The number of new addresses increased by 79.09% in the last seven days, while active addresses rose by 11.41%. This increase signifies that more and more users are involved in the Ethereum (ETH) ecosystem, which may strengthen the price position in the market.

Moreover, the growth of these new wallets not only indicates increased usage, but also increases investor confidence in Ethereum (ETH) as a long-term investment asset. This could potentially encourage more transactions and activity on the network, which could ultimately affect the market price.

Also Read: Potential Impact of Dogecoin ETF on Crypto Price and Market

Liquidity Improves as Reserves on Exchanges Increase

Ethereum (ETH) reserves on exchanges have seen a small increase to $36.07 billion, up 1.16%. This increase in reserves usually indicates that more Ethereum (ETH) is being held on central exchanges, which could be an indication of potential selling pressure.

However, this increase could also be interpreted as traders preparing to make large transactions, which could be a positive sign if supported by strong market sentiment. This analysis is important to understand the supply and demand dynamics that will affect the price of Ethereum (ETH) in the future.

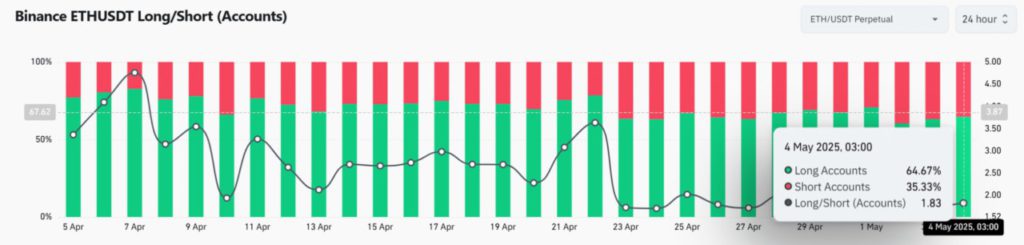

Leverage shows optimism, but risks remain

Data from Binance shows that 64.67% of traders are currently long Ethereum (ETH), with a long/short ratio of 1.83. This confirms traders’ confidence in Ethereum’s (ETH) price upside potential, but also increases the risk of a shakeout if the market reverses.

While high leverage suggests optimism, traders should still be wary of the possibility of sudden changes in market sentiment that could trigger massive selling. This vigilance is important to avoid unwanted losses and capitalize on potential price increases more effectively.

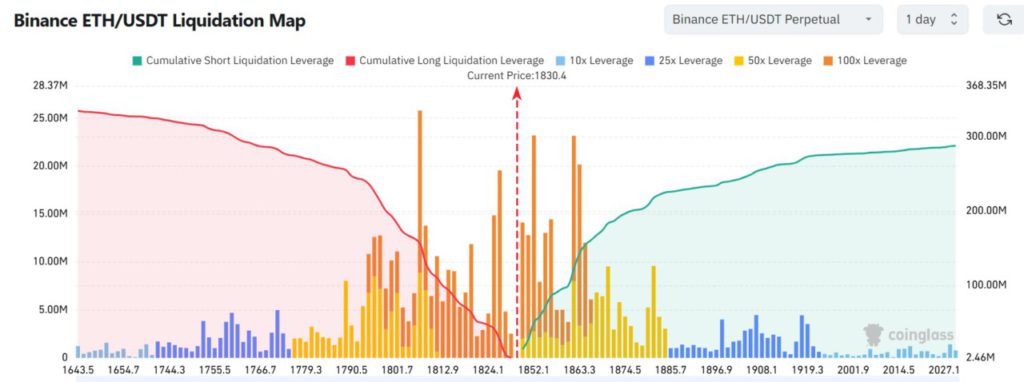

Ethereum is poised for a breakout, but barriers remain strong

Ethereum (ETH) price structure is currently in a tight range between $1,770 support and $1,867 resistance. The $1,867 level has been the upper limit in the last few price increase attempts. If Ethereum (ETH) manages to break this level with strong volume, the Fibonacci extension target of 1,618 at $2,030 could be reached.

With strong support at $1,770 and increased network activity, as well as a high long/short ratio, all indicators suggest that the bulls have strong control over the market. A break above resistance with significant volume support could trigger an acceleration towards the $2,030 target and trigger a broader momentum shift in the market.

Also Read: Ethereum Outperforms Bitcoin: The Impact of Vitalik Buterin’s Proposal and Adam Back’s Response

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Ethereum holds firm above $1770, can bulls push to $2030 next?. Accessed on May 5, 2025

- Featured Image: Bitcoinist