XRP Price Update: XRP to Hit $12 in 2026? Whale Analysis and Accumulation Give Positive Signals!

Jakarta, Pintu News – The price of Ripple has fallen by 5% in the past seven days, reflecting the overall crypto market trend after Bitcoin’s rally stuck at $96,000.

Even so, XRP appears to be gearing up for a self-sustaining rally towards double-digit figures in the next few months, and on-chain data suggests that the whales may be preparing themselves for such a move.

Elliott Wave Analysis Predicts XRP to Skyrocket to $12

The price of XRP is expected to experience a sharp surge to reach $12, after an analyst found a bullish formation on the weekly chart.

Read also: This Crypto Trader Turned April’s Market Crash Into a $14 Million Payday — Here’s How

He noted that Ripple has completed the correction phase in the Elliott Wave pattern in the price range of $2.05 to $1.65, indicating that XRP is preparing to enter the third wave – a phase that is usually characterized by a strong and prolonged rise.

In its analysis, EWCycles estimates that Ripple’s price target is a surge of 2,900% which is likely to occur between 2025 to 2026. This means that XRP could potentially increase 5 to 6 times from its current price level.

However, the potential rally has limits and will only happen if the altcoin is able to form new highs and lows gradually.

Currently, an ascending channel pattern is starting to form on the price of XRP, and as long as this altcoin stays within the channel, a strong uptrend is still the target.

Whale Accumulation Shows Bullish Positioning

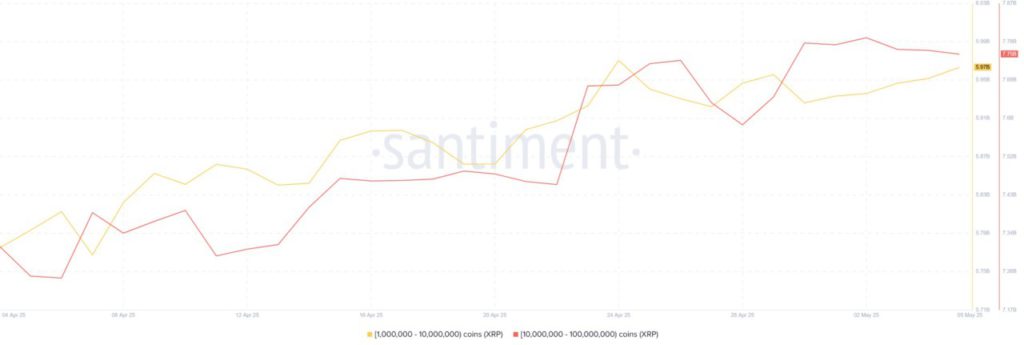

Whale activity has also reinforced bullish predictions for XRP, with on-chain data showing that two large address groups have made large purchases in the past month.

Address wallets holding between 1 million to 10 million XRP have purchased a total of 190 million tokens in the last 30 days. Meanwhile, wallets holding between 10 million to 100 million coins have accumulated 440 million XRP in the same period.

Whales are known to buy when prices are low, as they anticipate big gains in the future.

Hence, this accumulation trend hints that the Ripple whales are positioning themselves in a bullish scenario. This is in line with the Elliott Wave analysis which predicts that XRP has the potential to experience a huge surge into double-digit prices.

Read also: Litecoin ETF Approval Chances Increase, $500 Target Price Awaits!

Ripple Price Forecast in the Short Term

The four-hour chart shows that the price of XRP is likely on the verge of an upward movement, as it is currently testing the upper trendline of a falling wedge pattern – a pattern that usually indicates a potential upward breakout.

However, to confirm the bullish momentum that this pattern usually indicates, the market needs to show a return of buying pressure. Currently, the RSI is at 43, which indicates that the power is still with the bears.

If XRP manages to break this resistance level, then there is potential for a short-term rally of 7% towards $2.36. If this level is reached, it could pave the way for a further rise to $2.59.

Conversely, if this bullish scenario fails and Ripple price breaks the support at $2.13, it could drop further to $1.96.

Overall, the price of XRP is likely to experience a bullish breakout towards new highs in the near future, as strong signals from the Elliott Wave pattern and whale accumulation activity suggest that a major uptrend is lurking.

Moreover, the four-hour chart also indicates that Ripple may soon break the resistance level at $2.36 and begin its journey towards $3.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Get a web trading experience with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Will XRP Price Hit $12 in 2026: Elliott Wave Pattern, Whale Accumulation Signal Explosive Rally. Accessed on May 6, 2025