VanEck Disrupts the Market with the First-Ever Binance Coin (BNB) ETF Filing in the US!

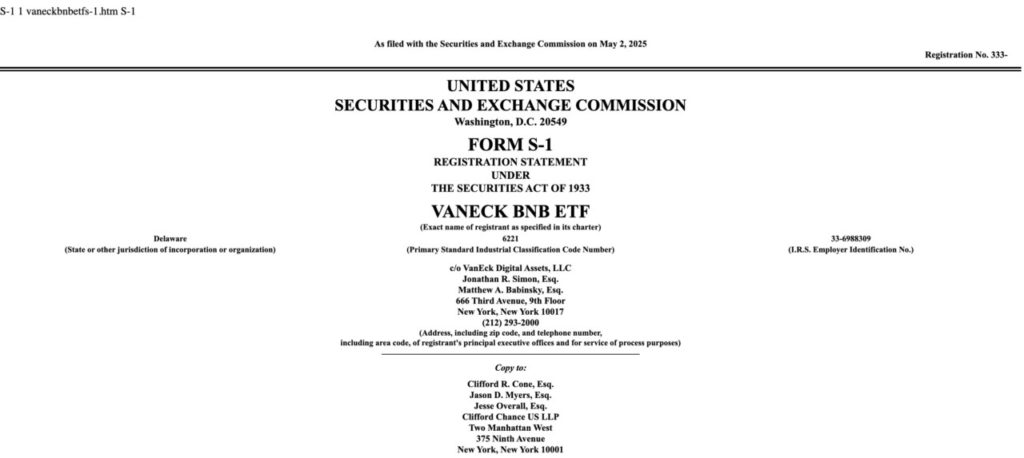

Jakarta, Pintu News – The global financial market may be about to witness a new buzz with the bold move by VanEck, an American investment management firm, which has filed S1 documents with the US Securities and Exchange Commission (SEC) to launch an Exchange-Traded Fund (ETF) product based on Binance Coin .

This filing marks an important step in the integration of cryptocurrencies in mainstream financial products in the United States.

VanEck filing for Binance Coin (BNB) ETF

VanEck has officially filed an S-1 form with the SEC, which is the first step towards registering the first Binance Coin (BNB) ETF in the United States.

Read also: Altcoin Season is Coming Soon? Bitcoin’s dominance reaches 65%!

The product, which will be known as the VanEck BNB ETF, aims to offer investors a structured and registered way to invest directly in Binance Coin (BNB), the underlying crypto asset of the BNB Chain. This filing follows VanEck’s establishment of a trust entity in Delaware, which is in preparation for the launch of this ETF.

If approved, this ETF will not only track the price of Binance Coin (BNB) but may also offer a staking feature, allowing shareholders to earn additional rewards in the form of Binance Coin (BNB).

ETF Impact on Binance Coin (BNB) Price

Currently, the Binance Coin (BNB) price is hovering around $593.17, showing a slight decline. Despite the ongoing negative trend, the announcement from VanEck has sparked optimism among investors and market analysts.

They hope that this ETF will increase demand for Binance Coin (BNB), which in turn could drive the price up. This optimism is supported by the significant increase in Binance Coin (BNB) trading volume, reaching $1.41 billion in the last 24 hours (5/5/25).

Increased demand and better investment options through ETFs are expected to reverse the current negative trend and push Binance Coin (BNB) prices higher.

Read also: Vitalik Buterin Raises Alarm Over Security Risks in Ethereum’s Layer-2 Network

Prospects and Regulatory Challenges

Although VanEck has shown strong initiative in integrating crypto assets into its regulated financial products, there is still uncertainty as to how the SEC will respond to these filings.

The SEC has previously declared Binance Coin (BNB) a possible security, and Binance is still facing legal challenges in the US. However, with VanEck’s experience in launching ETFs for Bitcoin and Ethereum , as well as futures-based products, there is hope that they can navigate these regulatory challenges.

Success in gaining approval for the Binance Coin (BNB) ETF will be an important milestone in the evolution of the crypto asset market.

Overall, VanEck’s move to launch the first Binance Coin (BNB) ETF in the US marks a new era in the integration of crypto assets with traditional financial markets.

With the potential to attract institutional and individual investors, this ETF can not only increase the visibility and acceptance of Binance Coin (BNB) but also strengthen its position as a major crypto asset in the global market.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Get a web trading experience with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Breaking: VanEck Files S1 Form with US SEC to Launch BNB ETF. Accessed on May 6, 2025

- Crypto Briefing. VanEck Files for First-Ever Binance Coin ETF in the US. Accessed on May 6, 2025

- Crypto Times. VanEck Quietly Files for First-Ever BNB ETF with the SEC. Accessed on May 6, 2025