3 US Economic Indicators Affecting the Crypto Market This Week

Jakarta, Pintu News – Crypto markets are often influenced by various economic indicators from the United States. This week, several US macroeconomic data are scheduled for release, which could provide important insights for crypto investors and traders. Here are some indicators to watch out for!

ISM Services Indicator and US S&P Services PMI

The first indicators to be released this week are the ISM Services and S&P final US services PMI. These two data will provide a snapshot of the condition of the services sector in the US for April. If the index value is above 50, it indicates expansion, while a value below 50 signals contraction.

According to data from MarketWatch, the median estimate for the final S&P US services PMI was 51.0, down from the previous reading of 51.4. Meanwhile, ISM Services had a median estimate of 50.4% after the previous reading of 50.8%.

The importance of this data to the crypto market lies in its influence on investor confidence and general market sentiment. The health of the services sector can provide clues about the strength of the US economy, which can indirectly affect the US dollar exchange rate and crypto market dynamics.

Read also: Crypto Millionaire’s Father Rescued from Kidnapping in Paris, What’s the Chronology?

US Trade Deficit

The second indicator to watch is the US trade deficit for March. This deficit measures the difference between exports and imports. The median estimate for March is -$136 billion, up from -$122.7 billion in the previous month. Trump’s tariff discussions may also affect the value of the US dollar, as a widening deficit indicates a higher reliance on imports.

Changes in the value of the US dollar can have a significant impact on the price of Bitcoin and other crypto assets, as many investors use the US dollar as the primary currency in crypto transactions. Therefore, this data is particularly relevant for those involved in the crypto market.

Read also: Vitalik Buterin Reveals Hidden Power in the Crypto World, What Does He Say?

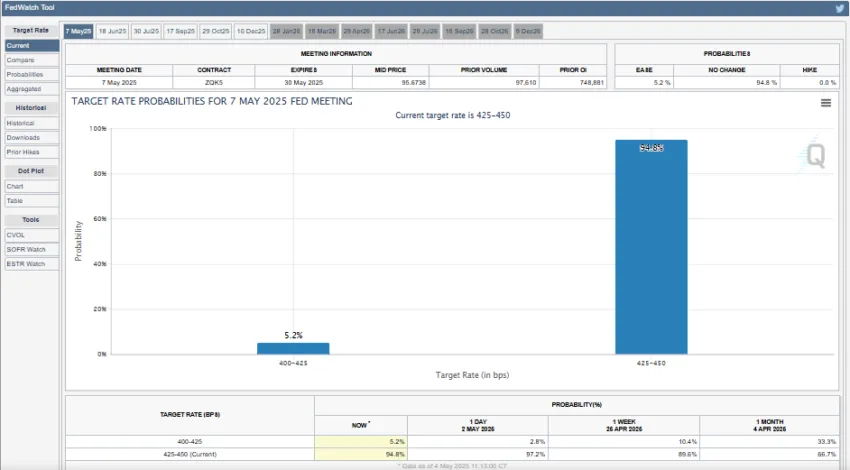

FOMC Meeting and Jerome Powell Conference

The most anticipated event this week is the Federal Open Market Committee (FOMC) meeting and the conference to be held by Federal Reserve (Fed) Chairman, Jerome Powell. Although the market expects interest rates to remain at 4.25%-4.5%, the tone used by the Fed will greatly affect market sentiment.

In addition, the Consumer Credit data to be released on Wednesday is also important, as it reflects lending trends in the US and consumer confidence. Initial Jobless Claims, which reports the number of new unemployment filings each week, will also provide an up-to-date picture of the health of the labor market.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. US Economic Indicators: How Do They Impact Crypto? Accessed on May 6, 2025

- Featured Image: Generated by AI