Brown University Invests in BlackRock Bitcoin ETF Worth $4.9 Million!

Jakarta, Pintu News – Brown University recently announced a significant investment in the world of digital assets by purchasing $4.9 million worth of BlackRock Bitcoin ETF shares. The move marks the university’s penetration of the cryptocurrency market through regulated financial products.

Check out the full news in this article!

Brown University’s Introduction to Crypto Investing

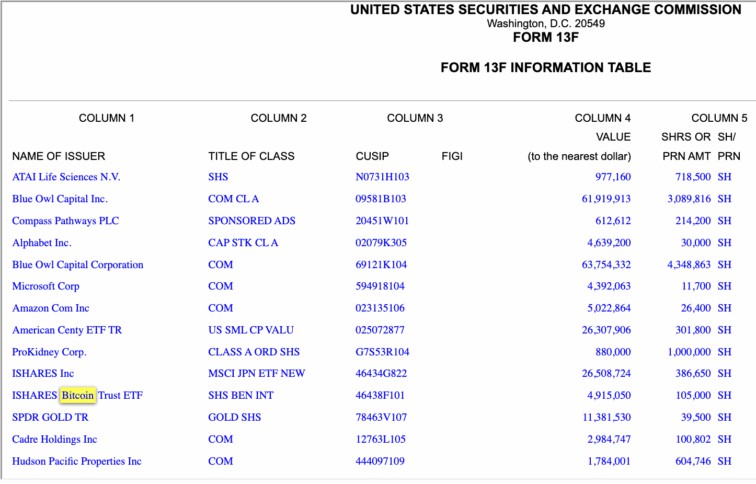

SEC disclosure documents reveal that Brown University has purchased 105,000 shares of BlackRock’s iShares Bitcoin Trust (IBIT) as part of its first quarter 2025 investment.

This purchase accounts for 2.3% of their $216 million equity portfolio. This is the university’s first step in adopting cryptocurrencies, showing confidence in the long-term potential of Bitcoin .

This investment puts Brown University at the forefront of educational institutions integrating digital assets into their asset allocation strategies. With a broad and well-diversified investment portfolio, the university is exploring new opportunities in regulated digital assets.

Also read: Ambitious Project, Maldives Builds $8.8 Billion Blockchain Financial Center!

IBIT Advantages as Institutional Investment Solution

IBIT, which is approved by the SEC, has been a popular choice among institutional investors since January 2024. In less than a year, this Bitcoin price tracking ETF has grown to become one of the top performing ETFs. As of March 31, 2024, IBIT managed 576,000 BTC, with total assets of $47.78 billion.

This investment solution offers stable and trusted access to Bitcoin (BTC), allowing institutional investors such as pension funds and university endowments to capitalize on Bitcoin’s growth without having to manage the token directly. This demonstrates the adaptation of traditional financial markets to digital innovation.

Also read: Crystal Intelligence Acquires Fraud Detection Platform Whale Alert!

Diversification Strategy and Investment Return

With an investment portfolio that stands at $7 billion, Brown University is looking at an 11.3% return on investment by 2024. The investment in the Bitcoin ETF marks a strategic shift in the university’s asset allocation, which was previously more focused on traditional financial instruments.

This diversification not only reduces risk but also opens up significant growth potential through new assets such as crypto. This allocation demonstrates a progressive approach to endowment fund management, where the university not only focuses on long-term asset growth but also adaptation to global market trends.

This sets a precedent for other educational institutions to integrate modern financial technology into their investment strategies.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Get a web trading experience with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Crypto Times. BlackRock Bitcoin ETF Bags $4.9M from Brown University. Accessed on May 6, 2025

- Featured Image: Brown University