SEC Releases Agenda for Tokenization Discussion to be Held on May 12, 2025!

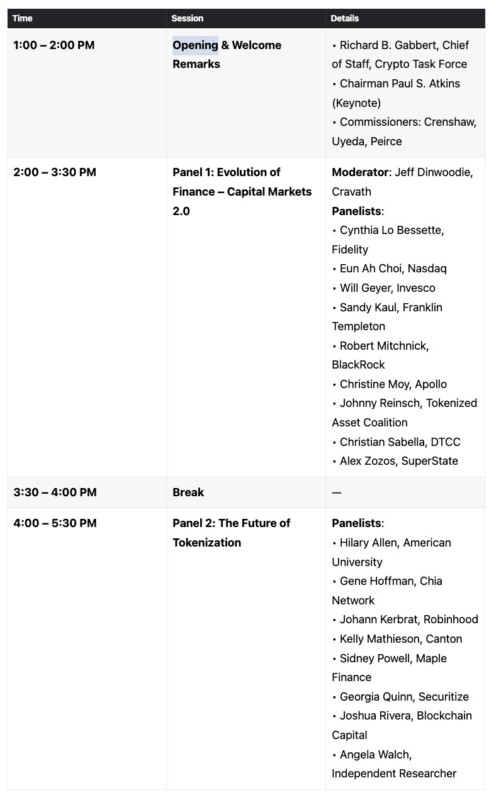

Jakarta, Pintu News—On May 12, the United States Securities and Exchange Commission (SEC) will hold a highly anticipated roundtable discussion on the theme “Tokenization—Moving Assets to Blockchain: The Confluence of TradFi and DeFi.”

The event, which will be held at the SEC headquarters in Washington, D.C., promises an in-depth discussion of blockchain technology’s impact on traditional financial markets.

Check out the full info in this article

May 12 Roundtable Agenda: Tokenization and TradFi Meeting with DeFi

Commissioner Hester M. Peirce, who leads the SEC’s Crypto Task Force, emphasized that tokenization can transform the traditional financial sector. She stated that it is a technological development that could significantly change many aspects of our financial markets.

The discussion will involve experts from various fields who will discuss how to best integrate these technologies into the existing financial system. The event is open to the public and will be streamed live via the SEC website.

No registration is required for those who wish to participate virtually, but those who want to attend in person must register in advance. Doors will open from 12:00 noon, and a link to watch live will be available on the www.sec.gov website on the day of the event.

Read also: Positive Signals from Bitfinex, Bitcoin Miners Not Giving Up Despite Volatile Market!

DeFi Roundtable Date Change

In a related development, the SEC also announced a date change for its next roundtable, “DeFi and the American Spirit.” Originally scheduled for June 6, the event will now be held on June 9. For those who registered for the previous date, there is no need to re-register, as their registration has been automatically updated.

New registrations are still open to the public. The event is part of the SEC’s broader effort to explore the implications of blockchain innovation for financial regulation in the United States. More information about the upcoming sessions and the topics can be found on the SEC’s Crypto Task Force webpage.

Read also: Shardeum Mainnet Officially Launched, Setting a Record for Validator Participation in Testnet

Broader Implications of Tokenization and Blockchain

Tokenization not only has the potential to change the way assets are traded, but also how they are stored and managed in the financial industry.

By moving assets to the blockchain, transparency, security, and operational efficiency are expected to increase significantly. It also opens up new opportunities for financial inclusion through broader access to financial products that were previously unavailable to a large portion of the population.

The discussion will also explore the challenges faced in integrating these technologies, including security, regulatory, and acceptance issues by traditional markets. The SEC hopes to gather input from various stakeholders to shape a regulatory framework that supports innovation while maintaining market stability.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Crypto Times. SEC Unveils Agenda for Tokenization Roundtable on May 12. Accessed on May 8, 2025

- Featured Image: Investopedia