Standard Chartered Says BNB Could Double in Price — Is a Massive Rally Coming?

Jakarta, Pintu News – The cryptocurrency market is always full of interesting dynamics. Recently, Standard Chartered issued a surprising prediction regarding the future of Binance Coin , which is expected to experience significant price increases in the coming years.

Binance Coin (BNB) Future Projections

According to a recent report from Standard Chartered, Binance Coin (BNB) is expected to reach a price of $1,275 by the end of 2025. This analysis is based on consistent trading patterns and increased attention from institutions.

Read also: SOL Strategies Buys $18 Million of SOL: Will Solana’s Bullish Momentum Return?

Geoffrey Kendrick, Head of Digital Asset Research at Standard Chartered, emphasized that BNB has shown a strong correlation with Bitcoin and Ethereum since May 2021. The report also predicts that this trend will continue, supporting BNB’s price rise in the future.

Furthermore, Standard Chartered also set a long-term price target of $2,775 for BNB by the end of 2028. Nonetheless, the report states that BNB will probably grow more slowly compared to Bitcoin (BTC) and Ethereum (ETH) in terms of market capitalization growth and investment returns.

Binance Chain Ecosystem Development

Several new developments in the Binance Chain ecosystem also support the positive outlook for Binance Coin (BNB).

Recently, asset manager VanEck applied to launch the first BNB exchange-traded fund (ETF) listed in the US. If approved, this will increase institutional access to the token.

In addition, Binance has introduced plug-and-play integration for artificial intelligence through the Model Context Protocol (MCP), which enables secure two-way communication between AI agents and blockchain systems.

On May 5, Changpeng Zhao, co-founder of Binance, revealed on the X platform that he had advised Kyrgyzstan to include BNB in their national crypto reserve. This suggestion also includes Bitcoin (BTC), which reinforces BNB’s role in the sovereign digital finance discussion.

Technical Analysis and Market Sentiment

Read also: Bitwise Takes Bold Step Toward Launching First-Ever NEAR ETF with SEC Filing!

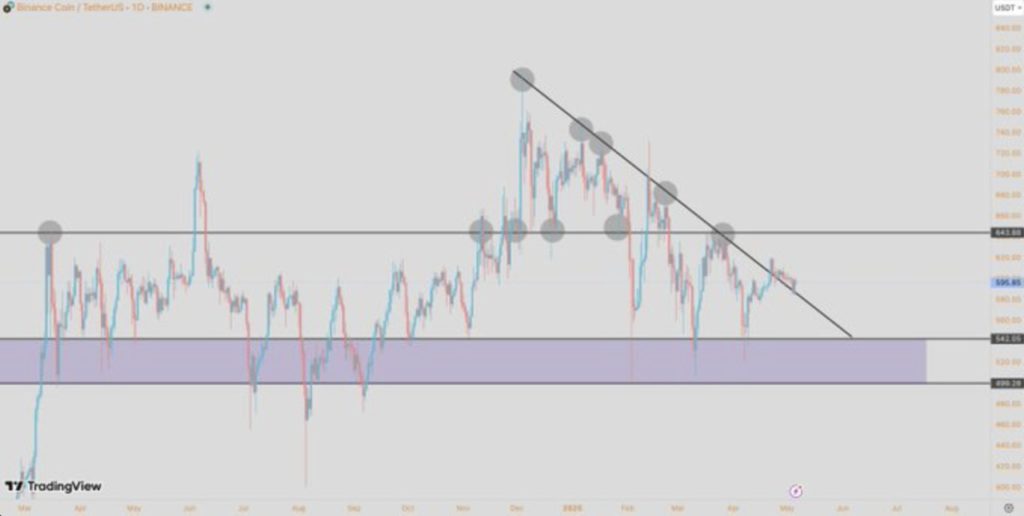

From a technical perspective, there are indications of a bullish pattern on the BNB price chart. Wagmisaurus crypto analysts note that the current formation shows a falling wedge pattern, which is usually a reversal formation.

The $500 to $530 horizontal zone has been tested several times, suggesting that this area could be a strong support for buyers. If the BNB price manages to break the upper limit of the wedge, then the next move could be towards the resistance levels of $640 and $690.

According to data from DeFiLlama, BNB Chain currently ranks as the fourth largest Layer-1 network with a total locked value of nearly $6 billion.

Although BNB Chain has slower developer growth compared to Ethereum (ETH) and Avalanche , this may lead to price consistency due to lower speculative activity.

With various ongoing developments and in-depth analysis from experts, the future of Binance Coin (BNB) looks bright.

Investors and market watchers may want to take a closer look at BNB as an asset that has the potential to provide significant returns in the coming years.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Binance Coin (BNB) Price Set to More Than Double by 2025: Standard Chartered. Accessed on May 8, 2025

- Cointelegraph. Standard Chartered Forecasts BNB Price More Than Doubling This Year. Accessed on May 8, 2025