Ethereum Skyrockets 19% in a Day – Open Interest Hits a Massive $25 Billion!

Jakarta, Pintu News – Ethereum soared 19% on Friday, bouncing back above the crucial $2,000 mark as optimism surged following the newly inked US-UK trade deal.

On-chain metrics reveal a wave of aggressive accumulation by investors, fueled by easing global trade tensions and renewed market confidence.

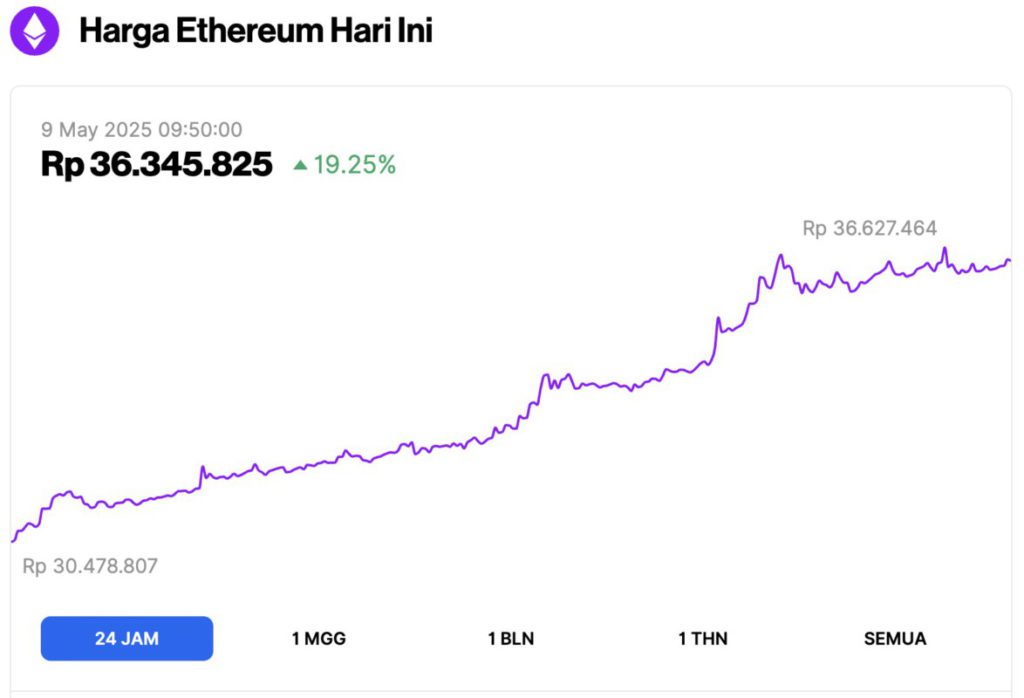

Ethereum Price Rises 19.25% in 24 Hours

As of May 9, 2025, the price of Ethereum (ETH) was recorded at around $2,214 or equivalent to IDR 36,345,825, experiencing a 19.25% surge in the last 24 hours. During this period, ETH touched its lowest level at IDR 30,478,807, and its highest level at IDR 36,627,464.

At the time of writing, data from CoinMarketCap shows that Ethereum’s market capitalization stands at around $267.35 billion, with daily trading volume rising 171% to $38.47 billion within the last 24 hours.

Read also: Is a Gold Price Crash Coming? Experts Say Bitcoin Could Take Over the Market – Here’s Why!

Ethereum Surges, Thanks to US-UK Trade Deal

Ethereum recorded a 19% surge today, outperforming other cryptocurrencies in the top 10 after the United States and the United Kingdom agreed on a trade agreement called “full and comprehensive”.

The deal includes a basic tariff reduction to 10%, as well as duty exemptions for aluminum and steel products. President Trump also stated that the US is in the advanced stages of trade negotiations with a number of other countries.

Ethereum, which previously experienced a significant decline in the first quarter due to Trump’s tariff policy against international trading partners, has started to show recovery since late April.

Following this rise, institutional investors and “whales” are showing interest in this major altcoin. Digital asset investment firm Abraxas Capital reportedly bought 49,644 ETH through Binance and Kraken platforms, based on data from Lookonchain.

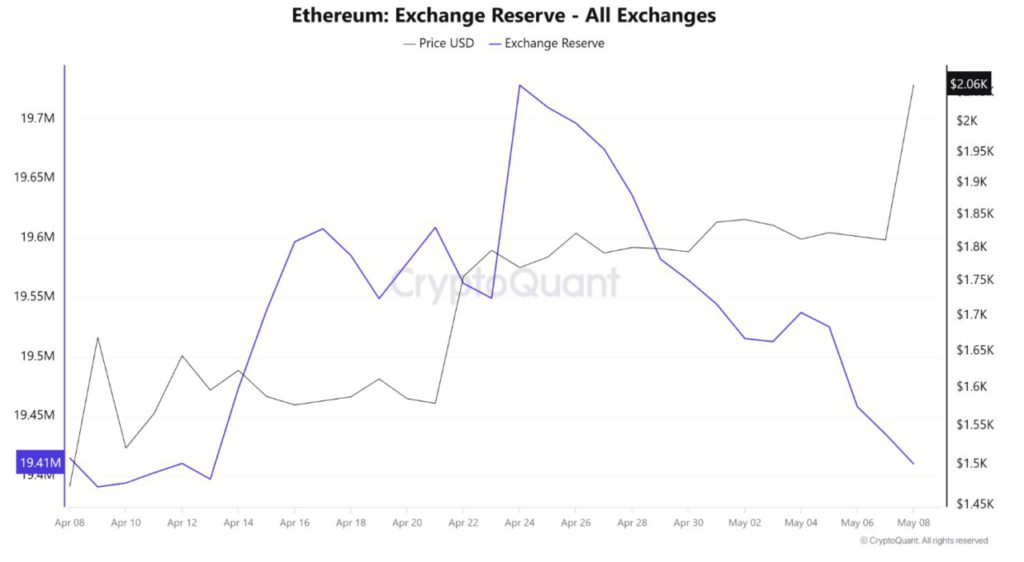

Buying pressure is evident from the ETH reserves on exchanges, which have decreased by 132,000 ETH in the last four days, totaling a decline of 323,000 ETH since April 24. A decline in reserves on exchanges generally indicates increased buying pressure.

Ethereum Open Interest Surges to $25 Billion

Similar positive sentiment was also evident in the derivatives market, where Ethereum’s open interest (OI) jumped to 12.08 million ETH or approximately $25.04 billion, according to data from Coinglass. Open interest refers to the number of unsettled derivatives contracts.

ETH’s price growth is in line with Bitcoin’s rise, which broke through the $100,000 mark for the first time since February 7.

Read also: Ethereum Pectra Upgrade: A Low-Cost Revolution for Layer-2 Users!

The stock market is also showing a positive trend, with both the S&P 500 and Nasdaq-100 indices rising by more than 1% on Thursday (8/5/25). This emphasizes the increasingly strong correlation between crypto markets and macroeconomic factors.

ETH’s recovery was also supported by the successful launch of the Pectra update on Wednesday, which brought a number of new features to Ethereum’s main network. Developers are now focused on the launch of the next upgrade, Fusaka, which is scheduled for release later this year.

Meanwhile, the Ethereum Foundation (EF) announced that it has distributed $32.64 million worth of grants to various projects in the Ethereum ecosystem during the first quarter of 2025.

These funded projects aim to improve Ethereum in various important aspects, such as community and education, consensus layer, cryptography and zero-knowledge proofs, developer experience, development tools, and protocol growth and support.

Ethereum Price Prediction: ETH Back to $2,000, Eyeing Key Resistance Levels

Ethereum recorded $188.04 million worth of futures contract liquidations in the last 24 hours, according to data from Coinglass (8/5/25). Of this amount, liquidated long positions amounted to $21.29 million, while short positions reached $166.75 million.

ETH surged more than 20% and briefly broke the $2,000 psychological level again. This rise came after buyers managed to defend the support level of $1,800 on Wednesday, which was reinforced by the 14-day exponential moving average (EMA) and 50-day simple moving average (SMA) indicators.

If Ethereum manages to regain control of the key range between $2,100 to $2,250 – which is reinforced by the 100-day SMA – then the asset could potentially rise further towards the $2,550 resistance level. A strong move above that resistance could signal the beginning of a major recovery for this major altcoin.

However, technical indicators such as the Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) are currently in overbought territory, indicating a strong bullish momentum.

However, this overbought condition also opens up opportunities for price corrections in the short term.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- FX Street. Ethereum Price Forecast: ETH jumps over 20%, outperforms top cryptos following US-UK trade agreement. Accessed on May 9, 2025