Ethereum (ETH) Poised to Surge to $1,950, What’s Driving the Rise?

Jakarta, Pintu News – Ethereum is showing significant gains after the US Federal Reserve’s latest decision to hold interest rates. With support from Vitalik Buterin’s network update proposal and an increase in open interest reaching $21 billion, Ethereum seems poised to reach new resistance at $1,950.

Market Reaction to Federal Reserve Decision

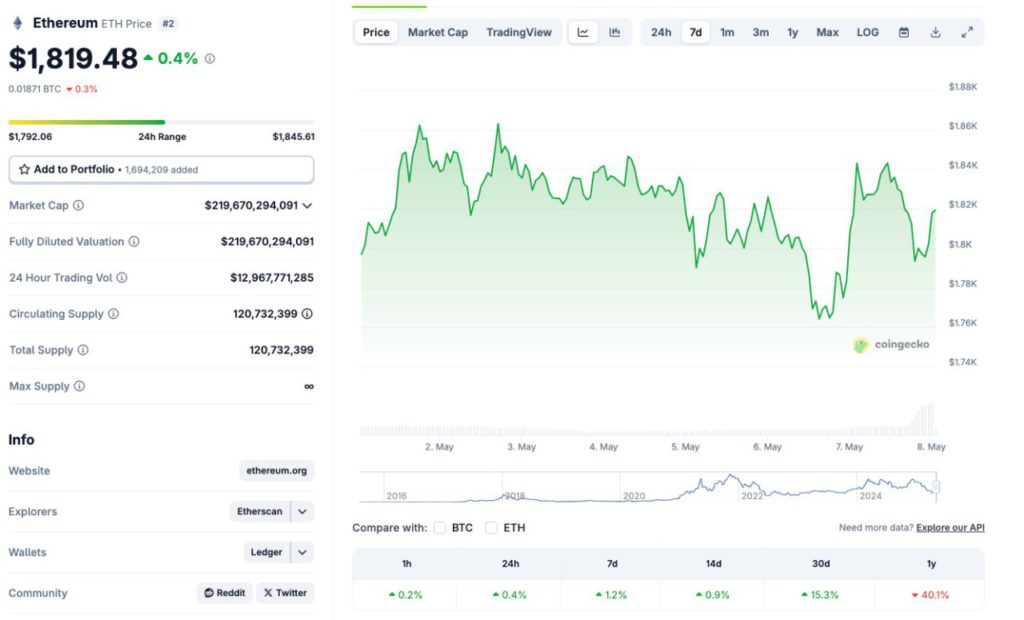

Following the Federal Reserve’s monetary policy announcement on May 7, Ethereum (ETH) saw an increase of 0.4% and managed to break the $1,845 resistance. The decision to keep interest rates at 4.25%-4.50% and a slowdown in balance sheet reduction was interpreted as a dovish move by investors, which boosted risk sentiment in the market.

This provided a boost to riskier assets such as Ethereum (ETH). On-chain data shows a decrease in selling pressure, with the Ethereum Age Consumed metric and outflows from exchanges indicating an increase in investor confidence post-FOMC. If macro sentiment remains stable, Ethereum (ETH) could potentially target $1,950 resistance, last seen in mid-March.

Also Read: Can Gaming PCs be Used to Mine Bitcoin (BTC)? Here are the Facts in 2025

Vitalik Buterin’s Renewal Proposal Adds Momentum

Just days before the Fed’s decision, Vitalik Buterin, co-founder of Ethereum, announced plans for the next major update to Ethereum. This proposal focuses on statelessness and better node efficiency, aiming to improve Ethereum’s long-term scalability and decentralization.

These updates include better witness compression, state storage optimization, and modular execution design. The timing of Vitalik’s announcement seems strategic, given the increased regulatory scrutiny and competition from Layer 2 chains eroding Ethereum’s (ETH) market share.

By addressing scalability without sacrificing decentralization, the upcoming changes could restore investor confidence, especially after Ethereum’s relative performance compared to competitors like Solana as early as 2025.

Derivatives data confirms traders’ confidence in Ethereum’s breakout potential

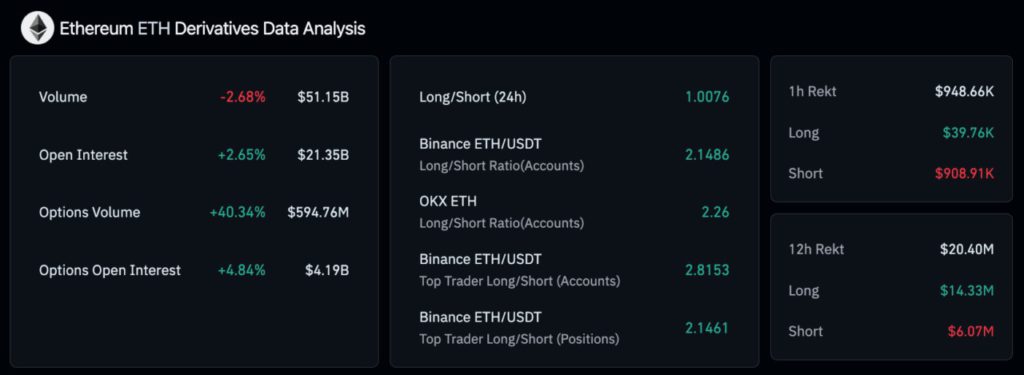

The derivatives market is showing an equally bullish picture for Ethereum, with key metrics reflecting renewed investor engagement. In the last 24 hours, Ethereum open interest increased by 2.65% to $21.35 billion, signaling $400 million of new capital committed to Ethereum (ETH) futures.

In addition, options volume jumped 40.34% to $594.76 million, and Options Open Interest rose 4.84% to $4.19 billion. This sharp increase indicates that speculators are pricing in higher volatility and directional movement ahead.

The long/short ratio on Binance for Ethereum stands at 2.1486, with traders on OKX showing an even more bullish ratio of 2.26 – more than double the accounts that are long versus short. Liquidation data supports this bullish trend, with Ethereum short losses reaching $6.07 million compared to $14.33 million of long liquidations.

Conclusion: Ethereum’s Outlook Toward the End of the Year

With support from stable monetary policy, innovative renewal proposals, and strong derivatives data, Ethereum (ETH) is in a strong position to reach and possibly even surpass $1,950 resistance. The combination of these factors puts Ethereum on a favorable path towards the end of the year, with significant growth potential.

Also Read: Robert Kiyosaki Highlights Potential Market Crisis, Calls Bitcoin (BTC) Superior to Gold

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Coingape. Ethereum Price Analysis Today: ETH to Breach $1950 if FOMC Reactions Align with $21B Open Interest Surge. Accessed on May 8, 2025

- Featured Image: CryptoSlate