Pi Coin Jumps 6%: 3 Powerful Reasons It Could Explode to $1 Soon!

Jakarta, Pintu News – Since the launch of the mainnet in February this year, the price of Pi Network has experienced a steep decline causing huge losses for pioneers and early investors.

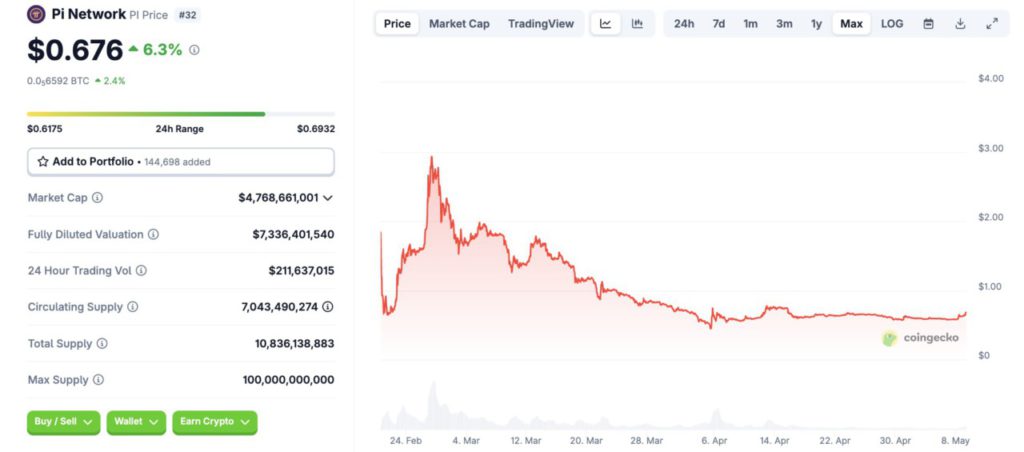

From its peak price of around $3, Pi Coin has now slumped all the way down to $0.6350, dropping its valuation from over $15 billion to only around $4 billion.

Behind the price pressure, there are a number of catalysts that could drive a significant rebound in the near future, ranging from major ecosystem announcements, potential listings on major exchanges, to technical signals indicating the formation of breakout patterns.

Then, how will the Pi Network price move today?

Pi Network Price Rises 6.3% in 24 Hours

On May 9, 2025, the price of Pi Network (PI) was recorded at $0.676, having risen 6.3% in the last 24 hours. If converted to the current rupiah ($1 = IDR 16,523), then 1 Pi Network is IDR 11,170.

On a daily timeframe, the PI price moved between $0.6175 to $0.6932, showing moderate volatility amidst improving market sentiment.

Read also: Dogecoin to the Moon? Analysts Predict 105% Spike Amid ETF Speculation!

With a market capitalization of $4.76 billion and a fully diluted valuation of $7.33 billion, Pi Network shows there is still considerable potential in the crypto space. The last 24-hour trading volume was recorded at around $211.6 million, reflecting fairly active market activity.

Big Ecosystem Announcement could Boost Pi Network Price

One of the reasons why the price of Pi Network is expected to surge in the near future is because the development team announced that they will be making a major announcement regarding their ecosystem on Tuesday, May 14, during the Consensus event taking place in Toronto.

Although the content of the announcement is still a mystery, market anticipation has already begun to show. Pi Coin’s price had even risen by more than 10% on Thursday morning as expectations began to grow among investors.

One of the possible contents of the announcement is the launch of an ecosystem fund – as some other major crypto projects have done. Such a fund would provide financial support for developers to continue developing applications within the Pi Network ecosystem.

Another possibility is Pi Coin’s listing announcement on a major crypto exchange. Companies like HTX are strongly suspected to be among those listing, especially after their mysterious series of posts on the X platform that indicated as much.

This assumption is even stronger as the Pi Network founder was also present at last week’s Token2049 event, where Justin Sun – HTX’s chief advisor – was the keynote speaker. Sun is also scheduled to speak at the Consensus event in Canada.

Read also: Bhutan Partners Binance Pay to Launch Crypto Payment System for Tourism!

In addition, Pi Network is also likely to announce major partnerships with companies from the crypto industry or other financial services, which could further strengthen its position in the global market.

Pi Coin’s Potential Listing on Major Exchanges could Boost Prices

Another reason that reinforces the possibility of a Pi Coin price spike in the near future is the potential listing on one or more tier-1 exchanges.

Over the past few months, many crypto exchanges have been hesitant to list Pi Coin. Some of the reasons include concerns about Pi’s tokenomics being too favorable to internal parties.

For example, more than 35 billion of the total 100 billion tokens are rumored to be owned by insiders.

Moreover, exchanges such as Bybit have publicly stated that they consider Pi a dubious project, even calling it a scam and vowing not to list it.

Low liquidity is also an issue. Based on data from CoinMarketCap, Pi Coin’s daily trading volume fell below $100 million-a relatively weak figure for the standards of a large coin.

Nevertheless, the opportunity remains open. Many major exchanges are thought to be reviewing Pi Network before deciding to list it. This process does take time, especially since thousands of new tokens appear every day.

Another possibility is that the Pi Network team itself is undergoing a Know Your Business (KYB) process with the stock exchange as part of the preparations before the official listing announcement is made.

Technical Analysis: Positive Signals from Pi Network Price

Another factor that could potentially push the price of Pi Coin higher is technical improvements.

The price chart shows that Pi is currently in a consolidation phase over the past few weeks-a phase that is often the foundation for the next big move.

Read also: Hamster Kombat GameDev Heroes Daily Combo & Daily Cipher Update May 9, 2025

This consolidation is likely part of the accumulation phase in Wyckoff Theory, which is characterized by flat price movements and low trading volumes.

In this phase, the asset only needs a “trigger” to enter the markup phase, which is a price surge phase usually triggered by the fear of missing out (FOMO) and a sudden surge in demand.

In terms of technical indicators, the Pi Network’s Bollinger Bands have also started to narrow during this year. Narrowing like this often signals a price squeeze or burst in the near future.

More importantly, Pi Coin has formed a falling wedge pattern, which is characterized by two descending trend lines approaching each other. This pattern is often a sign of a bullish breakout when the two lines converge-and that’s exactly what seems to be happening now.

With the combination of a strengthening technical pattern and other potential catalysts such as ecosystem announcements and listings on major exchanges, the price of Pi Coin is expected to rise significantly in the coming weeks. The initial upside target is projected towards $1.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Invezz. Pi Network price prediction: Top 3 reasons Pi Coin will surge soon. Accessed on May 9, 2025