Pepe Coin Set to Skyrocket? Analysts Predict a Massive 60% Surge Ahead!

Jakarta, Pintu News – On May 8, 2025 yesterday, the price of Pepe Coin surged by almost 9%, making it through the Fed’s meeting and their decision to keep the benchmark interest rate on hold.

Currently trading at $0.00000837, PEPE signals the possibility of a sustained rally to break the $0.000010 level, supported by a surge in holdings from whales by 2025.

Will this new momentum push Pepe Coin up to 60% to $0.00001465?

Pepe Price Spike Eyes Cup and Handle Pattern Breakout

Pepe Coin surged 5.28% on May 7, forming a bullish engulfing candle that completed a morning star pattern.

This pattern generally signals a trend reversal, as seen by the intraday recovery of 2.20%. This also ended PEPE’s downtrend which had previously recorded seven consecutive bearish candles.

Read also: MOODENG Crypto Soared 91% Today (May 9): What Happened?

Currently, PEPE has crossed the 23.60% Fibonacci level at $0.00000823 and is preparing to challenge the strong resistance at $0.0000090. The shift in the trend of this meme coin also reveals the formation of a cup and handle pattern.

The price reversal from the $0.00000576 low point in early April and the recent spike completed the pattern. The neckline of this pattern coincides with the supply zone at $0.0000090.

A convincing daily candle close above the neckline will confirm a breakout from the cup and handle pattern. This breakout has the potential to push the price of PEPE to the target of $0.00001465 (61.80% Fibonacci level).

This target is calculated by adding the depth of the “cup” to the breakout point. This is in line with Pepe Coin’s price optimistic predictions that expect a return of the bullish trend on this frog-themed coin.

As long as PEPE stays above $0.0000075, the Supertrend indicator shows a continued bullish outlook.

In addition, the MACD and Signal lines indicate a possible crossover, signaling a return of positive momentum. Hence, the technical indicators favor a potential uptrend in the price of PEPE.

However, if it fails to break the neckline, Pepe Coin is likely to experience another decline. In this scenario, the price could retest the support level at $0.0000075.

Whale Ownership Adds 24 Trillion PEPE in 2025

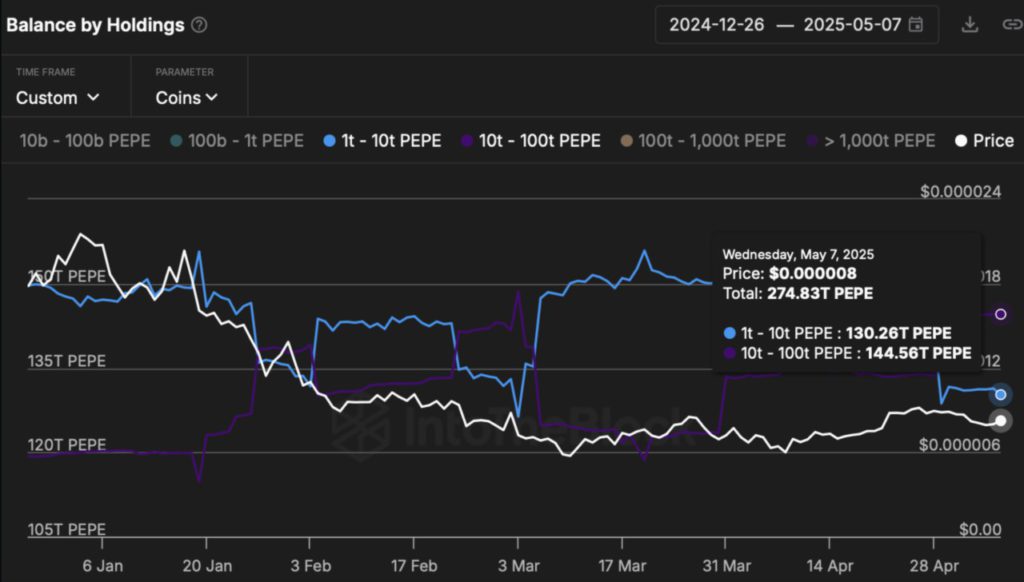

Based on IntoTheBlock’s Balance by Holding indicator, PEPE ownership by whales (with holdings between 10 trillion and 100 trillion) has increased by 20%.

Total holdings increased from 119.83 trillion PEPE on January 1 to 144.56 trillion on May 7.

This huge surge reflects the strong confidence of large investors in PEPE’s prospects, while increasing the potential for a significant bullish rally.

Strong Long Positions Protect Short Liquidation Risk

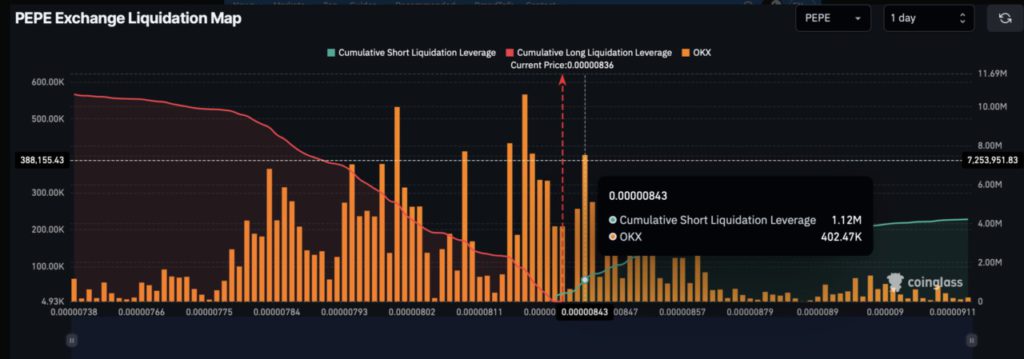

According to data from Coinglass, PEPE ‘ s Open Interest currently stands at $396 million, with long positions touching 52.78% in the last 4 hours. The rise in the long/short ratio to 1.1177 indicates increasing market optimism.

Read also: Solana Price Prediction: SOL Potential to Surge to $500? Find out why!

According to the Pepe Liquidation Map, this buildup of positions also maintains the risk of liquidating $1.64 million worth of longs at the $0.00000832 level.

With the uptrend continuing, the risk of short liquidation of $1.12 million begins to lurk at $0.00000843.

If the price continues to climb and touches this level, a massive liquidation of short positions could trigger a further price surge on PEPE. This increases the chances of a breakout above $0.000010 and paves the way for a bullish rally towards the $0.00001465 target.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Get a web trading experience with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Pepe Coin Price Eyes 60% Rally as Whales Load Up 24T PEPE. Accessed on May 9, 2025