Big Investors Accumulated 81,000 BTC in Last 6 Weeks, Bitcoin Ready to Rise?

Jakarta, Pintu News – In the past six weeks, large investors in the cryptocurrency ecosystem have accumulated more than 81,000 Bitcoins , equivalent to approximately Rp1.34 trillion (US$81,000 x Rp16,491). The move comes amid BTC price attempts to break through the psychological level of Rp1.64 billion (US$100,000), signaling institutional market participants’ growing confidence in the digital asset’s long-term prospects.

The Role of Large Investors in Market Trends

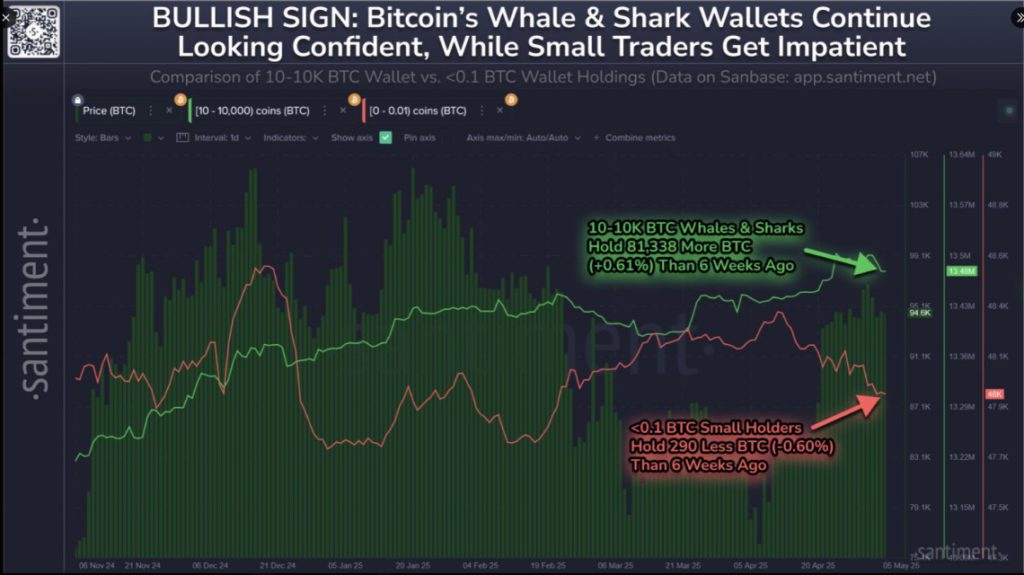

Data from Santiment shows that wallets holding between 10 and 10,000 BTC have added more than 81,000 BTC in the past six weeks. This accumulation action reflects the confidence of large investors in the potential future rise of Bitcoin prices.

In contrast, small holders with less than 0.1 BTC have sold around 290 BTC in the same period. This difference in behavior between large and small investors points to complex market dynamics, where accumulation by large players can be a bullish indicator for BTC prices.

Also Read: Can Gaming PCs be Used to Mine Bitcoin (BTC)? Here are the Facts in 2025

Impact on Prices and Liquidation of Short Positions

Bitcoin’s recent price rise has led to the liquidation of over US$734 million worth of short positions. Many traders who bet on a price drop were forced to close their positions when BTC broke through the previous resistance level of around US$95,600 (Rp1.57 billion).

These movements suggest that the current market momentum is driven by optimism and accumulation by large investors, which could push BTC prices higher if this trend continues.

Prospects for Psychological Level of IDR1.64 Billion

With the current price of BTC close to IDR1.61 billion (US$97,000), many analysts and market participants are waiting to see if the asset can break and hold above the psychological level of IDR1.64 billion (US$100,000). Success in breaking this level could pave the way for further rallies and strengthen bullish sentiment in the cryptocurrency market.

However, it is important to note that the crypto market remains volatile, and investors should consider risk factors and conduct in-depth analysis before making investment decisions.

Conclusion

Significant accumulation by major investors indicates growing confidence in Bitcoin as a long-term investment asset. Although challenges remain, especially in breaking through psychological resistance levels, current trends indicate continued growth potential for BTC in the cryptocurrency market.

Also Read: Robert Kiyosaki Highlights Potential Market Crisis, Calls Bitcoin (BTC) Superior to Gold

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Christian Encila / NewsBTC. Bitcoin Rebounds After Sharp Drop As Whales Fuel Push Toward $100K. Accessed May 9, 2025

- Featured Image: Generated by AI