Binance Coin (BNB) Price Projection by Standard Chartered: Toward IDR 45.7 Million by 2028

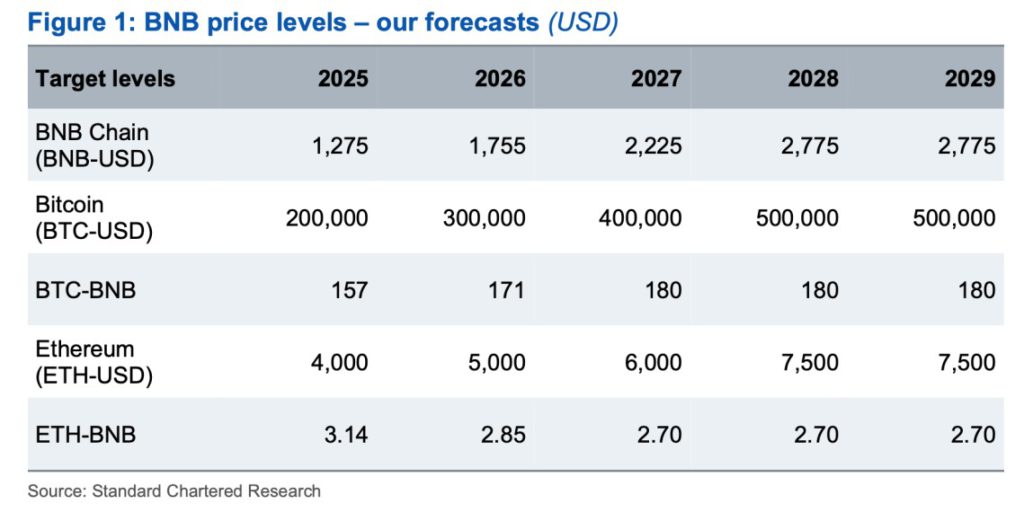

Jakarta, Pintu News – Standard Chartered, through its latest research report, projects that the price of Binance Coin could reach US$2,775 (around Rp45,748,725 at an exchange rate of Rp16,491 per US dollar) by the end of 2028. This projection reflects a potential upside of more than 360% from the current price of US$600.

Basis of Projection: Correlation with Bitcoin and Ethereum

Geoffrey Kendrick, Head of Digital Asset Research at Standard Chartered, stated that since May 2021, BNB’s price movements have shown a close correlation with the unweighted composite of Bitcoin and Ethereum , both in terms of returns and volatility. Kendrick predicts that this relationship will continue until 2028, supporting the projected rise in BNB prices.

Although BNB is expected to experience significant growth, projections show that Bitcoin’s price appreciation is likely to outpace BNB. The BTC-BNB ratio is expected to increase from 157 in 2025 to 180 in 2027, while the ETH-BNB ratio is expected to decrease from 3.14 to 2.70 in the same period, suggesting that Ethereum may outperform BNB, albeit by a smaller margin than Bitcoin.

Also Read: Can Gaming PCs be Used to Mine Bitcoin (BTC)? Here are the Facts in 2025

Supporting Factors: Binance Tokenomics and Ecosystem

One of the main factors supporting this projection is BNB’s deflationary tokenomics and its strong association with Binance, the world’s largest crypto exchange. BNB is used in a variety of services in the Binance ecosystem, including discounts on trading fees, participation in new token launches, and more, driving sustained demand for the token.

However, the report also noted that developer activity on BNB Chain has stagnated since the DeFi surge in 2021 and is now lagging behind compared to networks like Ethereum and Avalanche. In addition, BNB Chain’s “proof-of-staked authority” consensus model, which involves only 45 validators rotated every 24 hours, is considered more centralized compared to other more decentralized networks.

Conclusion

Standard Chartered’s BNB price projection reflects optimism towards the token’s long-term growth, supported by historical correlations with major crypto assets and support from the Binance ecosystem.

However, investors should consider factors such as network centralization and stagnation of developer activity in making investment decisions. As always, it is advisable to conduct in-depth research and consult with a financial advisor before investing in crypto assets.

Also Read: Robert Kiyosaki Highlights Potential Market Crisis, Calls Bitcoin (BTC) Superior to Gold

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Jake Simmons / NewsBTC. Binance’s BNB Could Hit $2,775 By 2028, Predicts Standard Chartered. Accessed May 9, 2025

- Featured Image: Generated by AI