Will BONK Continue to Surge? Check out the movement predictions below!

Jakarta, Pintu News – BONK is currently at an important junction, where the bearish pressure it is facing could turn into strong bullish momentum. By entering a critical supply zone on the daily chart, BONK faces a test that could determine the direction of its next price move. This analysis will delve deeper into BONK’s potential moves, considering technical indicators and prevailing market sentiment.

BONK on the Threshold of Critical Supply Zone

BONK has entered a significant supply zone, which historically often pushes assets towards a decline. Based on historical data, this zone has led to the formation of lower tops and lower bottoms, followed by a six-day decline. If BONK follows a similar pattern, a correction with an anticipated price drop is likely.

However, if BONK manages to break this level, there is potential for a continuation of the rally which could trigger a market breakout. There are two targets in focus: a short-term target at $0.00003689 which offers 51% upside, and a long-term target at $0.00006230 with upside potential of up to 155%.

Also Read: Potential for XRP, Kaspa, and Solana in the Next Altcoin Cycle According to Analysts!

Bullish Optimism Remains Strong

Despite continued selling pressure, the bulls are still maintaining their active positions in the market. The current Open Interest Weighted Funding Rate shows that the market is still in bullish territory. Since April 22, this metric has stayed in the positive zone for 20 consecutive days, indicating a strong bullish sentiment.

This bullish sentiment has helped BONK to quickly recover after each price drop. The majority of derivative contracts came from buyers, indicating the dominance of buying volumes in the market. Despite the $4 million selling pressure in this supply zone, derivatives traders continued to make purchases, which supported BONK’s momentum.

Technical Indicators Show Bullish Outlook

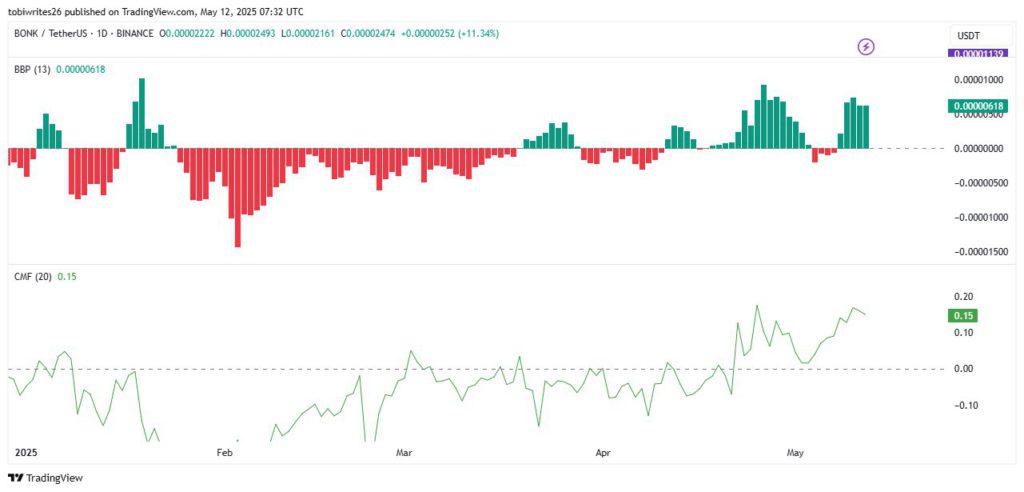

The Bull Bear Power and Chaikin Money Flow indicators both indicate bullish conditions in the market. The Bull Bear Power indicator, which helps determine market control between buyers and sellers, is currently showing a green histogram indicating that buyers have control over market movements.

Meanwhile, the Chaikin Money Flow (CMF) remains in bullish territory above 0.00, signaling that the overall market volume supports continued upside momentum. These two indicators provide a clearer picture of the market forces that may favor BONK’s price increase in the near future.

Conclusion

Taking into account technical factors and market sentiment, BONK is at a tipping point that could bring significant changes to the price. Investors and traders should monitor these indicators to make informed decisions in the face of crypto market volatility. Always do your own research before making an investment decision.

Also Read: New York Mayor Appoints Crypto Advisor After Corruption Case Dropped

That’s the latest information about crypto. Follow us on Google News for the latest crypto and blockchain technology updates. Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now.

Experience web trading with advanced trading tools such as pro charting, various order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Why Bonk’s next move hangs in the balance, odds of a correction are. Accessed on May 13, 2025

- Featured Image: LinkedIn